“`html

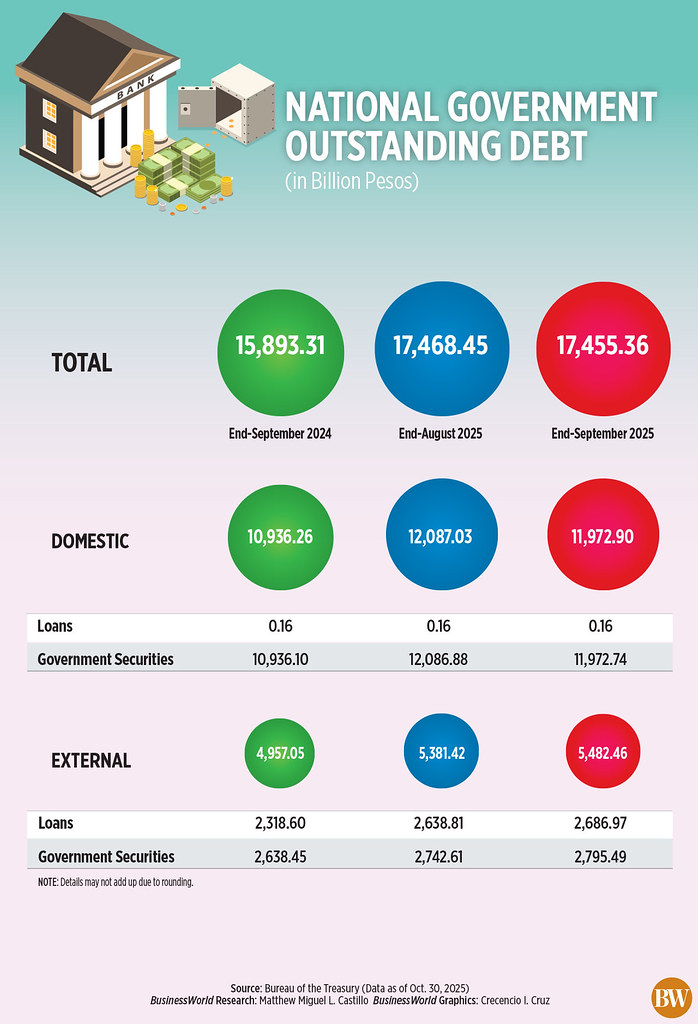

THE NATIONAL GOVERNMENT’S (NG) remarkable liability decreased to P17.46 trillion at the conclusion of September, yet remained above the annual forecast, information from the Bureau of the Treasury (BTr) indicated.

BTr information revealed that the total debt fell by 0.07% or P13.09 billion in September compared to P17.47 trillion at the close of August.

September represented the second consecutive month of reduction in total debt.

Nonetheless, this was still 0.6% above the anticipated year-end debt target of P17.36 trillion.

“The ongoing reduction signifies the government’s robust fiscal management, strategic borrowing approach, and proactive liability oversight, bolstered by stable market circumstances and strong domestic investor confidence,” the Treasury remarked.

On a year-over-year basis, NG debt swelled by 9.83% from P15.89 trillion at the end of September 2024, the BTr reported.

NG debt reflects the total amount owed by the Philippine government to creditors including international financial entities, partner nations, banks, global bondholders, and other investors.

“The September statistics affirm the Marcos, Jr. administration’s firm fiscal management and proactive debt supervision, ensuring that government financing remains sustainable, strategic, and supportive of the nation’s growth objectives,” BTr noted.

In September, a substantial 68.6% of the overall debt stock originated from domestic sources, with the remainder sourced externally. The BTr stated that this was “in line with the government’s strategy of minimizing foreign exchange risk while enhancing domestic capital market development.”

Domestic borrowings declined by 0.9% to P11.97 trillion at the end of September from P12.09 trillion at the end of August. This figure was lower than the P12.04-trillion year-end forecast for domestic debt.

“(The) government repaid more liabilities than it generated new ones… Total repayments surpassed new issuances by P117.29 billion, compensating for the P3.16-billion upward adjustment from the peso depreciation against the retail dollar bonds,” the Treasury mentioned.

In comparison to last year, domestic debt increased by 9.48% from P10.94 trillion.

Conversely, external debt rose by 1.9% to P5.48 trillion as of the end of September from P5.38 trillion at the close of August, primarily due to the weaker peso.

“This change more than compensated for the P1.3-billion in net loan repayments and P2.1 billion in third-currency fluctuations,” the BTr stated.

BTr data utilized an exchange rate of P58.149 per dollar at the end of September, down from P57.042 per dollar at the end of August and P56.017 at the close of September 2024.

Year-over-year, external debt rose by 10.6% from P4.96 trillion.

The latest external debt total also surpassed the P5.31-trillion year-end forecast by 3.16%.

Foreign liabilities were primarily composed of P2.79 trillion in global bonds and P2.69 trillion in loans.

External debt securities consisted of P2.36 trillion in US dollar bonds, P259.37 billion in euro bonds, P59.59 billion in Japanese yen bonds, P58.15 billion in Islamic certificates, and P54.77 billion in peso global bonds.

As of September, the NG-guaranteed commitments slightly increased by 0.05% to P346.63 billion from P346.46 billion in August.

“This was due to a P1.75-billion upward adjustment of guarantees owing to peso depreciation, partially counterbalanced by a P1.33 billion in combined net repayments, and downward adjustments prompted by third-currency movements amounting to P0.25 billion,” BTr stated.

On a year-over-year basis, obligations decreased by 7%.

“The reduction in debt is mainly driven by a significant decrease in government expenditure amid the corruption scandal. This resulted in reduced government spending, with some expenses suspended while investigations were underway,” Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., remarked in a Viber message.

Mr. Erece noted that the continuous repayment of existing debt also contributed to lowering debt levels.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort mentioned in a Viber message that the reduced debt level in September was also a result of a substantial volume of maturities in government securities during the month.

Mr. Ricafort added that the weakened peso during the month “effectively elevated the peso equivalent of the outstanding National Government foreign debts when converted to pesos.”

The peso depreciated by 1.87% or P1.066 to settle at P58.196 on Sept. 30 from P57.13 on Aug. 29.

Philippine Institute for Development Studies Senior Research Fellow John Paolo R. Rivera expressed that outstanding debt is anticipated to rise by year-end.

“With ongoing infrastructure spending, external repayments, and elevated interest costs, the National Government debt is likely to advance moderately toward year-end, remaining around 60-61% of GDP (manageable but still necessitating vigilance to maintain fiscal sustainability),” Mr. Rivera noted in a Viber message.

“This could reverse if the exchange rate exceeds P60 per dollar, requiring additional debt management,” he added.

At the end of Q2, NG debt as a portion of gross domestic product stood at 63.1%, the highest since 2005.

The Department of Finance anticipates the NG debt-to-GDP ratio to decline to 61.3% by end-2025 and eventually fall to 58% by 2030. — Aaron Michael C. Sy

Source link

“`