“`html

By Justine Irish D. Tabile, Journalist

PHILIPPINE AUTOMOBILE sales decreased year over year in August to the lowest level in four months, hampered by diminished demand for both passenger and commercial vehicles, according to industry statistics.

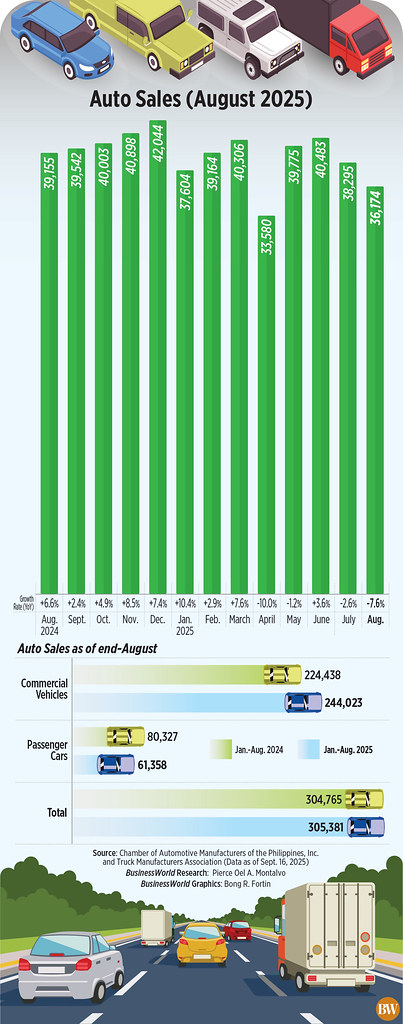

A combined report from the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA) revealed that total vehicle sales dropped by 7.6% from the previous year to 36,174 units last month.

The decline was the most gradual since the 10% decrease in April and marked the lowest sales since the 33,580 units sold that same month. On a month-to-month basis, vehicle sales fell 5.5% from July’s 38,295 units.

“Despite a slight reduction in month-on-month figures, the sector remains positive, fueled by shifting consumer preferences and an increasing transition toward eco-friendly mobility,” CAMPI stated in a declaration on Tuesday.

Passenger vehicle sales, which constituted over a fifth of industry volume, plummeted 20% year on year to 7,591 units in August. In comparison to July’s 8,120 units, passenger vehicle sales decreased by 6.5%.

Commercial vehicle sales, which represented nearly four-fifths of total sales, fell 3.5% to 28,583 units in August compared to a year prior. This was also 5.3% lower month over month.

Within the commercial vehicle category, light commercial vehicle sales dropped 4.4% year on year to 20,852 in August, while sales of Asian utility vehicles (AUV) inched up 0.2% to 6,840 units.

Month over month, light commercial vehicle sales fell 7.4%, while AUV sales grew by 2.6%.

Sales of light- and medium-duty trucks and buses fell 11.6% and 10.6% year on year to 555 and 279 units, respectively, while sales of heavy-duty trucks and buses increased by 26.7% to 57 units. Compared to July, sales of light, medium, and heavy trucks dropped 8.6%, 7.6%, and 27.8%, respectively.

From January to August, new automobile sales slightly increased by 0.2% to 305,381 units compared to the previous year. This growth was bolstered by commercial vehicles, whose sales rose by 8.7% to 244,023 units. Conversely, passenger vehicle sales fell by 23.6% to 61,358 units from a year earlier.

CAMPI noted that commercial vehicles remained the backbone of industry sales, while electrified vehicles (xEVs) gained momentum, now comprising 6% of the automotive market.

The industry sold 2,244 xEVs in August, or 6.2% of total sales, although this was down 17.1% from the 2,707 units sold in July. From January to August, xEV sales reached 18,439 units, accounting for a 6.04% market share.

Wider global and local risks are impacting auto sales, stated Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp.

“Protectionist measures, tensions in the Middle East, and other geopolitical threats are challenges that dampen sales, income, employment, and various business opportunities,” he mentioned in a Viber message. “This could hinder the repayment ability of borrowers, including those with auto loans.”

He also referenced the Chinese “ghost month” belief, indicating it may have deterred some purchasers in August.

Nevertheless, he anticipates improved conditions in the upcoming months. “Better weather patterns could enhance vehicle sales figures, particularly leading up to the Christmas season, alongside declining interest rates that support increased demand for vehicles and auto financing,” he elaborated.

The August figures reveal decreased demand across various segments, John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, conveyed to BusinessWorld.

“Significant factors include elevated interest rates, which render financing more expensive, inflation rising again, and consumer hesitance ahead of the ‘ber’ months,” he said in a Viber message.

He added that while the holiday period could trigger some recovery through promotions and heightened spending, the rebound might be limited given inflation, peso instability, and trade uncertainties associated with US tariffs.

Toyota Motor Philippines Corp. maintained its leading position with 146,357 units sold from January to August, an increase of 4.1% from 140,654 units last year. It held a 47.93% market share.

Mitsubishi Motors Philippines Corp. placed second with 57,908 units sold, down 1% from 58,513 units. Its market share was 18.96%.

Nissan Philippines, Inc. secured third position with 15,160 units sold, down 17% year on year, representing 4.96% of the market.

Ford Motor Co. Philippines, Inc. sold 14,940 units, a decrease of 21.2%, while Suzuki Philippines, Inc. sold 14,519 units, an increase of 9.9%.

Source link

“`