PHILIPPINE manufacturing activity increased in August, although at its slowest rate in two months due to a modest rise in output and new orders as the elevated US tariffs took effect, S&P Global announced on Monday.

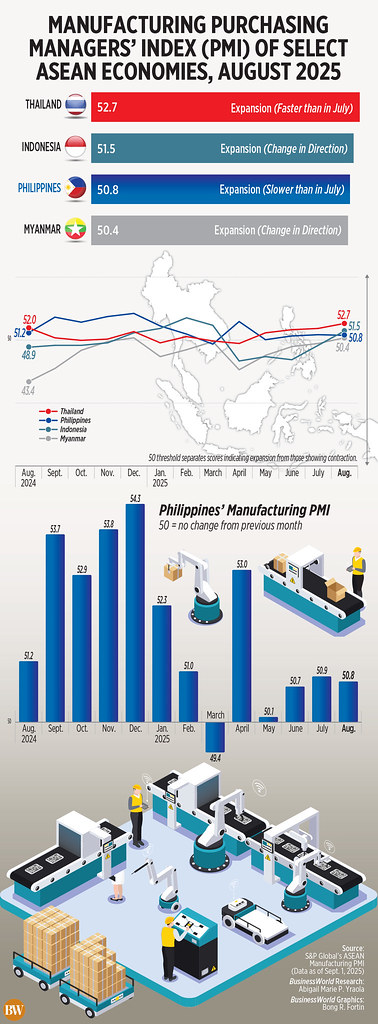

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) registered at 50.8 in August, down from 50.9 in July.

This marked the lowest PMI score since the 50.7 recorded in June.

A PMI score above 50 reflects improved operating conditions compared to the prior month, whereas a score below 50 indicates a decline.

“The manufacturing sector in the Philippines signaled a subdued performance once more, with growth rates for output and new orders remaining beneath their historical norms,” stated Maryam Baluch, economist at S&P Global Market Intelligence.

Data from S&P Global regarding select Association of Southeast Asian Nations members indicated that the Philippines secured the third-highest PMI reading, trailing only Thailand (52.7) and Indonesia (51.5).

According to the report, S&P Global noted “modest” growth in output and new orders in August, bolstered by new customer acquisition and heightened demand.

Manufacturing output rose for the third consecutive month in August, “with the growth rate hitting its fastest pace in four months,” the report stated.

“The increase in output was supported by a continued rise in new business. The growth rate was largely consistent with that seen in July, with anecdotal evidence suggesting new customer acquisitions and favorable underlying demand trends as the catalysts for the latest expansion,” S&P Global elaborated.

Manufacturers in the Philippines also observed a stronger international demand for goods, with the growth in orders reaching a seven-month peak.

S&P Global observed an expansion in purchasing activity, with August data indicating the swiftest rise in four months.

Ms. Baluch remarked that job creation came to a halt in August, marking the end of two consecutive months of “marginal increases” in employment.

“The combination of escalating production requirements and stagnant employment led to a further accumulation of backlogs, with the rate of buildup the fastest in six months,” the report stated.

S&P Global reported a “modest decline” in finished goods inventories in August, as firms worked to fulfill new orders.

“Reductions have been noted in three of the last four survey periods, with some businesses indicating that they released stock onto the market to prevent potential damage in warehouses from heavy rains,” it noted.

According to S&P Global, inflationary pressures were relatively mild in August even as material prices increased.

“Mild cost pressures, combined with manufacturers’ attempts to manage their pricing in order to remain competitive, could offer the boost firms require to regain sales momentum,” remarked Ms. Baluch.

Manufacturers in the Philippines displayed enhanced confidence for the upcoming 12 months for the fourth consecutive month, reaching the highest level since November 2024.

“Companies remained optimistic that demand conditions will enhance and support production. However, the positive sentiment was still subdued compared to the long-term series average,” S&P Global stated.

Factory operations might have been influenced by the implementation of the 19% tariff on many products from the Philippines beginning August 7.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., mentioned that the slowdown stemmed from the US tariffs, which led to a “wait-and-see attitude” among certain exporters.

“(This was) somewhat counterbalanced by some frontloading of exports prior to Trump’s increased tariffs coming into effect on August 7, 2025, as well as a seasonal uptick in imports and production activities by certain local manufacturers during the third quarter,” he added.

Mr. Ricafort emphasized that the heightened US tariffs could ultimately reduce demand for exports to the US, as well as hinder economic growth. — Aubrey Rose A. Inosante