“`html

By Luisa Maria Jacinta C. Jocson, Senior Correspondent

HEADLINE INFLATION decelerated to a nearly six-year low in July as utility and food prices continued to moderate, data from the Philippine Statistics Authority (PSA) indicated.

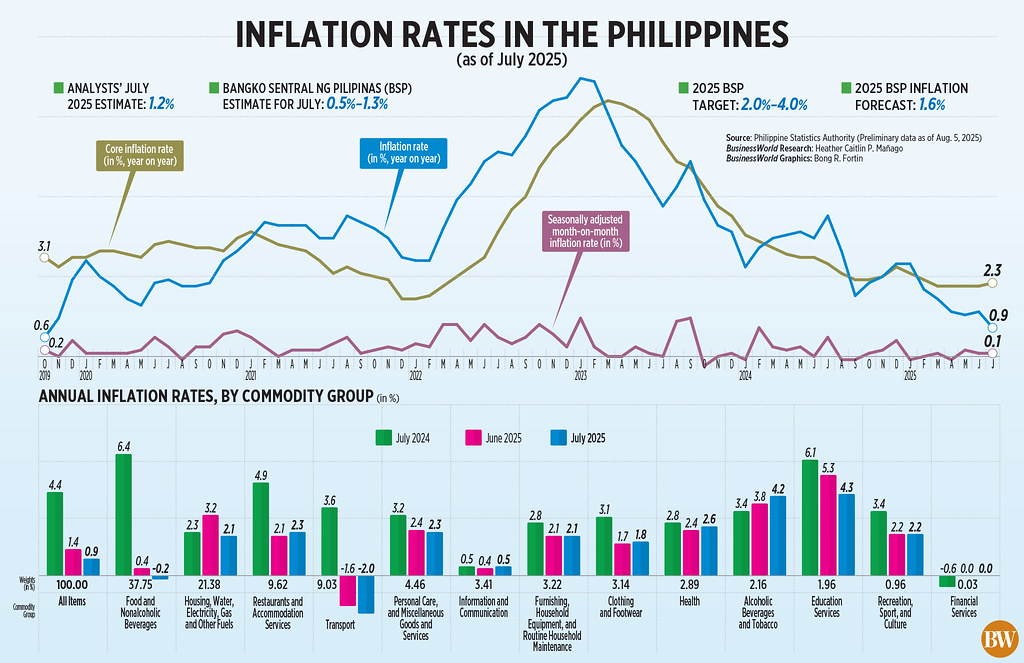

The PSA disclosed on Tuesday that the consumer price index increased by 0.9% year-on-year in July, slower than June’s 1.4% and a 4.4% rise from a year prior.

This represents the lowest inflation rate in almost six years, or since the 0.6% recorded in October 2019. It also signified the fifth consecutive month where inflation remained below the central bank’s 2-4% target range.

The July figure aligned with the Bangko Sentral ng Pilipinas’ (BSP) 0.5%-1.3% projection for the month, but was below the 1.2% median estimate from a BusinessWorld survey of 17 analysts conducted last week.

For the initial seven months of the year, inflation averaged 1.7%, slightly exceeding the BSP’s 1.6% forecast for the full year.

Core inflation, which omits volatile food and fuel prices, rose to 2.3% in July from 2.2% the previous month. For the January-to-July timeframe, core inflation averaged 2.3%.

The BSP stated that the inflation result for July is well within its projections.

“Inflation is anticipated to average below the lower threshold of the target in 2025, mainly due to the continued decline in rice prices,” it added.

National Statistician Claire Dennis S. Mapa mentioned that the slowdown in July’s inflation was mainly attributed to the subdued annual increase in the housing, water, electricity, gas, and other fuels index.

The index decreased to 2.1% in July from 3.2% in June, contributing 45.1% to the overall decline in inflation.

Notably, electricity inflation slowed to 1.3% in July from 7.4% the month before, despite Manila Electric Co. (Meralco) raising rates by P0.4883 per kilowatt-hour during the month.

Liquefied petroleum gas (LPG) also experienced a 0.7% inflation rate, a deceleration from the 1.9% increase in June. In July, LPG suppliers Petron and Solane implemented a price rollback of P1 per kilogram each.

Meanwhile, the heavily weighted food and nonalcoholic beverages index also decreased to 0.2% from the 0.4% rise in June.

Inflation for cereals and cereal products further contracted to 11.5% in July from the 10.3% drop a month prior.

RICE PRICES

Rice inflation remained in the negative, dropping to an unprecedented low of 15.9% since 1995.

“For the upcoming four months, we may still observe negative inflation for rice. Prices are continuously declining, even in our price per kilogram,” Mr. Mapa remarked.

The average cost of regular milled rice decreased by 18.2% to P41.31 per kilogram from P50.90 a year ago. Well-milled rice likewise fell by 14.8% year-on-year to P47.60 from P55.85, while special rice dropped by 11.8% to P56.83 from P64.42 per kilogram.

Since last year, the government has employed several strategies to control prices of the staple grain, such as reducing tariffs on rice imports.

However, the Agriculture department this week advised President Ferdinand R. Marcos, Jr. to suspend rice imports and increase tariffs due to declining farmgate prices.

In July 2024, rice tariffs were reduced to 15% from 35% amid soaring prices at that time. Agriculture Secretary Francisco P. Tiu Laurel, Jr. previously suggested a phased rise in rice import duties to the original 35%.

Mr. Mapa indicated that the potential rise in tariffs might influence rice inflation moving forward.

“It depends on the timing… when tariffs increase, there may be a corresponding rise in retail prices,” he stated, emphasizing that they analyze both the height of tariffs and the timing of their implementation.

Vegetables, tubers, plantains, cooking bananas, and pulses saw a decline to 4.7% from the 2.8% decrease in June.

Despite agricultural damage caused by recent weather events, Mr. Mapa noted vegetable inflation continued to ease.

“However, we observed in the National Capital Region, especially in the second half of July, there was an adjustment in the rise of certain vegetable items, such as leafy greens… We anticipate that this month of August may see an upward adjustment in vegetable prices, which could impact our inflation rate,” Mr. Mapa stated.

Meanwhile, the deterioration in transport inflation worsened to 2% in July from the 1.6% decrease in June. This was attributed to passenger transport by sea dropping sharply to 5.2% from 24.8% the prior month.

Gasoline inflation also fell to 10% from the 8.9% contraction a month earlier.

In July, price adjustments at the pump resulted in a net reduction of P1.10 per liter for gasoline and P1.10 per liter for kerosene. Conversely, it experienced a net rise of P1.20 for diesel.

Inflation in the National Capital Region (NCR) also eased to 1.7% in July from 2.6% in June.

Outside the NCR, inflation decreased to 0.7% in July from 1.1% in June.

Inflation for the lowest 30% of income households dipped to 0.8% from the 0.4% decline in June. Year-to-date, inflation for the lowest 30% income households averaged 0.5%.

OUTLOOK

The central bank stated that headline inflation will likely stay within the 2-4% target band from this year until 2027.

“For 2026 and 2027, inflation is projected to trend upward but will remain well within the 2-4% target range,” it noted.

“Global economic activity is exhibiting signs of slowdown, influenced by uncertainty over US trade policies and ongoing geopolitical tensions in the Middle East. These factors could contribute to a deceleration in domestic growth.”

The BSP anticipates inflation to average 3.4% in 2026 and 3.3% in 2027.

Department of Economy, Planning, and Development (DEPDev) Secretary Arsenio M. Balisacan mentioned that overall inflation this year will “remain favorable and supportive of domestic demand.”

“The steady decline in rice prices and the easing of inflation for low-income families are clear indicators that our interventions are effective,” he noted in a statement.

“This not only assists Filipinos in preserving the value of their peso but also enhances confidence for businesses and consumers to plan ahead.”

DEPDev also referenced data from the Philippine Atmospheric, Geophysical, and Astronomical Services Administration, which indicated a “relatively favorable climate outlook” from this month through January 2026.

“Between nine and 17 tropical cyclones are projected, but the prevailing ENSO (El Niño-Southern Oscillation) remains neutral

“““html

condition is probable to assist consistent agricultural output.”

Nonetheless, Mr. Balisacan emphasized the necessity to “stay alert towards external hazards, such as global policy changes and geopolitical strains.”

With inflation anticipated to remain well managed, the BSP asserted a “more lenient monetary policy approach is still justified.”

“Emerging threats to inflation from escalating geopolitical strains and external policy unpredictability will necessitate closer observation, along with the ongoing evaluation of the effects of previous monetary policy modifications,” it expressed.

Experts predict inflation to stay within the target for the remainder of the year.

“Although we might observe an upward trend in inflation in the coming days due to base effects, we still anticipate monthly inflation figures to stay beneath the BSP’s 2-4% target for the rest of the year,” Chinabank Research noted in a statement.

Rice inflation is projected to stay negative for the year due to base effects and a persistent drop in monthly rice prices, it added.

“Nonetheless, the influence of favorable base effects may start to diminish by September, and inflation could approach 3% by year-end,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. stated.

Chinabank pointed out that potential risks include unfavorable weather conditions and plans to increase the rice tariff rate while limiting rice imports.

“A significant storm impacting agricultural productivity could lead to accelerated inflation. Global oil costs might remain steady due to the anticipated rise in oil supply, but any resurgence of conflict in the Middle East could cause a surge,” Mr. Neri remarked.

RATE REDUCTIONS

However, considering inflation well under the 2-4% target range, the central bank has ample scope to implement further rate reductions, analysts noted.

“This favorable inflation forecast augurs well for domestic consumption activities, supporting the argument for additional monetary easing from the BSP,” Chinabank stated.

Mr. Neri indicated that the decelerating inflation and dovish cues from the BSP render a rate cut in August “extremely likely.”

For its part, Chinabank anticipates another 25-basis point decrease at the Monetary Board’s session later this month and an additional cut in the fourth quarter.

“A downside surprise in gross domestic product (GDP) on Thursday would likely solidify the case for a reduction,” Mr. Neri noted.

The PSA is scheduled to unveil second-quarter GDP on Aug. 7 (Thursday).

The Philippine economy is likely to have expanded by 5.5% in the second quarter, based on a median estimate from 17 analysts surveyed by BusinessWorld. If accurate, this would be slower than the 6.5% growth seen in the same period last year.

“A Fed rate cut in September could set the stage for the BSP to follow suit with another reduction in October,” Mr. Neri remarked.

The Federal Open Market Committee’s upcoming meeting is scheduled for Sept. 16 to 17.

“Nonetheless, uncertainties continue to obscure the outlook for US monetary policy. Tariffs might not have been entirely transferred to US consumers, and a rise in US inflation could postpone Fed easing.”

“In this context, the capacity for another BSP rate cut could diminish. Therefore, caution remains essential, and it might be premature to fully account for a BSP rate cut in October,” Mr. Neri added.

Source link

“`