By Luisa Maria Jacinta C. Jocson, Reporter

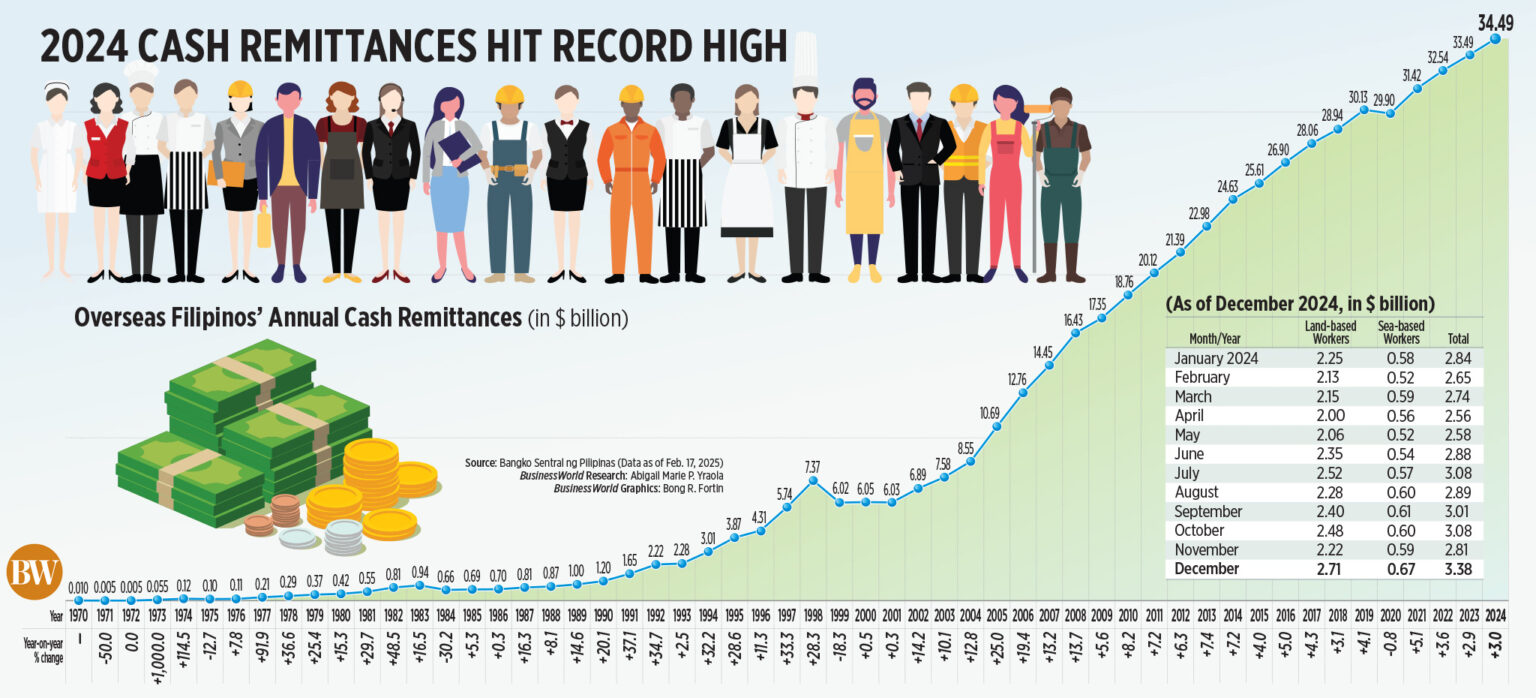

CASH REMITTANCES from overseas Filipino laborers (OFWs) reached a historic peak of $34.49 billion in 2024, according to data from the Bangko Sentral ng Pilipinas (BSP).

Funds transferred home by OFWs via banking institutions increased by 3% to $3.38 billion in December compared to $3.28 billion during the same month of 2023. This represented the highest monthly figure ever recorded for cash remittances.

This resulted in the full-year remittance amount being an unprecedented $34.49 billion, representing a 3% rise from the $33.49 billion reported in 2023.

This aligns with the BSP’s forecast of 3% growth in remittances and its annual estimation of $34.5 billion.

“The increase was noted in remittances from both land-based and sea-based workers,” stated the BSP.

In December alone, remittances from land-based workers surged by 3.7% year-on-year, rising to $2.71 billion from $2.61 billion.

For the entire year, remittances from land-based workers climbed by 3.4% to $27.55 billion from $26.64 billion in 2023.

Conversely, funds sent by sea-based workers rose slightly by 0.6% to $669.28 million in December and increased by 1.3% to $6.94 billion over the full year.

Personal remittances, encompassing in-kind inflows, grew by 3% to $3.73 billion in December compared to $3.62 billion in December 2023.

By the close of 2024, personal remittances amounted to $38.34 billion, a 3% increase from $37.21 billion in the prior year. This also marked an all-time high for personal remittances.

Remittances constituted 8.3% and 7.4% of the nation’s gross domestic product (GDP) and gross national income (GNI), respectively.

“The rise in cash remittances from the United States, Saudi Arabia, Singapore, and the United Arab Emirates significantly contributed to the overall increase in remittances in 2024,” remarked the central bank.

The US was the foremost source of cash remittances last year, comprising 40.6% of the total.

This was succeeded by Singapore (7.2%), Saudi Arabia (6.4%), Japan (4.9%), and the United Kingdom (4.7%).

Additional sources of remittances included the United Arab Emirates (4.4%), Canada (3.6%), Qatar (2.8%), Taiwan (2.7%), and South Korea (2.5%).

“The increase in cash remittances in 2024 showcases the sustained resilience of OFWs in bolstering the Philippine economy,” stated John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies.

“Ongoing economic recovery in the US, Middle East, and Asia-Pacific has resulted in improved wages and job opportunities for OFWs, enhancing remittances,” he elaborated.

Mr. Rivera mentioned that the weaker peso in the final months of the year also augmented the value of remittances sent back home.

By the end of 2024, the peso closed at P57.845 against the dollar, depreciating by 4.28% from its end-2023 rate of P55.37. It also dipped to a historic low of P59-per-dollar level on three occasions last year.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort stated that the spike in remittances was also influenced by seasonal factors during the holiday period.

“December experienced a seasonal rise in remittances as OFWs sent extra funds for holiday-related expenditures and family support. The utilization of digital remittance services accelerated transfers and reduced costs, promoting greater remittance flows,” Mr. Rivera elaborated.

Looking forward into this year, Mr. Rivera believes that remittances are likely to remain a consistent growth engine.

“Persisting overseas labor requirements, particularly in sectors such as healthcare, technology, and skilled trades, coupled with more favorable exchange rates, might stimulate higher remittance volumes. Agreements from the government and labor deployment strategies could open new job opportunities.”

Mr. Ricafort remarked that remittances have been “steadily rising by about 3% annually in recent times and are projected to grow similarly in the future, being demographic-driven.”

However, global uncertainties originating from US President Donald J. Trump’s trade policies could impact remittances, Mr. Ricafort mentioned.

“Mr. Trump’s threats of higher tariffs and America-first policies may also decelerate global trade, investments, employment including OFW positions, and overall global economic growth,” he articulated.

Mr. Trump is planning to implement reciprocal tariffs on all US imports following the imposition of a 10% tariff on all Chinese imports into the US, effective earlier this month.

Mr. Rivera similarly indicated that geopolitical tensions and the potential for a global economic downturn could hinder the growth in remittances.

“In general, remittances are anticipated to maintain modest growth in 2025, unless there are significant economic disruptions. The continuous inflows will persist in supporting household expenditures, thereby aiding in consumption-led growth,” Mr. Rivera added.

The central bank forecasts cash remittances to rise by 3% this year.