“`html

By Mon Abrea, Global Tax Policy Specialist and Chief Tax Consultant, Asian Consulting Group

Enterprises — ranging from small business owners to large organizations — are experiencing a breath of relief after President Ferdinand Marcos, Jr. directed the Bureau of Internal Revenue (BIR) to reallocate its audit and enforcement initiatives toward those associated with the multibillion-peso flood-control corruption scandal.

The President’s directive serves not only as a response to a scandal but also as an indication that the government is finally attentive. For years, advocates for reform have pushed the BIR to cease bothering compliant taxpayers and instead concentrate on high-risk, high-impact investigations where corruption and tax avoidance intersect.

This adjustment, if maintained, could signify the most pivotal change in the nation’s tax administration since the TRAIN Law. It is time to institutionalize this strategy — making accountability, not coercion, the essence of the BIR’s audit culture.

Repairing a Deficient Audit System

The BIR’s own statistics narrate a concerning tale: less than 3% of overall revenues are derived from audits. Nevertheless, the majority of audits focus on micro, small, and medium enterprises (MSMEs) — the most susceptible to intimidation yet the least prone to fraud.

Arbitrary, manual audits have cultivated inefficiency and corruption. Some auditors reportedly exploit their authority to demand bribes for “settlements,” transforming the auditing process into a source of revenue loss rather than a revenue generator. The outcome: compliant taxpayers lose faith, while politically connected tax evaders go unscathed.

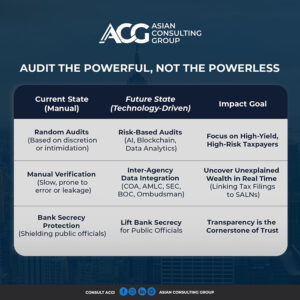

Redirecting audit efforts towards individuals connected to government irregularities is a commendable step. However, to ensure this is not merely a fleeting initiative, the BIR must implement risk-based, technology-driven frameworks that eliminate discretion and enforce accountability where it is most crucial — at the upper levels.

Restoring Confidence Through Technology

Contemporary tax systems no longer depend on arbitrary audits. They employ risk-based computer-assisted auditing systems enhanced by AI, blockchain, and data analytics to pinpoint red flags and uncover undeclared assets.

The BIR ought to amalgamate data from the Commission on Audit (CoA), the Anti-Money Laundering Council (AMLC), the Securities and Exchange Commission (SEC), the Bureau of Customs (BoC), and the Office of the Ombudsman. Correlating tax returns with Statements of Assets, Liabilities, and Net Worth (SALNs) can reveal unexplained wealth in real-time — a task unattainable using manual systems.

International experience indicates that risk-based auditing can double audit effectiveness and increase revenues by as much as 200%, with most advantages arising from high-yield, high-risk taxpayers. For this to succeed, Congress must remove bank secrecy for public officials, enabling tax authorities to confirm if their declared income aligns with actual assets. Transparency stands as the foundation of trust.

Relief Coupled with Accountability

Tax reform must be equitable as well as stringent. The Department of Finance’s (DoF) proposition to elevate tax-free benefit limits and alleviate the burden on Filipino workers is greatly overdue. Revising the income tax exemption threshold from P250,000 to P400,000 or P500,000 — as suggested in Senator Win Gatchalian’s Ginhawa Bill — would finally align tax policy with economic circumstances.

The threshold has remained unchanged since 2018, despite rising prices and increasing living costs. Adjusting it would deliver tangible relief for middle-income earners — the backbone of the economy — while enhancing consumption and voluntary compliance. Any temporary revenue shortfall can be compensated by minimizing leakages, automating processes, and focusing on genuine evaders.

Digital Evolution and VAT Reform

Beyond audits, transparency necessitates automation. The Electronic Invoicing System (EIS) must be thoroughly implemented and expanded to encompass all professionals and service providers. Real-time surveillance of sales and income will diminish underreporting and corruption at every tier.

Similarly, the World Bank’s recommendation to widen the VAT base — eliminating most exemptions aside from essentials like food, healthcare, and education — provides a clear pathway to reduce the rate from 12% to 10% without sacrificing revenue. A streamlined, broader VAT will fortify compliance, equity, and competitiveness.

From Response to Reform

The President’s instruction is a positive initiation—but the true challenge lies in maintaining consistency. The BIR, DoF, and Congress must now institutionalize risk-based auditing, digital invoicing, inter-agency data sharing, and public accountability.

A government that implements tax justice at the top will gain the moral standing to collect taxes from others. The Philippines does not require higher taxes; it needs a more intelligent system that rewards integrity, punishes corruption, and rebuilds public confidence.

Only then can we change our tax framework from one founded on fear to one based on fairness — where doing what is right is no longer the most challenging action to take.

About the Author

Mon Abrea is a Global Tax Policy Specialist and Chief Tax Consultant of the Asian Consulting Group (ACG). An alumnus of Harvard, Oxford, and Duke Universities, he collaborates with governments and international organizations on tax reform, investment strategy, and governance. Acknowledged among the TOFA 100 Most Influential Filipinos in the World, he directs global initiatives through his Reimagining the World book series, Thought Leaders and Game Changers podcast, and International Tax & Investment Roadshow, endorsing the Philippines as an ESG-aligned investment destination.

Spotlight is BusinessWorld’s sponsored section that permits advertisers to amplify their brand and engage with BusinessWorld’s audience by sharing their stories on the BusinessWorld Web site. For further details, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to receive more updates and subscribe to BusinessWorld’s titles to obtain exclusive content through www.bworld-x.com.

Source link

“`