“`html

The Bitcoin market has undergone a considerable price adjustment in the past few hours, with values declining to approximately $110,000 as the trade conflict between the US and China might resume. Prior to this drop, the crypto market leader spearheaded a robust rally, establishing a fresh all-time high of $126,198.17 on October 6, 2025. Notably, recent statistics from the Bitcoin Options market revealed a trend of cautious positioning among institutional investors amidst this price upswing leading to the present market decline.

Institutions Withdraw as Bitcoin’s Rally Becomes Exuberant – Glassnode

In an X post dated October 10, blockchain analytics firm Glassnode presents some compelling observations in its weekly options market update. Noteworthy is that Glassnode analysts indicate that although Bitcoin prices climbed over 10% during the recent ascent to a new all-time peak, institutional traders seem to have adopted a calm market stance, choosing to secure profits and safeguard against loss rather than pursue the rally.

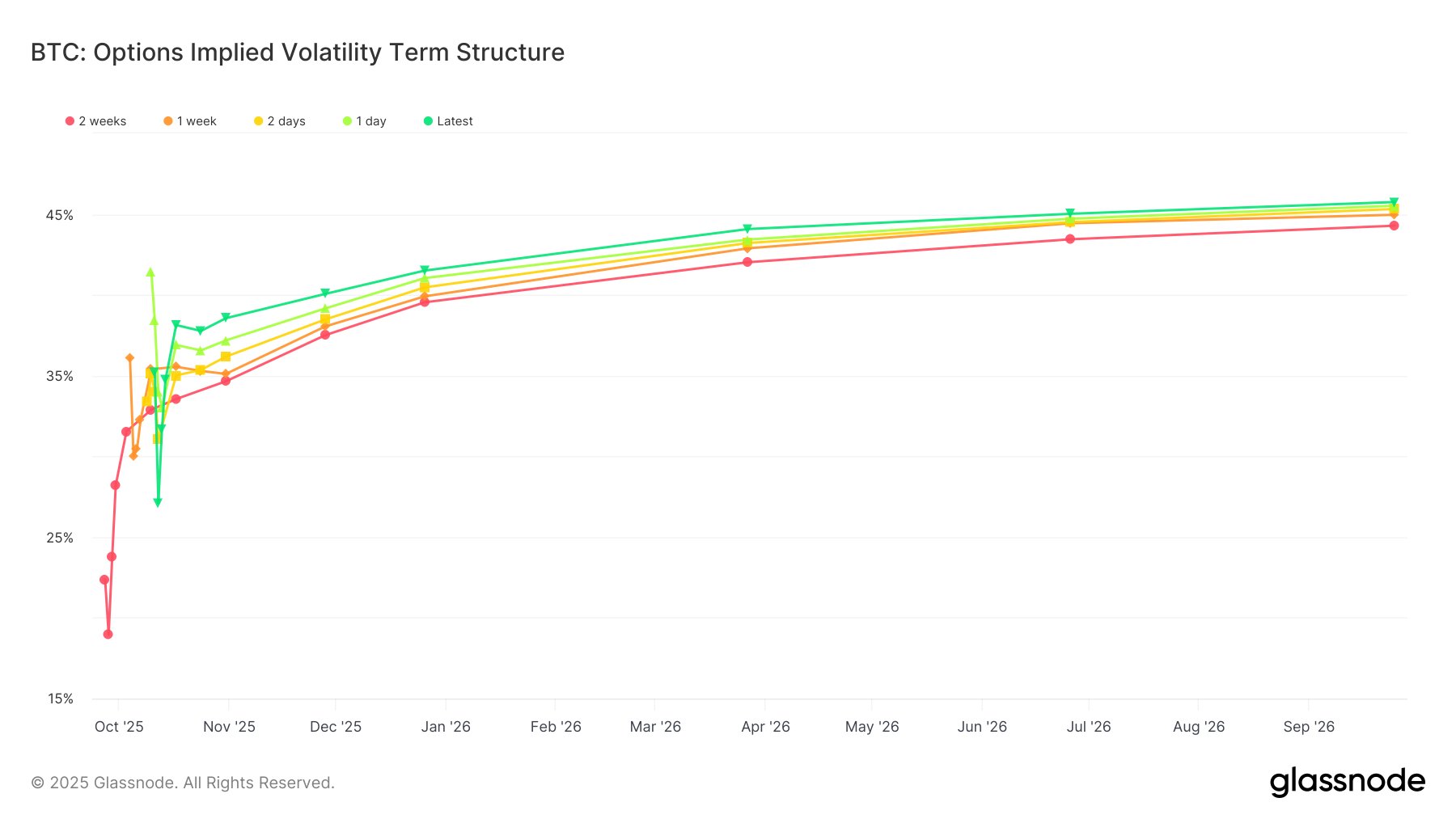

In spite of the drastic upward move, implied volatility, or a measure of anticipated price fluctuations, scarcely changed, hovering around 38–40%. Typically, a rally of such magnitude would elevate volatility as traders rushed to call and increase their exposure. Nevertheless, the muted response indicates steadiness from institutional investors who were either already positioned for the shift or simply reluctant to invest further for potential upside.

Glassnode analysts also highlight another discreet yet indicative signal in option skew. Even at the peak of the rally, the demand for put options remained robust, sustaining the market’s elevated state. This suggests that several large participants were offloading calls, effectively capping possible upside, through the options market, while securing insurance in the event of a market reversal.

Furthermore, the put-call ratio also strengthens this cautious trend among institutions. In light of the option expiration on Friday, October 9, the ratio increased above 1.0, signifying that more puts were transacted than calls as traders focused on hedging positions prior to the current downturn rather than pursuing momentum and securing recent profits.

Overall, Glassnode describes the Bitcoin market as exhibiting a different behavior during this cycle, influenced by institutional discipline rather than soaring volatility and retail enthusiasm as witnessed in previous cycles. The prominence of institutional funding driven by spot ETFs and the recent emergence of crypto treasury firms may have added a substantial layer of maturity to the $2 trillion market.

BTC Market Overview

At the moment of writing, Bitcoin is valued at $110,805 following a 7.54% decrease in the last 24 hours. Meanwhile, daily trading volume has escalated by 150.37%, reflecting an increase in market activity as traders respond to the sharp decline.

Featured image from Flickr, chart from Tradingview

Editorial Process for bitcoinist is focused on delivering thoroughly researched, precise, and impartial content. We adhere to stringent sourcing standards, and every page undergoes meticulous review by our team of leading technology experts and experienced editors. This procedure guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`