“`html

By Katherine K. Chan

HEADLINE INFLATION presumably accelerated to a six-month apex in September, yet still beneath the 2-4% objective, attributed to a surge in food and energy expenses, analysts indicated.

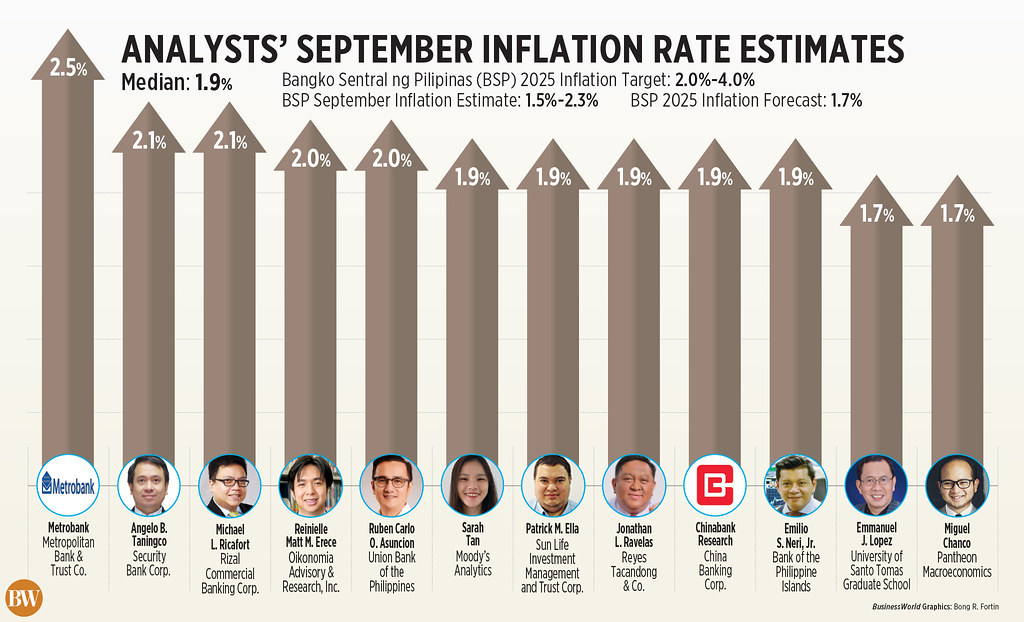

A BusinessWorld survey of 12 analysts yielded a median prediction of 1.9% for September inflation, falling within the Bangko Sentral ng Pilipinas’ (BSP) 1.5-2.3% projection for the month.

If materialized, inflation would have intensified from 1.5% in August but stabilized from the 1.9% rate in September 2024.

This would also mark the quickest print in six months or since the 2.1% in February.

September may represent the seventh consecutive month in which the consumer price index remained below the central bank’s 2-4% target range.

The Philippine Statistics Authority is set to unveil the September inflation statistics on Tuesday, Oct. 7.

“Inflation in the Philippines is likely to have risen to 1.9% (year on year) in September from 1.5% in August, following a series of typhoons that compromised crops and escalated food prices,” Moody’s Analytics economist Sarah Tan remarked in an email.

Last month, typhoons Mirasol, Ragasa (locally referred to as Nando), and Bualoi (Opong), along with the southwest monsoon, imposed significant rains and flooding across various regions of the country.

“Food prices in September skyrocketed, primarily due to the severe storms impacting the nation. Costs for vegetables and fish surged notably, with vegetable prices undergoing a particularly steep increase compared to last year’s lower price baseline,” Metropolitan Bank Trust & Co. (Metrobank) noted in a report.

Emilio S. Neri, Jr., principal economist at the Bank of the Philippine Islands, stated that inflation may have accelerated to 1.9% in September, “propelled by heightened fish prices amidst rainfall and increasing rice costs following the government’s rice import halt.”

The 60-day ban on imports of regular milled and well-milled rice commenced on Sept. 1.

“The prohibition was implemented to support local palay pricing and shield Filipino farmers from economic hardship. Despite the ongoing import suspension, prevailing deflation in rice prices this month will persist in mitigating headline inflation,” Metrobank observed.

ENERGY COSTS

Increased costs for fuel, electricity and cooking oil might have also contributed to inflation in September, Chinabank Research stated.

“Nonetheless, these rising price pressures were likely counterbalanced by reductions in the prices of rice, meat, vegetables, fruits, and sugar,” it added.

In September, fuel prices experienced a net increase of P2.80 per liter for gasoline, P3.70 per liter for diesel, and P2.50 per liter for kerosene.

“I speculate that headline inflation for September 2025 may have risen to 1.7%, mainly due to a combination of multiple variables, chief among them being the continuous escalation in prices of essential petroleum products particularly diesel, which in a month has cumulatively increased by over P4,” Emmanuel J. Lopez, professorial lecturer at the University of Santo Tomas Graduate School, conveyed in an email.

Metrobank remarked that Manila Electric Co. (Meralco) rates were lower month on month in September, yet remained high compared to the previous year.

Meralco reduced electricity rates by P0.1852 per kilowatt-hour (kWh) in September, bringing the overall rate for a typical household to P13.0851 per kWh from P13.2703 per kWh in the prior month. Nonetheless, this is still above the P11.7882 per kWh noted in September 2024.

“Visayas Electric and Davao Light also reported heightened prices for the month, attributed to outages at power plants nationwide,” Metrobank added.

Angelo B. Taningco, research head and chief economist at Security Bank, indicated that the depreciation of the peso may have also played a role in the inflation increase last month.

The peso closed at P58.196 per dollar on Sept. 30, depreciating by P1.066 or 1.83% from its value of P57.13 on Aug. 29.

OUTLOOK

Chinabank Research anticipates inflation to remain minimal for the remainder of the year, with average inflation stabilizing below the 2-4% target.

Reinielle Matt M. Erece, an economist at Oikonomia Advisory & Research, Inc., mentioned inflation may rise ahead of the Christmas season as “increased demand exacerbates price pressures.”

“For the rest of the year, there exists a possibility that inflation could increase due to holiday demand, climatic risks, and fluctuations in global oil prices. However, in the absence of major disturbances, it is likely to remain below or at 2%,” Jonathan L. Ravelas, a senior advisor at Reyes Tacandong & Co., noted.

The state weather bureau previously indicated that it anticipates five to nine additional tropical storms to impact the country prior to year-end.

“Looking forward, inflation risks are tilted to the upside as beneficial rice base effects diminish, with the prolongation of the import suspension exerting extra pressure,” BPI’s Mr. Neri commented.

He predicted inflation would likely hover around the 2% mark until December, before exceeding 3% in the first half of 2026 due to “base effects and possible supply shocks resulting from supply-chain disruptions related to Trump’s tariffs.”

“Meanwhile, the influx of inexpensive Chinese exports into global markets, including the Philippines, may assist in alleviating price pressures,” Mr. Neri remarked.

In a separate commentary, Diwa C. Guinigundo, country analyst at GlobalSource Partners, stated that the expected accelerated headline inflation may compel the BSP to maintain its stance at its forthcoming policy-setting meeting.

“Rice and fish prices continue to remain high, while soaring fuel costs add another layer of pressure on household expenditures. These elements are anticipated to intensify headline inflation,” he said.

“Given this situation, the BSP may deem it wise to keep its policy rate unchanged in the upcoming Monetary Board meeting, prioritizing financial stability over short-term growth assistance,” he concluded.

On Aug. 28, the central bank decreased borrowing rates by 25 basis points (bps) to 5%. It has thus far reduced the benchmark interest rate by 150 bps within the current easing cycle.

The Monetary Board is poised for its last two meetings this year on Oct. 9 and Dec. 11.

Source link

“`