“`html

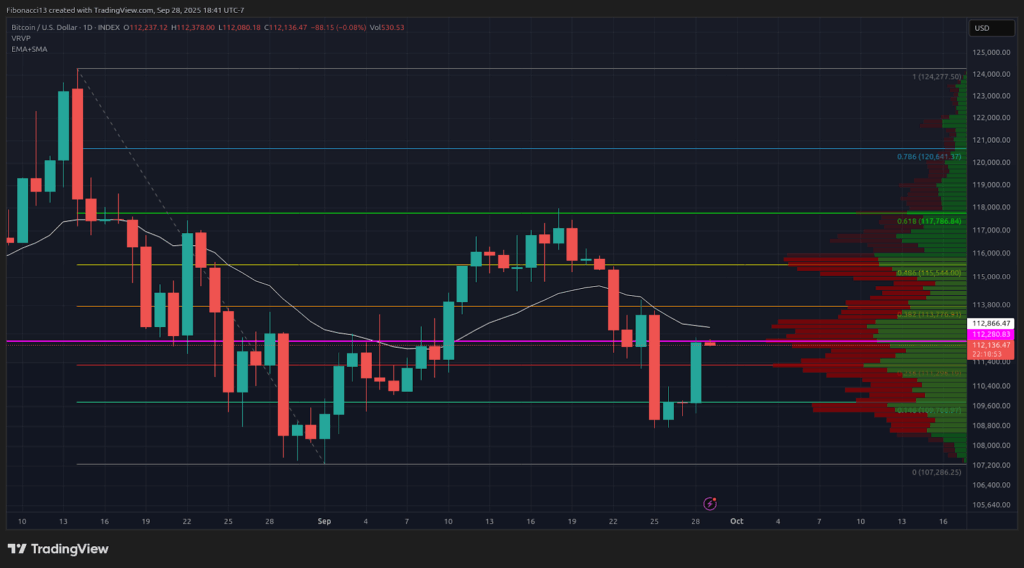

As emphasized in last week’s report, bitcoin experienced a significant decline last Sunday evening, plummeting to $111,800. Subsequently, the price recovered to re-examine the $113,800 resistance threshold and the 21-day EMA at $114,000, but faced rejection there, descending back to the $111,300 support threshold. This level yielded another rebound for the bulls back to the 21-day EMA, yet access above the $113,800 resistance level was denied again, dropping just below the weekly support of $109,500 on Thursday. The price surged from that Thursday low to conclude the week at $112,225.

Current Key Support and Resistance Levels

Given that the price settled above the 21-week EMA at $109,500 to wrap up the week, the bulls are looking for this support to remain intact moving forward. $109,500 should serve as the foundation as we enter this week, if the bulls are to deliver a weekly higher low and reverse the trend. $105,000 represents the next support level below, with the potential for a considerable reversal from there down to around $102,000. Falling below $102,000 would open the pathway to substantial long-term support at $96,000.

On the upside, bulls will aim for the price to close above the $115,500 resistance level to reinstate the uptrend. This would instill confidence for the bulls to confront the $118,000 resistance once more and likely breach it. $121,000 lies above as the threshold to new peaks, although it probably won’t hold for long if we achieve a weekly close above $118,000.

Week Ahead Outlook

Anticipate the price to re-test the $109,500 low at the start of the week, with the potential to solidify this level as support for a bullish ascent back to $113,800. It would likely require substantial buying momentum to surpass the $115,500 resistance level this week, so expect this threshold to restrain progress if $113,800 can be overcome. Bulls will aim to establish a green candle this week to validate last week as a higher low.

Nonetheless, the bias remains bearish on the weekly chart, thus we should expect the $113,800 resistance level to hold in the short term. A drop below $109,500 on the daily chart could trigger another significant price decline this week, testing new lows in the $105,000 to $102,000 support region.

Market Sentiment: Bearish — with a substantial red candle to conclude the week, the bears maintain control. The bulls must emerge vigorously this week to safeguard the 21-week EMA support.

Upcoming Weeks

The weekly chart continues to exhibit a bearish trend until demonstrated otherwise. Bulls need to shift the bias back in their favor to encourage more favorable price movements ahead; they can achieve this with a strong finish to conclude this week. With September’s interest rate cut now behind us, markets will be anticipating further rate cuts in the October and December FOMC meetings to ensure capital remains flowing. Investors will be closely watching US financial reports in the coming weeks for data indicative of further cuts. Any obstacles to additional cuts in the data will likely result in more bearish price movements and increased selling.

Glossary:

Bulls/Bullish: Participants or investors anticipating an increase in price.

Bears/Bearish: Participants or investors predicting a decrease in price.

Support or support level: A level at which the price is expected to remain for the asset, at least initially. The more times support is tested, the weaker it becomes, increasing the likelihood it may fail.

Resistance or resistance level: The opposite of support. The level likely to reject the price, at least initially. The more times resistance is tested, the weaker it becomes, raising the odds that it may fail to hold back the price.

EMA: Exponential Moving Average. A moving average that assigns more significance to recent prices compared to earlier ones, reducing the lag of the moving average.

Source link

“`