“`html

As per information from Coinglass, the cryptocurrency market experienced liquidations exceeding $1.6 billion in the last 24 hours, primarily involving long positions. Heightened inflows to exchanges pose a risk of driving Bitcoin (BTC) further down past the crucial support threshold of $112,000.

Bitcoin Dips, Is $112,000 at Risk?

Bitcoin dropped from approximately $116,000 to a minimum of $111,800 earlier today, as the broader crypto marketplace faced fluctuations amid worries of a US government shutdown. Prediction markets on Kalshi are currently projecting a 70% probability of a shutdown occurring in 2025.

Related Articles

Reflecting on today’s BTC market movements, CryptoQuant contributor PelinayPA noted that at the end of August and the beginning of September, nearly 65,000 BTC were taken out from exchanges, which coincided with a price rebound in the digital currency.

The analyst provided the following chart, illustrating BTC withdrawals from trading platforms. Typically, significant outflows from exchanges signify that investors are relocating their assets to private wallets – alleviating immediate selling pressure and indicating a bullish trend.

That being said, current patterns suggest that such outflows have diminished. Specifically, since September 20, exchange statistics indicate that a larger number of investors are opting to retain their assets on exchanges.

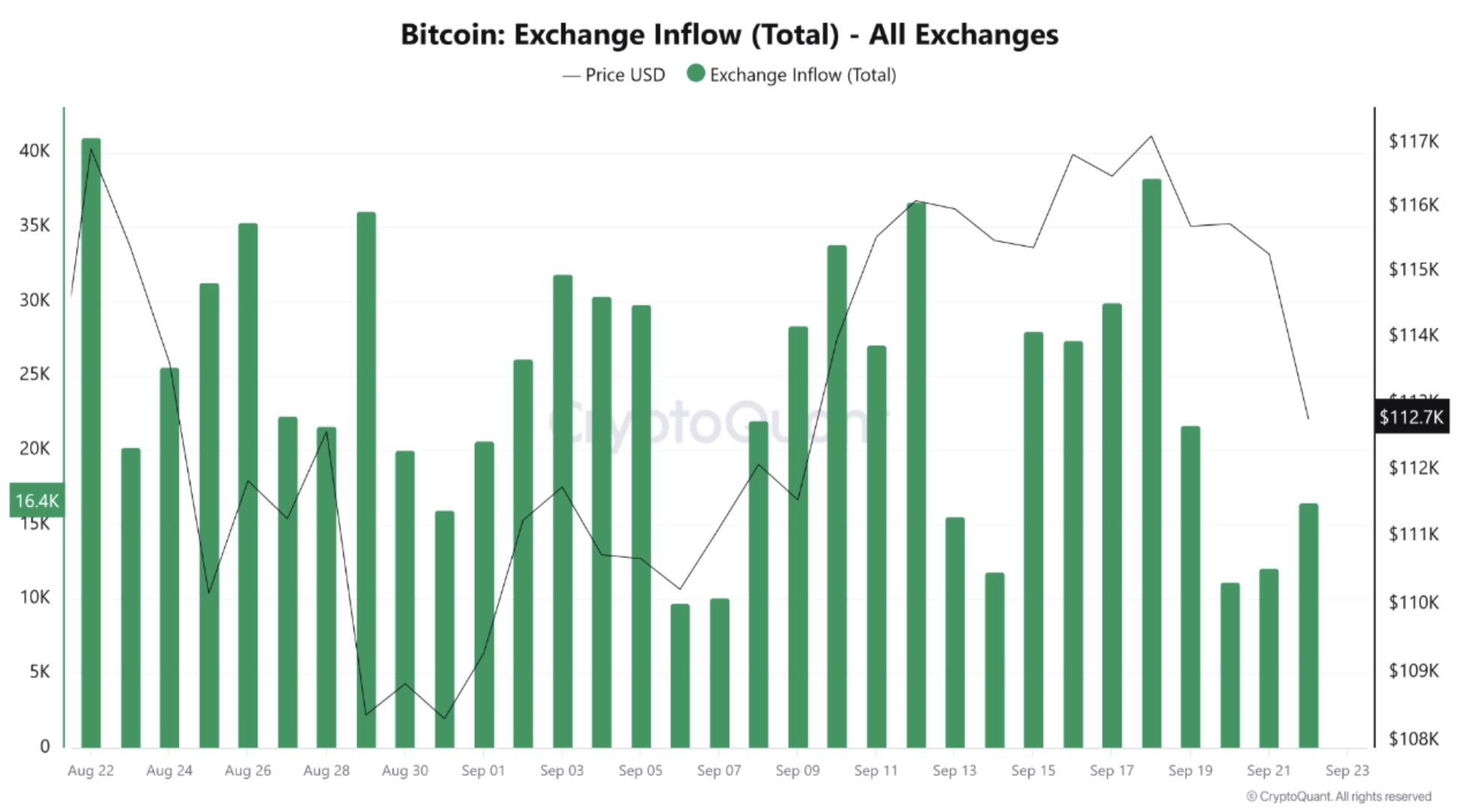

PelinayPA presented another chart depicting BTC deposits to exchanges. Notably, from September 17 to 19, Bitcoin inflows to exchanges skyrocketed to nearly 40,000, while the price fell to $117,000.

For those unfamiliar, high BTC inflows to exchanges typically suggest that investors are shifting their cryptocurrencies from personal wallets to platforms where they can be traded, indicating a heightened intention to sell. This results in short-term bearish pressure on price, as an increased supply on exchanges may surpass demand.

The CryptoQuant analyst further noted that during the rally from September 7 to 15, BTC outflows from exchanges outstripped inflows, promoting bullish momentum. However, inflows surpassed outflows following September 17, stimulating strong selling pressure and driving BTC down to $112,700. She concluded:

Despite high inflows, outflows are relatively weak, pointing to short-term downward pressure. Should outflows rise again, indicating accumulation, BTC could rebound decisively from the $112K region. Otherwise, additional downside risk persists.

Should BTC Holders Be Concerned?

Bitcoin’s decline to $112,000 should not be unexpected. Recent on-chain metrics had already suggested that BTC might face difficulties due to a dearth of whale involvement in the recent upswing.

Related Articles

It’s important to note that BTC’s recent price drop occurred shortly after the US Federal Reserve (Fed) reduced interest rates by 25 basis points. Although the leading cryptocurrency dipped, analysts believe that a genuine capitulation is still far off.

CryptoQuant CEO Ki Young Ju recently forecast that BTC might reach $208,000 in this market cycle. Currently, BTC trades at $113,175, down 2.1% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Source link

“`