Bitcoin is experiencing a fundamental transformation, and institutional investors are progressively tightening their hold on the cryptocurrency. As of mid-2025, institutional investors are emerging as a significant presence in Bitcoin ownership and are continually acquiring a substantial share of its circulating supply.

Institutional Bitcoin Holdings Approach 20% Of Supply

Recent statistics indicate that institutions, spanning from ETFs to publicly traded companies, now oversee an unparalleled portion of Bitcoin, valued in the hundreds of billions. Estimates suggest that institutional ownership ranges from 17 to nearly 31 percent of total supply when including the quantity held by governments.

Related Reading

According to data from Bitbo, entities like ETFs, private and public companies, governments, and DeFi protocols together possess over 3.642 million BTC, representing around 17.344% of the total supply. At current prices, this translates to about $428 billion in Bitcoin stored within institutional treasuries.

ETFs are the primary contributors, holding more than 1.49 million BTC, while public entities like strategy firms, Tesla, and others account for 935,498 BTC. Strategy’s involvement is particularly notable, as the firm’s unwavering accumulation strategy in recent years has led it to acquire 628,946 BTC, or approximately three percent of the whole circulating supply.

Bitbo data shows private companies possess 426,237 BTC, valued at $50.17 billion, accounting for about 2.03% of the total circulating supply. BTC mining companies own 109,808 BTC (0.523% of the total circulating supply), while DeFi protocols hold 267,236 BTC (1.273% of the total circulating supply).

Bitcoin holdings by category. Source: Bitbo

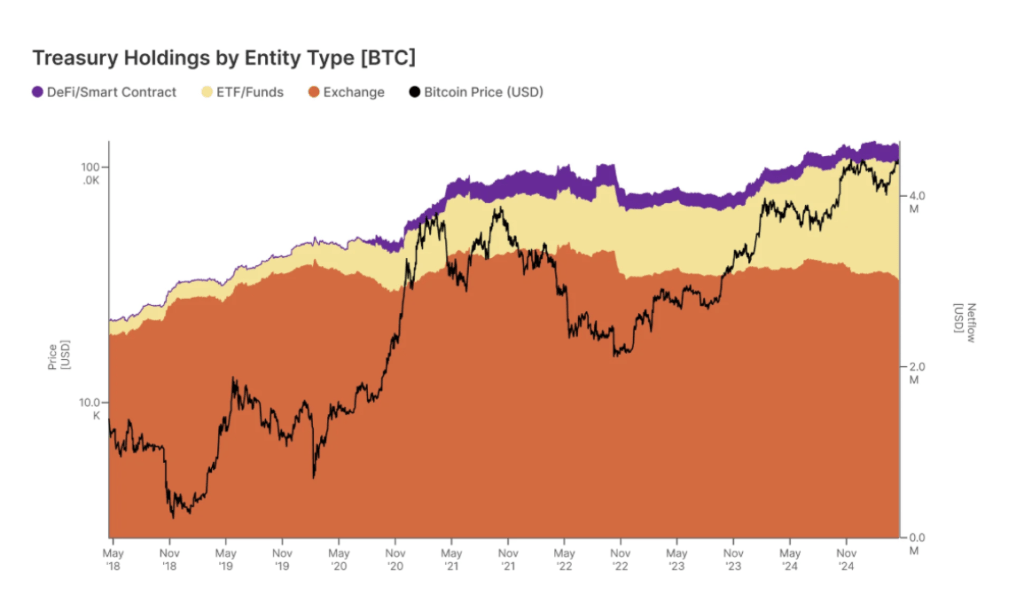

Additional reports, such as a collaborative study by Gemini and Glassnode, indicate that these figures could be even greater. Their analysis highlights centralized treasuries made up of governments, ETFs, corporations, and exchanges controlling as much as 30.9% of circulating Bitcoin, equating to over 6.1 million BTC. This escalation signifies a 924% increase in institutional dominance over Bitcoin compared to a decade prior.

Chart Image From Gemini: Bitcoin treasury holdings by entity type

Is Bitcoin The New Playground for Wall Street?

Bitcoin’s ascent in its formative years was fueled by a combination of excitement from retail investors and long-term belief from early adopters, yet the market’s distribution of power is changing. Based on holding data, Bitcoin is increasingly becoming less accessible for retail traders, now turning into a playground for prominent Wall Street firms.

Institutional appetite for Bitcoin is not limited to corporations and ETFs alone. Governments are also starting to establish their footprint, with the United States making a notable move earlier this year. In March 2025, the US government created a Strategic Bitcoin Reserve composed of seized and forfeited digital assets. Other nations like El Salvador and Bhutan are also acquiring Bitcoin through deliberate, ongoing purchases, further constricting the circulating supply.

Related Reading

Some analysts believe this could diminish Bitcoin’s price volatility and promote its price appreciation in the long run. Conversely, the concentration of Bitcoin among a relatively small set of entities might threaten its decentralization and the organic development of its price. Regardless, data demonstrates that Bitcoin is now emerging as Wall Street’s latest playground.

As of this writing, Bitcoin was trading at $117,460.

Featured image from Unsplash, chart from TradingView