By Luisa Maria Jacinta C. Jocson, Senior Correspondent

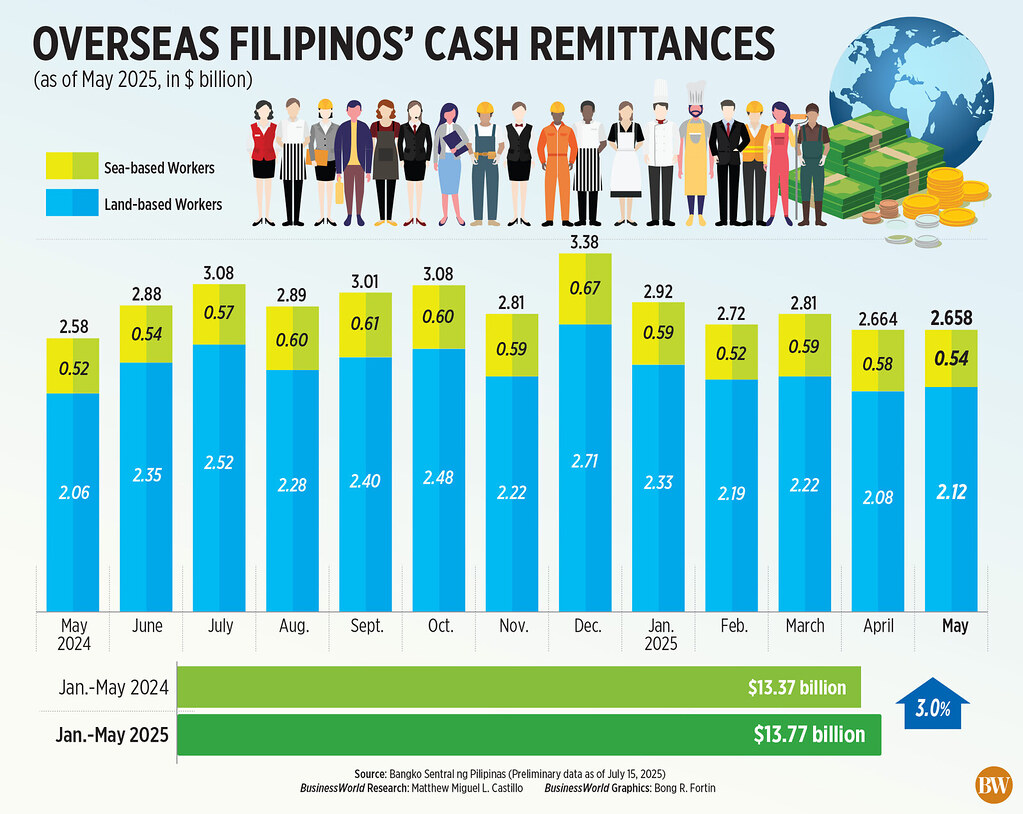

FUNDS SENT BACK home by overseas Filipino workers (OFWs) increased by an annual 2.9% in May, even though the monthly total was the lowest in a year, according to data from the Bangko Sentral ng Pilipinas (BSP).

Cash remittances processed through banks rose by 2.9% to $2.658 billion in May from $2.583 billion during the same month last year, the central bank reported on Tuesday.

This marked the lowest monthly remittance level in 12 months or since May 2024.

Growth in remittances for May also decelerated from April’s pace of 4%, when cash remittances hit $2.664 billion.

Funds sent by land-based workers rose by 2.8% to $2.12 billion in May compared to $2.06 billion in the same month last year.

Remittances from sea-based migrant workers surged by an annual 3.1% to $536 million in May.

“The uptick in cash remittances contributed to a rise in personal remittances too,” stated the BSP.

Personal remittances, which encompass in-kind inflows, increased by 3% to $2.97 billion in May from $2.88 billion in the same month last year.

Breaking it down, remittances from workers under contracts of a year or more rose by 2.8% to $2.29 billion, while those with contracts shorter than a year increased by 3.4% to $590 million.

FIVE-MONTH PERIOD

During the initial five months, cash remittances expanded by 3% to $13.77 billion from $13.37 billion in the same period last year.

Remittances from land-based workers climbed by 3.3% to $10.94 billion from January to May, while sea-based workers’ remittances rose by 2% to $2.82 billion.

The United States was the leading source of remittances in the five-month span, contributing 40.2% of the overall total.

It was followed by Singapore (7.4%), Saudi Arabia (6.4%), Japan (5%), the United Kingdom (4.6%), the United Arab Emirates (4.2%), Canada (3.3%), Qatar (2.9%), Korea (2.8%), and Taiwan (2.7%).

Personal remittances rose by 3% to $15.34 billion at the end of May from $14.89 billion a year earlier.

“The slowing global economy due to Trump’s tariffs may have hindered recent OFW remittance volumes,” noted Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort.

Jonathan L. Ravelas, a senior adviser at Reyes Tacandong & Co., also pointed out the heightened uncertainty arising from the tariffs.

“The tariff actions contribute to geopolitical and trade uncertainty, which may discourage foreign direct investment (FDI),” he remarked.

US President Donald J. Trump initially announced the first wave of tariffs to be imposed on trading partners back in April.

Earlier this month, Mr. Trump issued notifications with the updated tariff rates he intends to enforce.

“The implementation of a 20% tariff on all Philippine exports to the US starting August 1, 2025, by President Trump is projected to have considerable and varied impacts on the Philippine economy,” Mr. Ravelas added.

The Philippines is set to face a 20% reciprocal tariff, which is higher than the previously announced 17% in April.

“In the upcoming months, Mr. Trump’s protectionist policies, especially tighter immigration regulations, could exert pressure on certain OFW remittances, particularly from the US,” stated Mr. Ricafort.

Mr. Trump has promised mass deportations, citing the need for them following the high levels of illegal immigration during his predecessor’s term, according to Reuters.

Mr. Trump’s recently approved “One Big Beautiful Bill” also imposes a 1% excise tax on remittance transactions from the United States to other nations, effective after December 31, 2025. This was reduced from earlier proposals of a 3.5% levy.

Originally intended for non-US citizens, the tax now applies to all remittance senders.

“Trump’s threats of increased tariffs and other America-first measures may also decelerate global trade, investments, and employment, including some OFW jobs, along with overall world economic growth, consequently possibly hampering the growth of OFW remittances,” Mr. Ricafort remarked.

This year, the central bank anticipates remittances to increase by 2.8%.