FOREIGN DIRECT INVESTMENTS (FDI) in the Philippines increased by 7.1% year on year in April, driven by inflows from Japan and capital in the manufacturing sector, as reported by the central bank.

“Net foreign direct investments (FDI) in the Philippines remained positive in April 2025, with leading inflows from Japan and into manufacturing,” the Bangko Sentral ng Pilipinas (BSP) stated in a release.

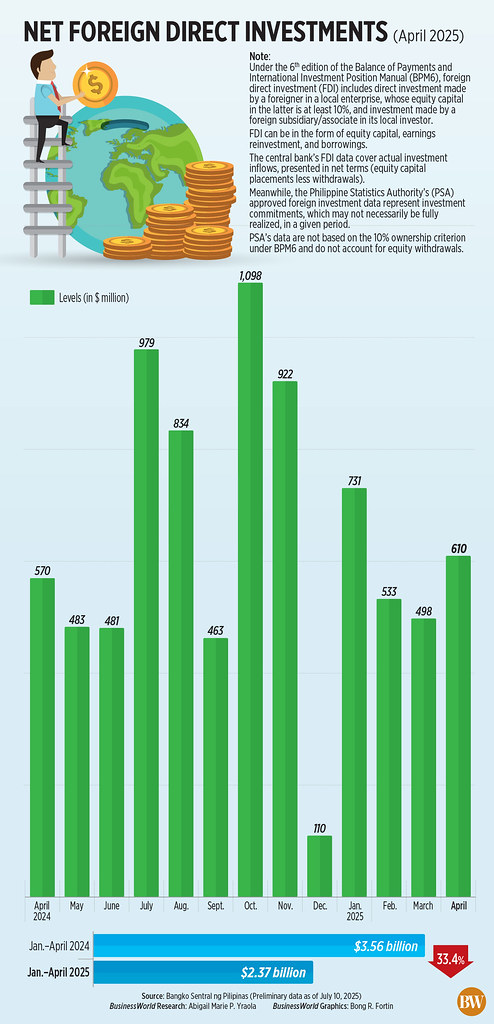

FDI net inflows reached $610 million in April, an increase from $570 million a year prior and from $498 million in March. The latest statistic indicates a recovery from the 27.8% decline noted in March.

The BSP credited the upswing to a 24.3% annual rise in nonresidents’ net investments in debt instruments issued by local affiliates to $522 million.

Conversely, equity capital investments — excluding reinvested earnings — plummeted by 94.1% to merely $4 million compared to a year ago.

Japan constituted the largest share of equity placements at 32%, trailed by the US (18%), Singapore (13%), South Korea (13%), and Taiwan (9%).

Nearly half (47%) of April’s investments were directed towards the manufacturing sector, while the financial and insurance, as well as real estate sectors each represented 16%.

Reinvestment of earnings also grew by 3.3% to $84 million in April.

Total investments in equity and investment fund shares decreased by 41.1% to $88 million compared to April 2024.

“The rise in FDIs in April, primarily driven by higher inflows into manufacturing from Japan, indicates renewed investor enthusiasm for the Philippines as a production center amidst global supply chain changes,” John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, communicated in a Viber message.

“Strategic industries such as electronics and automotive components are drawing investment as companies shift away from China in search of cost-effective alternatives in Southeast Asia,” he remarked.

However, he indicated that the 20% tariffs levied by the US on the Philippines could dampen FDI sentiment in the upcoming months.

On Thursday, the US government increased tariffs on Philippine exports to 20%, up from 17%, as part of President Donald J. Trump’s extensive tariffs on US trading partners.

“Investors may reevaluate the Philippines’ competitiveness in comparison to peers like Vietnam or Thailand, which may negotiate more favorable trade agreements,” Mr. Rivera stated.

He urged the administration to engage in “swift trade diplomacy,” offer assistance to affected sectors, and enhance the country’s investment attractiveness through consistent policies, incentives, and improved logistics.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., noted that the April FDI was bolstered by the recent enactment of a measure that expands fiscal incentives and lowers corporate income taxes for foreign investors.

Despite the FDI recovery in April, FDI net inflows for the first four months decreased by 33.4% to $2.37 billion year on year.

Debt instrument investments fell by 24.3% to $1.72 billion, whereas equity capital investments, excluding reinvested earnings, dropped by 68.6% to $302 million.

Equity placements declined by 57.5% to $509 million, while withdrawals decreased by 11.8% to $207 million.

Key sources of equity investments during this timeframe included Japan (40%), the US (17%), Singapore (14%), South Korea (7%), and Malaysia (6%).

The majority of investments were directed to the manufacturing sector (47%), followed by real estate (21%) and financial and insurance (14%).

In the meantime, reinvestment of earnings from January to April increased by 7.4% to $348 million compared to the previous year. — A.M.C. Sy