“`html

PHILIPPINE manufacturing activity in June grew at its swiftest rate in two months as output increased and new requests surged, S&P Global reported.

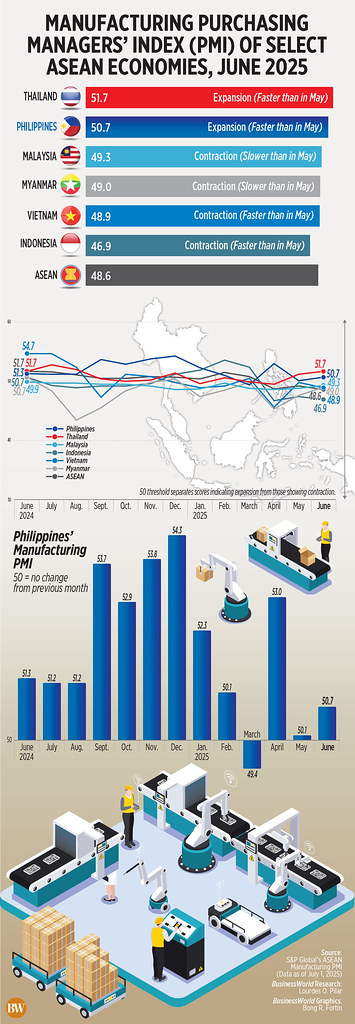

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) rose to 50.7 in June from 50.1 in May.

June also indicated the third successive expansion following the 49.4 figure in March.

A PMI score exceeding 50 signifies improved operating conditions compared to the previous month, while a score below 50 denotes decline.

“The overall condition of the Philippine manufacturing industry remained relatively muted as the first half of the year came to a close,” stated Maryam Baluch, economist at S&P Global Market Intelligence.

“Nonetheless, even though new requests keep increasing, the pace is historically subdued, hindered by a stagnant export landscape,” she added.

Uncertainties surrounding the Trump administration’s tariff policies have impacted the Philippines and other Southeast Asian nations, which depend on exports to the US market.

S&P Global data on the Association of Southeast Asian Nations (ASEAN) revealed that only two nations registered an increase in PMI in June: Thailand and the Philippines. Thailand recorded the highest PMI at 51.7, with the Philippines at 50.7. Both figures surpassed the ASEAN average of 48.6.

Conversely, Malaysia (49.3), Myanmar (49), Vietnam (48.9), and Indonesia (46.9) experienced a contraction in manufacturing activity.

In April, US President Donald J. Trump announced a baseline 10% tariff on all trading partners, along with higher reciprocal tariffs on some nations. The Philippines faced a 17% tariff, the second lowest within Southeast Asia.

While the reciprocal tariffs have been suspended for 90 days until July 9, the baseline 10% tariff remains active.

NEW REQUESTS

In June, S&P Global indicated that Philippine manufacturers noted an additional rise in new requests.

“The growth rate was marginally stronger than that recorded in the prior month, although it stayed below the long-term survey average. Anecdotal information attributed this latest improvement to successful customer acquisitions, enhanced underlying demand trends, and effective marketing initiatives,” it added.

S&P Global observed that production levels returned to the expansion zone, albeit “only slightly.” This marked a turnaround from the minor contraction noted in May.

“The growth rate of output lagged behind the increase in incoming new business,” it remarked.

Manufacturers escalated purchasing activities in response to improved demand.

However, Ms. Baluch pointed out that delays in delivery times for inputs and material shortages have hindered production capabilities.

“Delayed delivery times for inputs and shortages in materials meant that goods-producing firms in the Philippines struggled to adequately replenish their post-production inventories, reflecting the challenges manufacturers face in effectively expanding production amidst rising demand,” S&P Global stated.

In the meantime, Philippine manufacturers increased employment for the first time in four months, responding to the heightened demand.

S&P Global reported that inflationary pressures remained historically low in June.

“Rates of input price and output charge inflation were marginally slower than those observed in May. Where input prices increased, this was primarily attributed by panelists to rising material costs,” it noted.

S&P Global indicated that business confidence strengthened compared to May but was still significantly below historical standards.

“The coming months will be crucial to assess whether the sector can return to growth rates similar to those of much of last year,” stated Ms. Baluch.

“Lower inflationary pressures and sustained demand will partially assist Filipino manufacturers in achieving this through improved pricing power. However, historically subdued business confidence indicates a more temperate path for the upcoming year.” — A.R.A.Inosante

Source link

“`