“`html

HEADLINE INFLATION may have marginally increased in June as steady food prices contributed to balancing the surge in fuel prices, analysts noted.

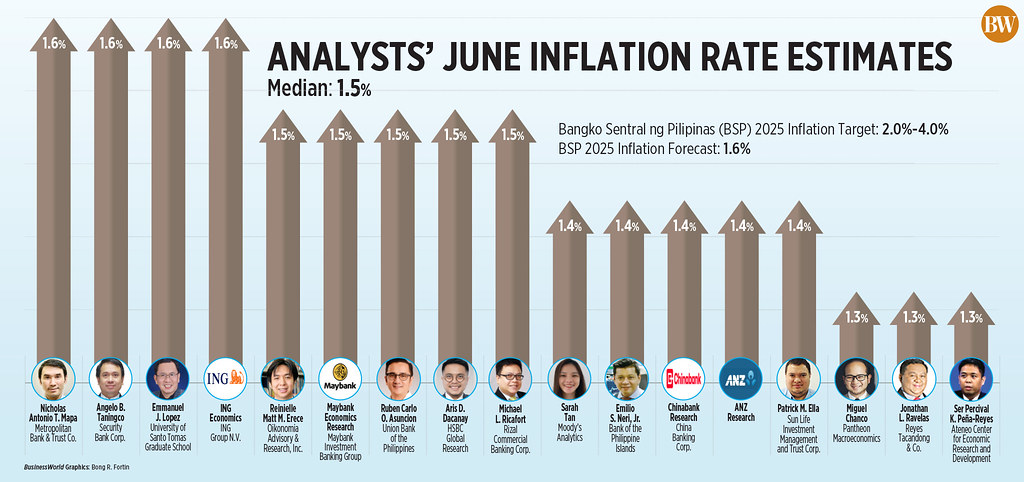

A BusinessWorld survey of 17 analysts produced a median prediction of 1.5% for June inflation, accelerating from 1.3% in May yet still below the Bangko Sentral ng Pilipinas’ (BSP) target range of 2-4%.

If actualized, this would mark the quickest pace in three months, since the 1.8% in March. However, it would be slower than the 3.7% figure in June 2024.

The Bangko Sentral ng Pilipinas (BSP) is set to issue its inflation forecast for June on Monday, June 30.

The June inflation figures will be published by the Philippine Statistics Authority (PSA) on July 4.

Maybank Investment Banking Group Economics Research provided a June inflation estimate of 1.5%, attributing it to a slower rise in food and electricity prices.

“Elements include sustained low inflation in crucial categories such as food and electricity, which may counterbalance some upward pressures from the rise in fuel costs in the last two weeks of the month because of increasing global oil prices due to the escalation in the Middle East conflict,” stated Maybank.

Moody’s Analytics economist Sarah Tan, anticipating inflation to have settled at 1.4% in June, suggested that prices in the food basket likely remained steady, “supported by a slight decline in rice prices.”

The PSA indicated that rice prices further decreased in June, with regular milled rice averaging P42.77 per kilo, down from P43.32 per kilo in mid-May.

“Our food-price tracker indicates that food inflation has diminished further—approaching zero—but this should be completely neutralized by a temporary uptick in housing and utility inflation to over 3%,” conveyed Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco.

Aris D. Dacanay, an economist for ASEAN at HSBC Global Research, noted that electricity rates in Metro Manila fell by 0.9% month-on-month in June due to reduced generation costs.

Manila Electric Co. (Meralco) lowered the overall rate by P0.1076 per kilowatt-hour (kWh) to P12.1552 per kWh in June from P12.2628 per kWh the previous month. Generation rates dropped by 0.9% to P7.3552 per kilowatt-hour (kWh) compared to May.

“We project June inflation to settle at 1.6% year-on-year, up approximately 0.2% from the previous month. Electricity prices along with the costs of select non-rice food items exerted upward pressure on inflation,” stated Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co.

Chinabank Research posited that inflation likely escalated due to higher pump prices, and increasing expenses related to meat, vegetables, and education as the new school year commenced.

FUEL PRICE SURGE

Ms. Tan mentioned that the surge in fuel prices, prompted by the Middle East conflict, may have exerted upward pressure on the utilities sector.

In June, pump price adjustments reflected a net increase of P6.3 per liter for gasoline, P8.25 per liter for diesel, and P6.5 per liter for kerosene.

“Retail gas prices jumped 3% on June 17, reacting to escalating tensions between Iran and Israel, only to have slightly moderated towards the end of the month when tensions began to de-escalate,” Mr. Dacanay observed.

Reuters reported that oil prices were on track for their steepest weekly decline since March 2023, as the lack of significant supply disruption from the Iran-Israel conflict led to the evaporation of any risk premium.

“While global oil prices have moderated after the ceasefire between Israel and Iran, the potential for renewed conflict remains and could drive prices higher again. Nevertheless, inflationary pressures may be alleviated by falling rice prices,” Chinabank Research indicated.

ING Philippines expressed that the rise in domestic pump prices “should be temporary,” with a decline expected in July.

CUTTING RATES PROSPECTS

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. remarked that inflation may begin accelerating by September as “the favorable base from rice will diminish by then.”

“Headline prints are likely to stay within the BSP target, which could permit them to implement another cut before the conclusion of 2025,” Mr. Neri added.

The Monetary Board executed a second consecutive 25-basis-point (bp) cut during its June 19 meeting, lowering the policy rate to 5.25% amidst a benign inflation outlook and slowing economic expansion.

BSP Governor Eli M. Remolona, Jr. indicated they could enact one more 25-bp reduction this year.

The BSP has revised its inflation forecast downwards to 1.6% for the current year from 2.4%. They also expect inflation to settle at 3.4% for 2026 and 3.3% for 2027.

Security Bank Corp. Vice-President and Head of Research Division Angelo B. Taningco expressed his expectation that inflation will be controlled for the remainder of the year, with his full-year forecast set at 1.9%.

“Upside risks to our inflation outlook include a global oil price shock due to a resurgence of the Israel-Iran conflict. We still project a manageable inflation environment and another quarter-point policy rate cut by the BSP before year-end,” remarked Mr. Taningco.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines (UnionBank), foresees inflation gradually rising to 2% by September and closing the year at 2.5%.

“We anticipate that the BSP will sustain its policy easing cycle, likely executing a final 25-bp rate cut in October. This action would provide the central bank with a chance to evaluate the cumulative impact of its previous rate adjustments while preserving a supportive stance for growth,” remarked Mr. Asuncion.

Ms. Tan mentioned that the Middle East conflict could result in persistently elevated global oil prices, potentially leading to increased domestic fuel and utility expenses.

The Philippines, as a net oil importer, is particularly susceptible to fluctuations in global oil prices.

“Should these risks materialize, they could restrict the BSP’s capacity for further policy easing, particularly if second-round effects begin to emerge. However, in the absence of ongoing supply shocks, inflation should remain within targets,” Ms. Tan concluded.

For the full year, Moody’s inflation forecast remained at 2.2%.

In his analysis, Mr. Chanco expressed that there exists ample opportunity and an “urgent need” for two additional 25-bp rate cuts.

The Monetary Board has scheduled its remaining policy meetings for this year on Aug. 28, Oct. 9, and Dec. 11. — Aubrey Rose A. Inosante

Source link

“`