“`html

Fidelity Digital Assets has published a new report indicating that for the first time ever, more bitcoin is entering “ancient supply,” which denotes coins that haven’t moved for 10 years or longer, than are being extracted.

As of June 8, an average of 566 BTC daily is surpassing the 10-year threshold, while merely 450 BTC is being generated each day following the 2024 halving. 3

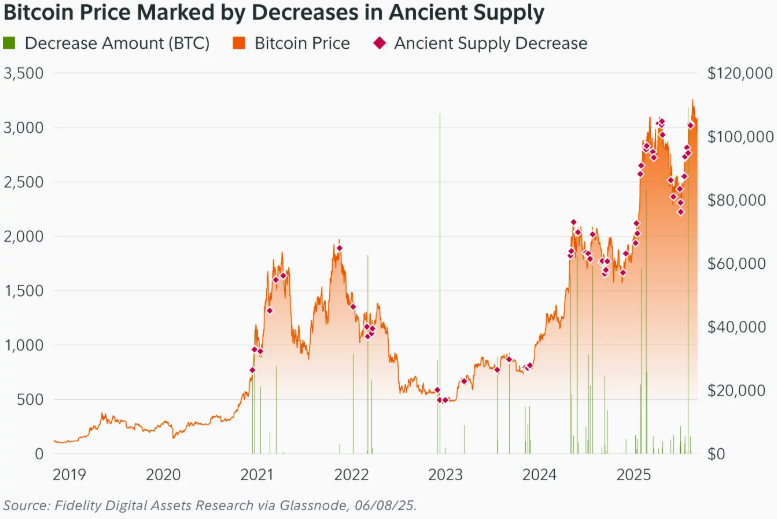

“The proportion of ancient supply also tends to rise each day, with daily reductions noted less than 3% of the time,” the report states. “Conversely, that percentage increases to 13% when the standard is adjusted to bitcoin holders for five years or longer.”

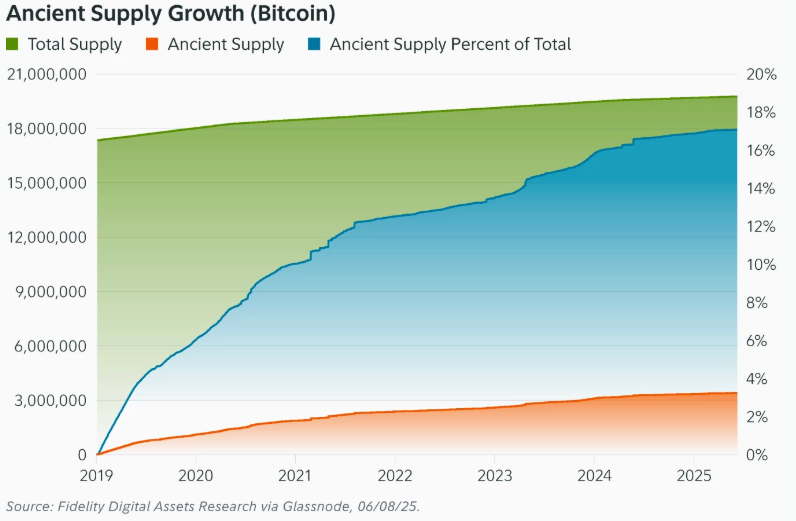

Bitcoin’s ancient supply has expanded since January 1, 2019, when Satoshi Nakamoto became the inaugural 10-year holder. Currently, over 3.4 million BTC qualify in this category, valued at more than $360 billion. It is estimated that approximately one-third of this belongs to Nakamoto.

In spite of their increasing value, long-term holders are refraining from liquidating. Ancient supply constitutes over 17 percent of all bitcoin, and that portion keeps expanding.

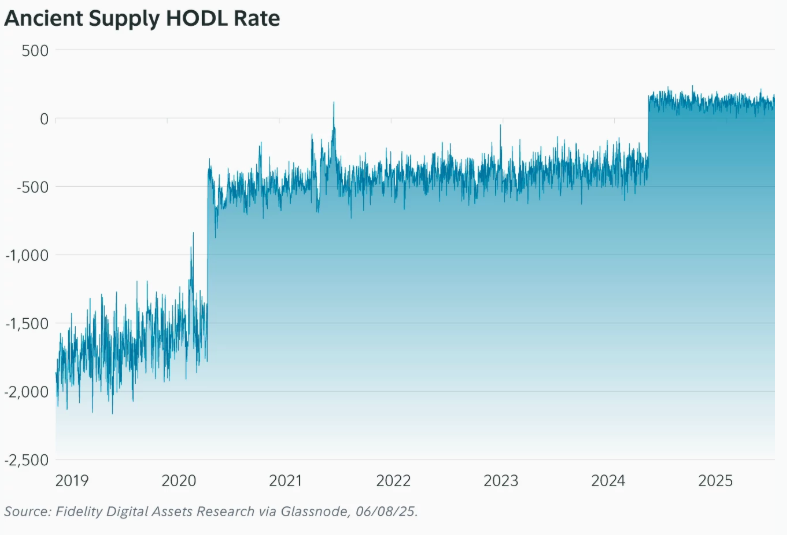

Post the 2024 halving, the volume of coins entering ancient supply has persistently exceeded the amount of newly mined coins, as per the report. This change underscores a growing long-term belief among holders and illustrates a broader constriction of bitcoin’s liquid supply.

After the 2024 U.S. election, ancient supply diminished on 10% of days, which is nearly four times greater than the historical average. Movement among the holders was even more notable, with daily declines happening 39% of the time.

To comprehensively monitor this trend, Fidelity employs a metric known as the ancient supply HODL rate. This measures how many coins are entering the 10-year category each day, adjusted for new issuance. This rate turned positive in April 2024 and has stayed that way, reinforcing the long-term supply shift.

Looking forward, Fidelity Digital Assets projections

“`

That historical supply could achieve 20 percent of the overall bitcoin by 2028 and 25 percent by 2034. If publicly traded companies with at least 1,000 BTC are factored in, it might reach 30 percent by 2035.

According to the report, as of June 8, 27 publicly traded firms collectively hold over 800,000 BTC. This rising institutional involvement could further constrict supply and amplify the sway of long-term holders in the future.