FUNDING SENT BACK HOME by overseas Filipino laborers (OFWs) surged by an annual 4% in April, marking the quickest growth in 28 months, according to data from the Bangko Sentral ng Pilipinas (BSP).

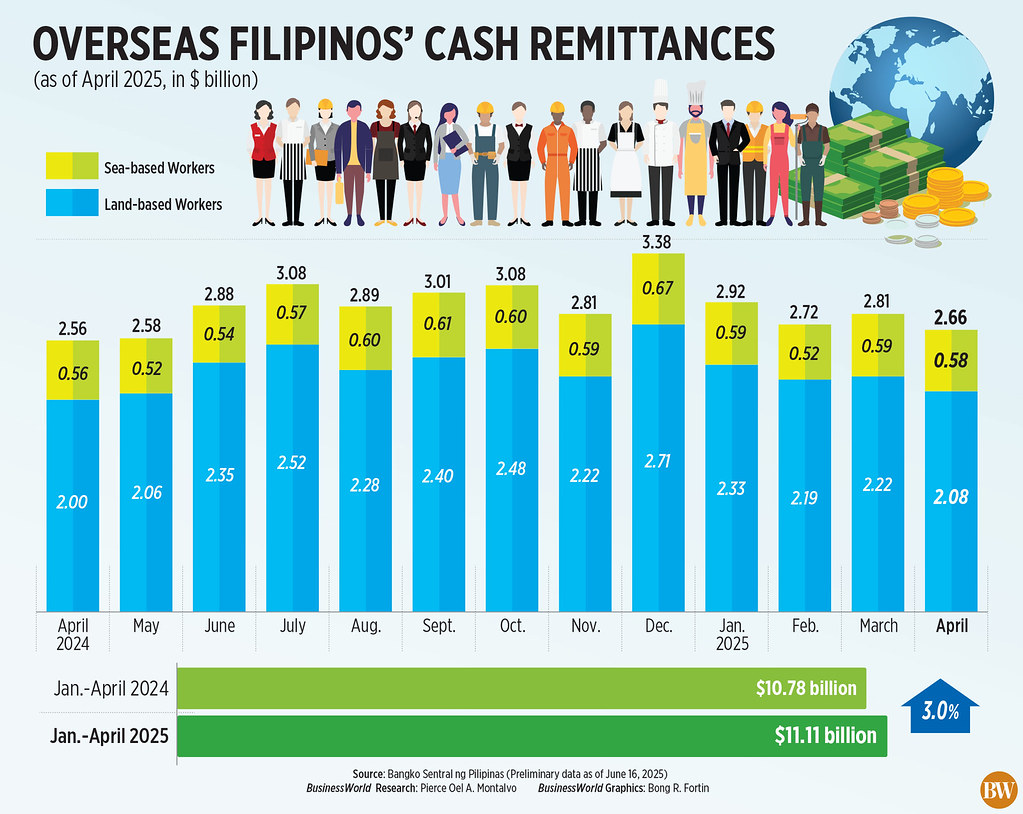

Monetary remittances from Filipino migrants funneled through banks increased by 4% to $2.66 billion in April from $2.56 billion during the same month the previous year.

The 4% annual increase in April was the most rapid since the 5.8% recorded in December 2022.

Nonetheless, the total amount of cash remittances in April was the lowest in almost a year, since May 2024 when remittances amounted to $2.58 billion.

Month over month, remittances fell by 5.1% from $2.81 billion in March.

In April, monetary remittances from land-based laborers increased by 4% to $2.08 billion from $2 billion in the same month last year.

Sea-based migrant laborers sent home $580 million, which is a 3.8% rise from the $560 million a year prior.

Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., stated that the cash remittances exhibited a “robust” growth mainly due to “seasonal dynamics, as this month typically witnesses one of the highest flows during the summer season.”

“The year-on-year growth illustrates a foundational strength in remittance influx, supported by stable overseas employment, especially in the US, Middle East, and various regions of Asia,” said John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies in a Viber correspondence.

Personal remittances, which encompass non-cash inflows, increased by 4.1% to $2.97 billion in April from $2.86 billion a year ago.

Personal remittances from workers with contracts lasting a year or longer rose by 3.9% to $2.25 billion, while those with contracts shorter than a year jumped by 4.1% to $650 million.

FOUR MONTHS

In the initial four months of 2025, cash remittances grew by 3% to $11.11 billion annually from $10.78 billion in the previous year.

Cash remittances transmitted by land-based workers surged by 3.4% to $8.82 billion as of the end of April, while sea-based workers’ remittances rose by 1.7% to $2.29 billion.

“The increased remittances from the United States, Saudi Arabia, Singapore, and the United Arab Emirates (UAE) fueled the overall growth in remittances during January-April 2025,” the BSP noted.

The US remained the leading source of remittances in April, contributing 40.4% of the total.

This was trailed by Singapore (7.3%), Saudi Arabia (6.3%), Japan (5%), the United Kingdom (4.5%), the UAE (4.5%), Canada (3.2%), Qatar (2.9%), Taiwan (2.7%), and Hong Kong (2.7%).

Personal remittances rose by 3% to $12.37 billion during the January-to-April span, compared to $12.01 billion in the same timeframe the prior year.

“We may continue to witness enhanced remittance inflows from OFWs due to the relative strength of the peso. They might be incentivized to send more to sustain the same peso value they previously sent,” remarked Mr. Erece.

The peso closed at P55.84 per dollar at the conclusion of April, appreciating by P1.37 from the P57.21 finish at the end of March.

Mr. Rivera indicated that remittance expansion is likely to remain stable due to the demand for Filipino laborers abroad, especially in healthcare, logistics, and domestic services.

“Global uncertainties such as inflation in host nations, geopolitical tensions, and policy changes like taxes on remittances in major markets (e.g., the US) are risks to keep an eye on,” Mr. Rivera cautioned.

In the US, the One Big Beautiful Bill Act proposes a 3.5% tax on remittances sent overseas by foreign laborers, including green card holders and temporary visa workers.

This is expected to have significant repercussions for nations that heavily depend on remittances, including the Philippines, India, Mexico, and China.

The BSP anticipates a 2.8% increase in cash remittances to an estimated $35.5 billion this year.

Next year, cash remittances are expected to rise by 3% to $36.5 billion. — Aubrey Rose A. Inosante