THE BANGKO SENTRAL ng Pilipinas (BSP) is anticipated to lower rates by 25 basis points (bps) this week due to diminishing price pressures and decelerating economic growth.

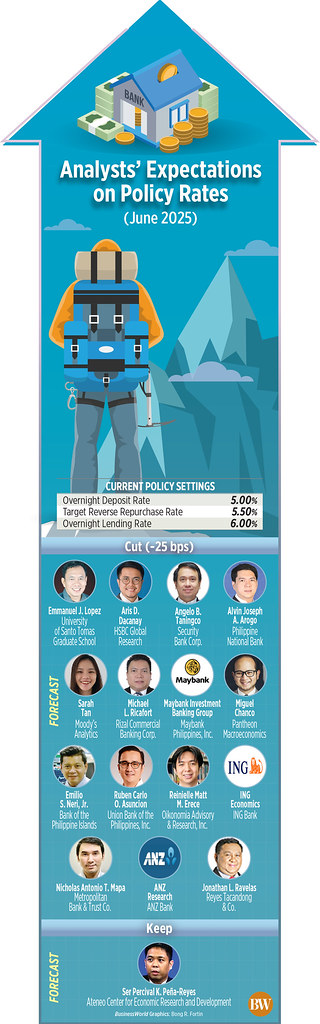

A BusinessWorld survey conducted last week revealed that 15 out of 16 analysts foresee the Monetary Board reducing the target reverse repurchase rate by 25 bps during its policy conference on June 19.

If realized, this would adjust the benchmark rate to 5.25% from the existing 5.5%.

Only one analyst, Ateneo Center for Economic Research and Development Director Ser Percival K. Peña-Reyes, predicts the BSP will maintain rates as is.

Experts indicated that the trending down of inflation along with lower-than-expected growth in the first quarter creates space for the central bank to persist with its easing strategy.

“A lower-than-anticipated inflation path in the Philippines, a more robust local currency, elevated real rates, and uncertainties regarding global growth reinforce our belief that the monetary easing process is far from concluded,” stated ING Bank.

HSBC economist for ASEAN Aris D. Dacanay mentioned he initially projected a pause in June “to be cautious of the Fed’s inclination to take its time,” but now anticipates a 25-bp rate reduction on Thursday.

“Due to decreased inflation over the prior two months and sluggish growth in 1Q 2025, we now foresee the BSP reducing its policy rate by 25 bps to 5.25% on June 19,” he clarified.

Inflation eased to a five-year low of 1.3% in May, as utility costs increased at a more gradual rate. This adjusted the five-month mean to 1.9%, slightly below the BSP’s 2-4% target range.

“Declining inflation offers solace to consumers and businesses that struggled with higher prices from 2022 until the first half of the previous year,” noted Moody’s Analytics economist Sarah Tan.

ANZ Research stated that the inflation prognosis “remains favorable amid softer global commodity costs.”

“Considering that retail rice prices haven’t dropped as sharply as global rice prices, there’s still ample opportunity for food and overall inflation to remain subdued for the remainder of 2025,” Mr. Dacanay conveyed.

In May, rice inflation persisted in its decline, reducing to 12.8% from the 10.9% drop in April.

Metropolitan Bank & Trust Co. Chief Economist Nicholas Antonio T. Mapa stated he anticipates inflation to be “target consistent” for this year, 2025, and 2026.

The central bank decreased its risk-adjusted inflation projections to 2.3% in 2025 from 3.5% earlier; and 3.3% in 2026 from 3.7%. It now expects average inflation to be 3.2% in 2027.

BELOW-TARGET GROWTH

Angelo B. Taningco, chief economist of Security Bank, remarked that below-target gross domestic product (GDP) growth in the initial quarter, along with a strong peso, are some factors the BSP will consider in this week’s decision.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco expressed his expectation of a rate cut this week “with GDP growth still struggling to attain a significant increase.”

The Philippine economy grew by an annual 5.4% in the first quarter, slightly exceeding the 5.3% growth in the fourth quarter of 2024 but lagging behind the 5.9% rate in the same quarter last year.

This growth was also beneath the government’s 6-8% growth target range for the year.

“We believe this slowdown heightens pressure on the BSP to accelerate its easing cycle. A policy rate cut can bolster the country’s services exports (or exports in general) by enhancing the peso’s competitiveness relative to other currencies,” Mr. Dacanay noted.

Reinielle Matt M. Erece, economist from Oikonomia Advisory & Research, Inc., mentioned that the peso’s recent strength provides the BSP with more leeway to lower rates ahead of the US Federal Reserve.

The local currency concluded at P56.21 per dollar on Friday, declining by 32.5 centavos from its P55.885 closing on Wednesday, according to data from the Bankers Association of the Philippines.

This marked the peso’s weakest performance in over a month, since its P56.42 close on April 28. It was also the first instance the local currency dipped below the P56-per-dollar mark since ending at P56.145 on April 29.

Year-to-date, the peso has appreciated by P1.635 from its P57.845 close on December 27, 2024.

Ms. Tan asserted that the recent stabilization of the peso will “provide an additional boost to the decision-making process.”

“Ongoing monetary easing would be crucial in supporting the domestic economy amidst a complex external climate. While discussions with the US to reduce reciprocal tariffs are currently in progress, the outcome is still uncertain,” she added.

Maybank Investment Banking Group Economics Research indicated that further rate reductions will also help shield the country’s economy from global growth uncertainties and tariff-related threats.

OUTLOOK

Experts project the BSP to further lower borrowing costs this year as inflation stays under control.

“Given the manageable inflation forecast, we anticipate the BSP will decrease the policy rate by an additional 50 bps by (third quarter) 2025, bringing the terminal rate to 5%,” ANZ Research stated.

Oikonomia’s Mr. Erece speculated that the BSP could cut rates by 50-75 bps more this year in 25-bp increments to mitigate extreme currency volatility.

“A rate cut, beyond its influence on borrowing costs, also serves as a message to the markets that the central bank is confident inflation is well managed,” he emphasized.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. indicated that the BSP might maintain borrowing costs steady during its Aug. 28 meeting.

“To prevent the need for a sudden policy reversal, the BSP will likely keep the policy rate above 5% before the year concludes and well above 4% through 2026. Risks comprise a surge in global oil prices, uncertainties in global tariff policies, US stagflation, local wage increases, and other potential risks to a rise in local inflation expectations,” he mentioned.

BSP Governor Eli M. Remolona, Jr. previously stated that the Monetary Board may implement two cuts in rates of 25 bps for the rest of the year. — A.M.C. Sy