NET INFLOWS of overseas direct investments (FDI) dropped to a three-month nadir in March, with first-quarter inflows also declining by over 40% compared to the previous year, amid intensified global unpredictability stemming from US tariff regulations.

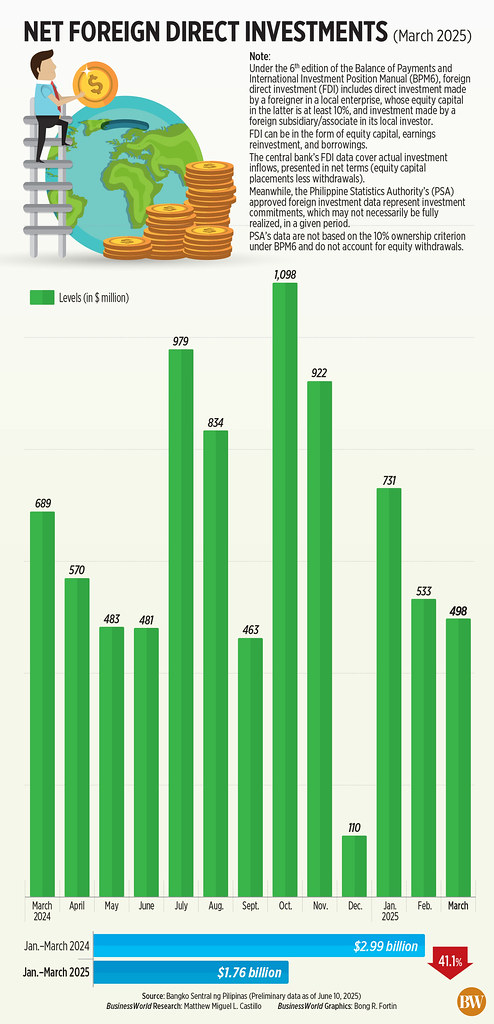

Initial figures from the Bangko Sentral ng Pilipinas (BSP) indicated that FDI net inflows fell by 27.8% to $498 million in March compared to $689 million during the same period last year.

This marked the lowest level of FDI in three months, or since the $110-million inflow recorded in December.

“The noted decline was due to reduced net inflows across all principal FDI categories,” the BSP stated.

Foreign nationals’ net investments in debt instruments of domestic affiliates plummeted by 31.6% to $329 million in March from $481 million in the same month in 2024.

Foreign nationals’ net investments in equity capital, excluding the reinvestment of earnings, dropped by 27.4% to $102 million from $141 million year on year.

This occurred as equity capital placements fell by 5.5% to $148 million. Conversely, withdrawals nearly tripled (185.1%) to $46 million.

Equity placements in March were predominantly from Singapore (25%), Japan (24%) and the United States (20%), along with South Korea (9%) and Malaysia (5%).

“These were mainly directed into the real estate; manufacturing; financial and insurance; and administrative and support services sectors,” the central bank remarked.

Reinvestment of earnings decreased by 1.2% to $66 million in March from $67 million a year prior.

Investments in equity and investment fund shares dropped by 19% to $168 million in March from $208 million a year earlier.

FIRST-QUARTER DECLINE

In the first quarter, FDI net inflows fell sharply by 41.1% to $1.76 billion from $2.99 billion in the same year-ago timeframe.

Net investments in debt instruments declined by 35.3% to $1.2 billion in the period ending March from $1.85 billion a year prior.

Investments in equity capital excluding reinvested earnings decreased by 66.7% to $298 million in the January-March timeframe from $894 million in the previous year.

Equity placements dropped by 64.4% year on year to $397 million, while withdrawals fell by 54.8% to $99 million.

These placements primarily originated from Japan (42%), followed by the United States (17%), Singapore (14%), and Malaysia and Singapore (both at 6% each).

Nearly half (47%) of these were allocated to the manufacturing sector, with real estate (22%) and financial and insurance (13%) sectors following.

Conversely, foreign nationals’ reinvestment of earnings increased by 8.8% to $264 million from $242 million.

“The drop in FDI is one of several indicators, along with increasing debt and rising unemployment, that reflect the gradually declining economic growth in the country,” said Leonardo A. Lanzona, an economics professor at Ateneo de Manila University.

In the first quarter, the Philippine economy expanded by a weaker-than-expected 5.4%, significantly below the government’s target of 6-8% for the year.

Gross capital formation, the investment segment of the economy, rose by 4% in the first quarter, a slowdown from the 5.5% experienced in the fourth quarter.

“The reality is that the country’s growth relies heavily on remittances and consumption. Therefore, if global conditions remain unfavorable, we cannot anticipate incoming FDIs,” Mr. Lanzona concluded.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, suggested that the decline in FDI results from a mixture of global and domestic challenges.

“Externally, escalating geopolitical tensions, elevated interest rates in developed markets, and global trade uncertainties, particularly from US tariff actions, continue to deter cross-border investments,” he noted.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort pointed out that the US government’s tariff strategies have prompted investors to adopt a wait-and-see approach regarding investments.

US President Donald J. Trump began issuing tariff threats soon after he took office in late January. However, it wasn’t until early April that he declared a baseline 10% tariff on all trading partners, as well as heightened reciprocal tariffs on most trading partners. These reciprocal tariffs are postponed until July.

Domestically, Mr. Rivera indicated that investors were likely more cautious in the first quarter and are now seeking greater clarity on “policy direction, post-election stability, and economic strategy implementation in the medium to long term.”

“Internally, the Philippines is grappling with political distractions, investor apprehensions regarding regulatory predictability, and sluggish progress in structural reforms needed to enhance long-term investor confidence.”

Looking ahead, Mr. Ricafort mentioned that the full execution of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy Act could allure investors.

“Some foreign investors may also be biding their time for Fed and BSP rates to decrease further before becoming more assertive in financing additional FDIs,” he added.

BSP Governor Eli M. Remolona, Jr. has indicated further easing this year, potentially through two additional 25-basis-point (bp) rate reductions. He stated that a rate cut remains on the table during the Monetary Board’s policy review on June 19.

The BSP’s FDI statistics differ from the investment figures of other government sources as they encompass actual investment flows, the BSP clarified.

The approved foreign investments data released by the Philippine Statistics Authority are gleaned from investment promotion agencies and symbolize investment commitments that may not be realized in their entirety during a certain timeframe. — Luisa Maria Jacinta C. Jocson