By Luisa Maria Jacinta C. Jocson, Senior Reporter

HEADLINE INFLATION diminished to its lowest level in over five years in May, as utility expenses increased at a more gradual rate, according to the Philippine Statistics Authority (PSA) on Thursday.

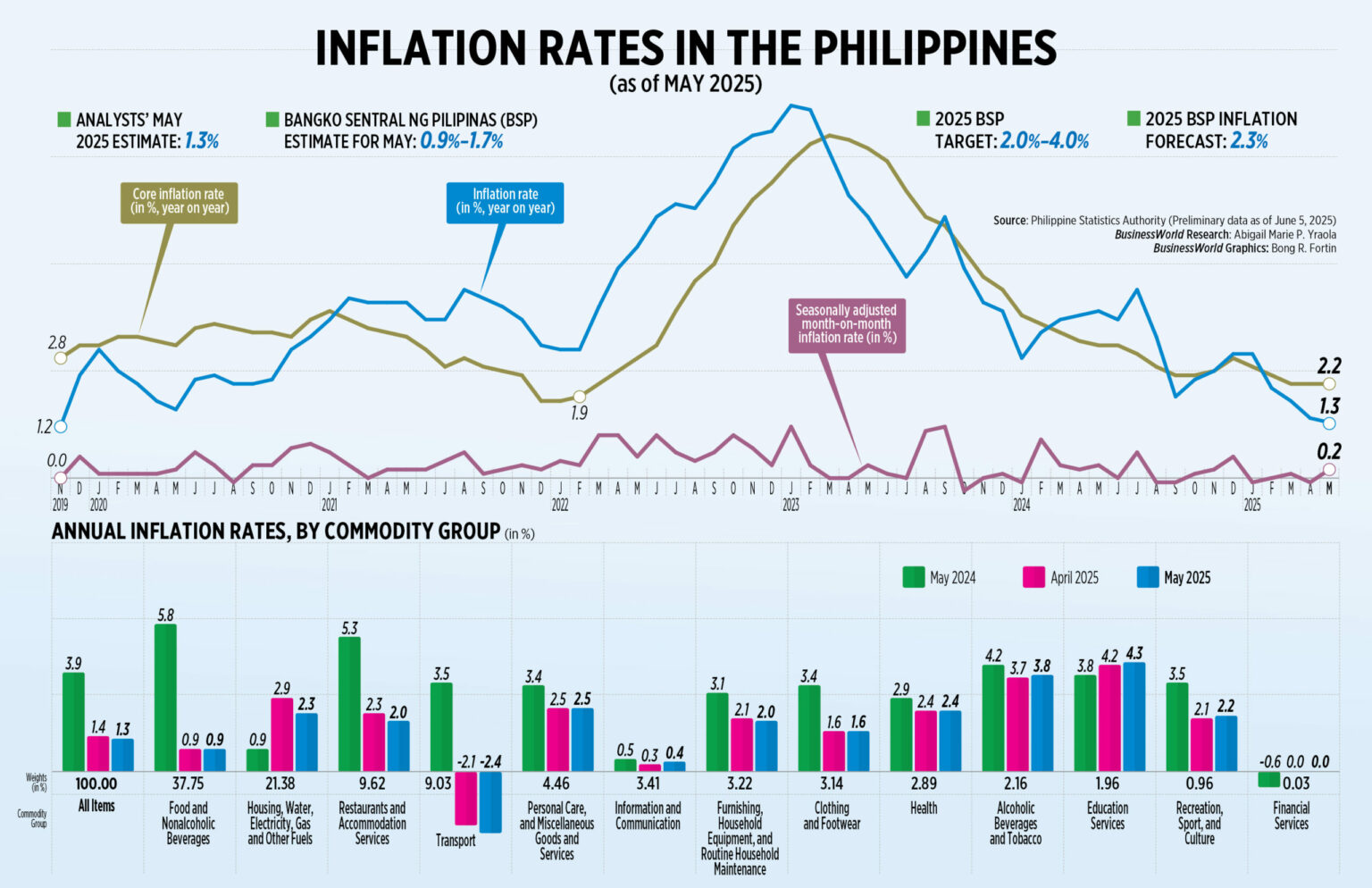

The consumer price index (CPI) increased to 1.3% in May, a decrease from 1.4% in April and 3.9% for the same month last year, preliminary data from the PSA indicated.

This coincided with the 1.3% median prediction derived from a BusinessWorld survey of 17 analysts conducted last week and fell within the Bangko Sentral ng Pilipinas’ (BSP) projected range of 0.9%-1.7% for the month.

The May figure represents the lowest inflation rate in five and a half years, or since the 1.2% reported in November 2019.

May also registered the fourth consecutive month of deceleration and the tenth straight month of inflation remaining within the 2-4% target band.

For the first five months of the year, inflation averaged 1.9%. The BSP anticipates inflation to settle at 2.3% for the entire year.

Core inflation, which excludes volatile food and fuel prices, remained stable at 2.2% in May compared to the previous month. This brought the year-to-date core inflation up to 2.3%.

“The recent inflation outcome aligns with the BSP’s evaluation of a manageable inflation landscape over the policy horizon with a downward adjustment in baseline inflation forecasts,” noted the central bank, highlighting the continued reduction in commodity price pressures.

National Statistician Claire Dennis S. Mapa stated that the slowdown in the May figures was primarily due to the decreased annual increase in the index for housing, water, electricity, gas, and other fuels.

This index, which accounted for a 68.4% contribution to the downtrend during the month, eased to 2.3% in May from 2.9% in April. It was also the leading contributor to May’s inflation, with a 37.1% share.

Electricity inflation decreased to 2.8% in May from 5.4% the previous month.

Following three months of consistent increases, Manila Electric Co. reduced the overall rate for May by P0.7499 per kilowatt-hour (kWh) to P12.2628 per kWh from P13.0127 per kWh in April.

Water expenses also declined to 5.7% in May from 6.3% the prior month.

The transport index fell at an accelerated rate to 2.4% in May, compared to a 2.1% drop in the previous month. This coincided with a slowdown in inflation for passenger transport by sea, which decreased to 42.4% from 68.8%.

Gasoline prices also fell to 13.2% in May from a 12.4% decrease in April, while diesel prices slipped to 9.3% from an 8.3% decline a month earlier.

The index for restaurants and accommodation services similarly slowed to 2% in May from 2.3% in April.

Meanwhile, the heavily weighted food and nonalcoholic beverages index sustained its status as a key contributor to inflation during the month, holding a 25.7% share of the overall figure.

This index remained steady at 0.9% in May from April, with food inflation also stable at 0.7%.

Prices for pork accelerated to 11.9% in May from 10.3% in April. This was the leading contributor to the May CPI, accounting for 25% or 0.3 percentage points.

Rice inflation maintained its negative trend, declining to 12.8% in May from a 10.9% drop in the prior month.

“The average rice inflation from January to May is -7.7%. Thus, for the first five months of 2025, it has been negative, and there are expectations that it will remain negative in the coming months, as the prices of rice are dropping per kilo,” Mr. Mapa stated.

In the meantime, inflation in the National Capital Region (NCR) decreased to 1.7% in May from 2.4% in April. Outside of NCR, inflation remained unchanged at 1.2% in May.

ZERO INFLATION

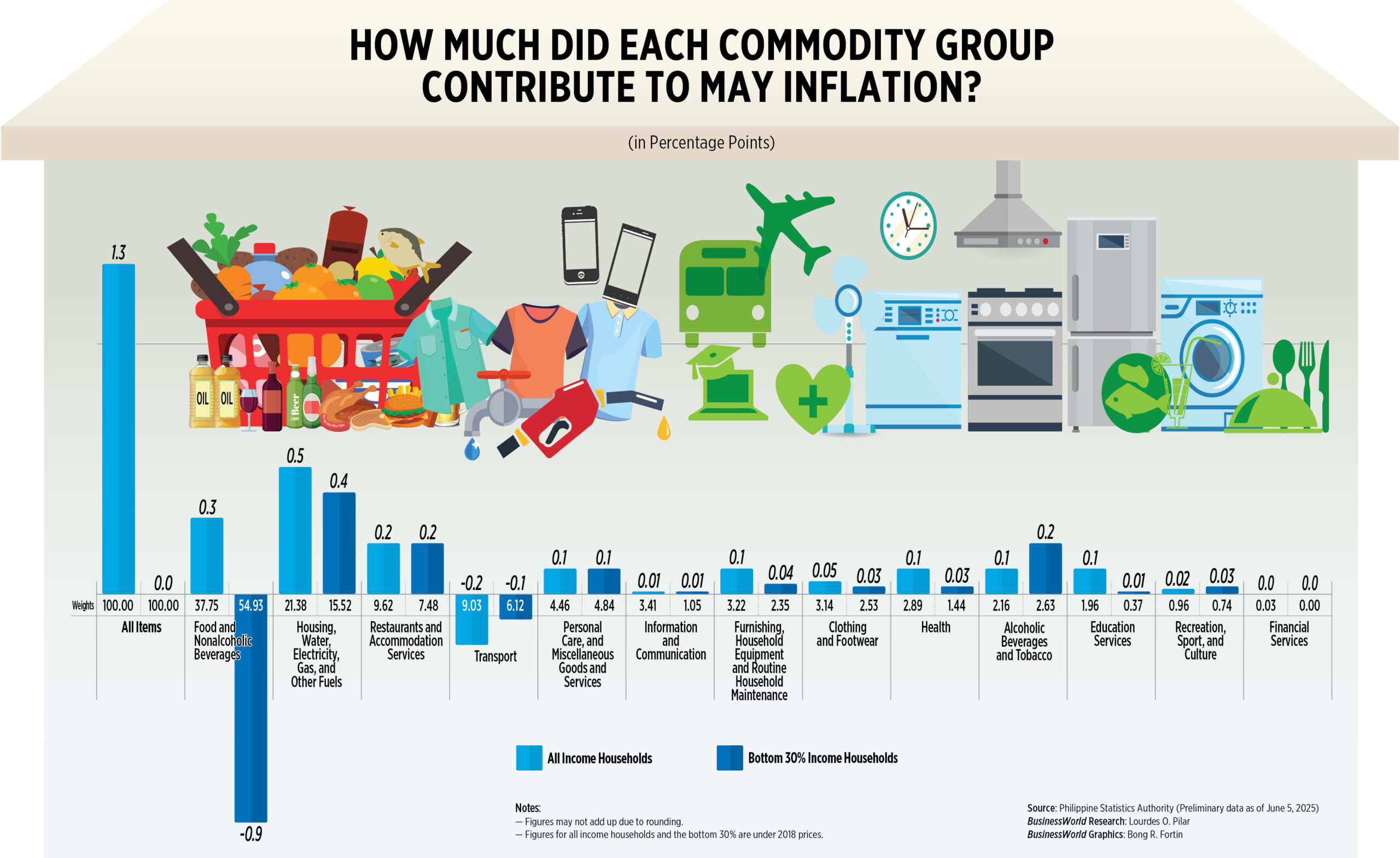

Additionally, inflation for the lowest 30% of income households registered 0.0% in May, down from 0.1% in April and 5.3% a year ago.

This brought the year-to-date inflation for the bottom 30% to 1%.

Food and nonalcoholic beverages for the lowest 30% fell to 1.6%, contributing an 83.6% share. Transport inflation also saw a drop of 1.9%, accounting for an 11.6% share.

“A significant contributor was food items, specifically cereals. Rice for the bottom 30% is at -14.7%. This was a considerable decrease,” Mr. Mapa noted.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort emphasized that rice prices make up a significant part of the bottom 30%’s CPI.

“Given that the poorest Filipinos allocate a larger portion of their budget for rice and other essentials, they stand to benefit the most from lower rice prices,” he explained.

INFLATION OUTLOOK

Concurrently, the BSP stated that threats to the inflation outlook remain broadly balanced from this year through 2027.

“Upside risks arise from potential increases in transportation fees, meat costs, and utility rates,” it added.

“Conversely, downside risks are associated with the ongoing effects of reduced tariffs on rice imports and the anticipated impact of weaker global demand.”

Department of Economy, Planning, and Development Undersecretary for Policy and Planning Rosemarie G. Edillon expressed confidence that inflation will stay within the 2-4% range for the year.

“We are steadfast in implementing necessary measures to maintain stable and low prices,” she indicated in a statement.

The government will introduce “targeted policies aimed at alleviating inflationary pressures and preserving the purchasing power of Filipino families,” she further remarked.

In response, Agriculture Secretary Francisco P. Tiu Laurel, Jr. stated they are working to ensure rice prices remain regulated.

“We are expanding the coverage of the P20 rice initiative and examining a reduction in the suggested retail price for imported rice — the national staple that plays a significant role in Filipino diets, especially among the economically disadvantaged,” he mentioned in a statement.

Mr. Tiu-Laurel added that the President has directed the Agriculture department to implement the subsidized rice initiative through June 2028.

MORE RATE CUTS?

On another note, the BSP mentioned that there is still potential to continue easing its monetary policy despite external challenges.

The Monetary Board highlighted the difficult external environment, which could “impact global growth expectations and consequently represent a downside risk to global commodity prices and domestic economic activity.”

“In summary, the more manageable inflation forecast and the downside risks to domestic economic performance permit a transition towards a more accommodative monetary policy stance,” it added.

In April, the Monetary Board reduced interest rates by 25 basis points (bps), bringing the benchmark to 5.5%. It has decreased borrowing costs by a total of 100 bps since initiating its easing cycle in August.

“Diminished food and utility inflation, alongside reductions in transport costs, have contributed to a lower headline figure. It appears the BSP’s opportunity to cut rates in June remains favorable,” stated Nicholas Antonio T. Mapa, a senior economist at the Metropolitan Bank & Trust Co.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco noted that they anticipate the central bank will execute another 25-bp cut later this month.

“We maintain our below-consensus view that the BSP’s benchmark rate will conclude 2025 at 4.75%, suggesting three additional 25-bp cuts, including one in two weeks’ time.”

BSP Governor Eli M. Remolona, Jr. indicated that a 25-bp cut is still an option during the Monetary Board’s review on June 19.

Conversely, HSBC economist for ASEAN Aris D. Dacanay mentioned that the central bank might consider maintaining current rates.

“Our baseline scenario suggests a pause in the BSP’s easing cycle in June as the bank awaits more information regarding proposed tariff measures from the US,” he stated.

“The BSP has the advantage to adopt a cautious approach considering the economy’s insulation from external trade headwinds.”

However, the significantly below-target inflation raises the likelihood of a cut in June, particularly with weaker-than-expected growth in the fourth quarter.

“The relative strength of the peso may also provide the BSP with the capacity to lower policy rates regardless of actions by the Fed. Nevertheless, the June Monetary Board meeting is likely to present a tough decision,” he elaborated.

He pointed out other inflation risks that require surveillance, including the bill proposing a P200 across-the-board minimum wage increase for private sector workers, which was approved by the House of Representatives on its final reading on Wednesday.

“Furthermore, policymakers are contemplating the possibility of increasing tariff rates on rice based on seasonal crop patterns. If implemented, this could significantly impact the inflation outlook, compelling the BSP to reassess the pace of its easing cycle,” Mr. Dacanay added.