“`html

By Aubrey Rose A. Inosante, Reporter

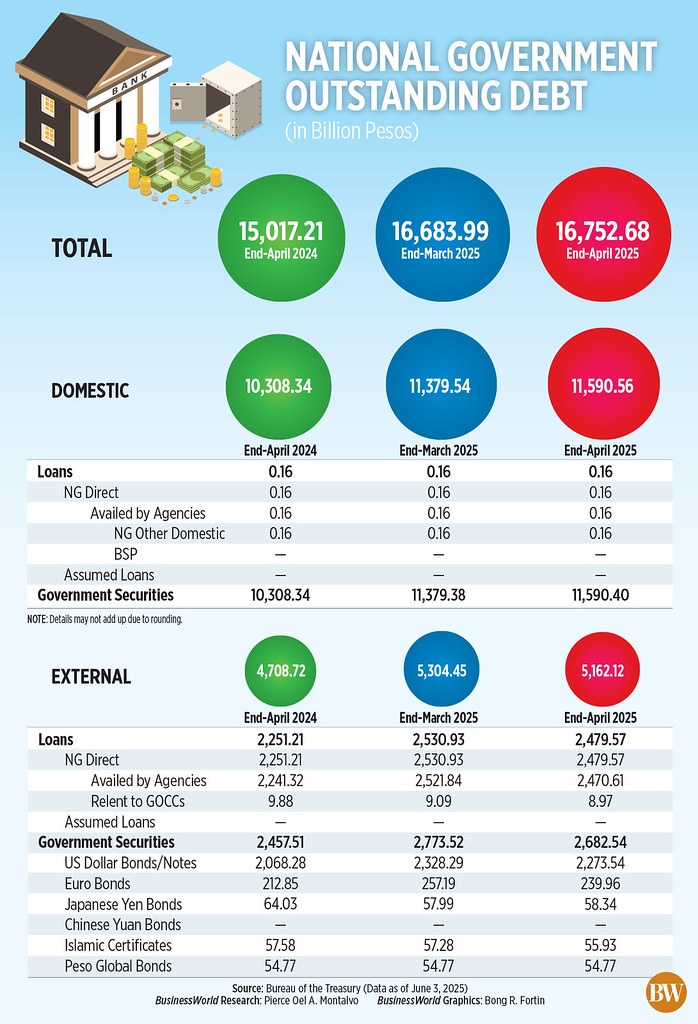

THE NATIONAL GOVERNMENT’S (NG) total liabilities surged to an unprecedented P16.75 trillion in the initial four months, reflecting a slight increase from March that was moderated by a robust peso, as per the Bureau of the Treasury (BTr).

Treasury statistics revealed that total liabilities climbed by 0.41% or P68.69 billion compared to the end of March. Compared to the previous year, the liabilities escalated by 11.56%.

“The increase was mitigated by the significant appreciation of the peso, which diminished the impact of extra borrowings consistent with the fiscal program,” stated the BTr in a release on Tuesday.

It utilized an exchange rate of P55.93 per dollar in April, an improvement from P57.28 in March and P57.58 in April 2024.

A majority, specifically 69.2%, of the total debt originated from domestic avenues, while external commitments accounted for the remaining portion.

The enhanced portion of external liabilities at 30.8% aligns with the government’s strategy to minimize vulnerability to external disturbances.

As of the end of April, domestic liabilities rose by 1.85% to P11.59 trillion, largely comprised of government securities.

The BTr attributed this growth to strong demand for government securities, which included P300 billion in benchmark bonds.

In April, the government secured P300 billion in new 10-year fixed-rate Treasury notes amid heightened interest for longer-term tenors anticipating rate reductions by the Bangko Sentral ng Pilipinas.

“With economic fundamentals staying strong, the nation continues to enjoy robust market access at favorable rates,” it remarked.

The strength of the peso decreased the peso valuation of dollar-denominated domestic securities by P3.85 billion. Year over year, domestic liabilities increased by 12.44%.

Conversely, external liabilities decreased by 2.68% to P5.16 trillion at the end of April compared to March.

“The decline was mainly attributed to the P124.74 billion reduction in the peso valuation of external liabilities stemming from the peso appreciation, coupled with net repayments amounting to P58.28 billion,” the Treasury indicated.

Foreign liabilities saw a 9.63% rise year on year.

NG-guaranteed liabilities dwindled by 0.68% to P377.54 billion at the end of April from March due to P1.75 billion in net repayment of domestic guarantees and a P2.14 billion lower valuation resulting from the peso appreciation, according to the BTr.

Year-over-year, guaranteed liabilities dropped by 5.2%.

‘FIRMLY ON TRACK’

“Ultimately, the debt portfolio remains resilient, with 91.7% of obligations featuring fixed interest rates and 82% classified as long-term,” the Treasury remarked. “This structure aids in shielding public finances from sudden shifts in interest rates and market conditions.”

It noted that the Philippine economy is “firmly on track” to reduce the debt-to-gross domestic product ratio to below 60% by the end of President Ferdinand R. Marcos, Jr.’s term in 2028.

The debt-to-GDP ratio had surged to 62% by the end of March — the highest in two decades.

“The fiscal deficit has also been consistently decreasing and is expected to drop to approximately 3.8% by 2028,” it added.

Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., linked the increase in government liabilities to heightened demand for government securities.

“In the upcoming months, I anticipate the country’s liabilities to rise as spending initiatives may continue to pressure the nation’s fiscal space,” he informed BusinessWorld via a Viber Message.

The debt would remain “manageable” provided that debt servicing is in line and revenue growth is robust, he emphasized.

However, the relative strength of the peso, which mitigated the increase in domestic liabilities, is anticipated to be short-lived, Mr. Erece noted.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., observed that the additional liabilities in April reflected the P300 billion in Treasury notes issued during that month along with the prior month’s budget shortfall.

The NG reported a P67.3 billion surplus in April, a reversal from the P375.73 billion deficit in March.

“In the forthcoming months, the outstanding National Government liabilities could reach unprecedented levels due to new borrowings early in the year, as well as the necessity to hedge both domestic and international borrowings of the National Government in light of the Trump factor,” Mr. Ricafort remarked in a Viber Message.

US President Donald J. Trump’s protectionist measures, including elevated tariffs, have led to fluctuations in global financial markets since October, he noted.

The NG’s total liabilities are projected to reach P17.35 trillion by the year’s end.

In a related update, Finance Secretary Ralph G. Recto indicated that the Bureau of Internal Revenue (BIR) is on course to meet its P3.232 trillion collection target for this year.

“Thus far, they are on the right path to achieve their objective,” he told BusinessWorld in a text message on Monday.

The BIR, which aims to enhance revenue by 13.36% or P380.87 billion this year compared to 2024, announced on Friday that it surpassed its target for the first four months by 14.5%, accumulating P1.11 trillion.

“Cumulative collections as of April 2025 represent over 35% of the Bureau’s calendar year 2025 revenue goal of P3.232 trillion,” it stated in a release.

John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, observed that this is a “promising indication.”

“The introduction of new tax measures such as digital taxation and enhancements in tax administration could further bolster collections, particularly if enforcement remains consistent,” he noted in a Viber message.

However, an economic slowdown driven by global uncertainties or domestic expenditure limitations presents risks to the BIR target, he cautioned.

“Volatile inflation and declining business profits may also hinder collection growth,” he stated. “Sustained efficiency reforms, broadening the tax base, and reducing leakages will be critical to meeting the target.”

Mr. Ricafort expressed optimism that digital taxes will assist the BIR in achieving its goal this year. He also highlighted the Philippines’ “strong record of growth in recent years.”

Achieving the BIR target relies not only on new taxes but also on enforcement, asserted Eleanor L. Roque, tax principal at P&A Grant Thornton.

“The majority of tax revenue will still stem from voluntary compliance with standard taxes like income tax and value-added tax,” she conveyed in a Viber message. “To meet this year’s ambitious target, the BIR must exert additional efforts to expand their tax net.”

“The BIR has to make the cost of tax evasion higher than the cost of compliance,” she added.

Source link

“`