“`html

By Luisa Maria Jacinta C. Jocson, Senior Reporter

HEADLINE INFLATION probably decelerated further in May to another below five-year minimum amidst the ongoing reduction in food prices and a strengthened peso.

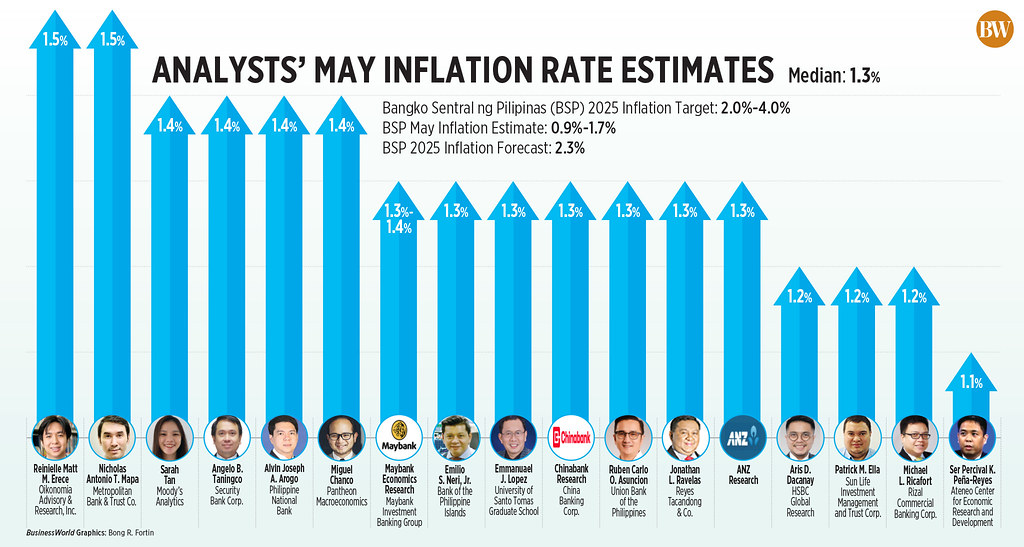

A BusinessWorld survey of 17 analysts carried out last week produced a median forecast of 1.3% for the May consumer price index (CPI), which is slower than the 1.4% in April and 3.9% in the same month last year. This falls within the Bangko Sentral ng Pilipinas’ (BSP) 0.9%-1.7% prediction for the month.

If actualized, this would mark the lowest rate in over five years or since the 1.2% in November 2019.

The Philippine Statistics Authority is set to disclose May inflation figures on Thursday (June 5).

“We anticipate May inflation to have lessened marginally to 1.3% year on year from 1.4% in April, indicating a month-on-month decrease of 0.1%,” stated Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr.

“The persistent decrease in rice prices, along with lower energy and fuel expenses, continues to be the primary forces behind disinflation,” he expressed.

Emmanuel J. Lopez, a lecturer at the University of Santo Tomas Graduate School, indicated inflation probably declined to 1.3% “due to reduced costs of food and agricultural commodities and lower transportation expenses.”

“This is compounded by the ongoing rise of the peso against the US dollar leading to more affordable imported goods,” he added.

Sun Life Investment Management and Trust Corp. economist Patrick M. Ella remarked that the slower inflation in May is likely attributable to “advantageous food prices slowing down and stable nonfood prices consistent with the last two months.”

“The continued reduction in rice prices and a drop in oil costs likely kept inflation underneath the BSP’s 2-4% target,” noted Philippine National Bank economist Alvin Joseph A. Arogo.

In April, rice inflation further decreased to 10.9% from the 7.7% decline in March.

Recent data illustrated that the average cost of a kilo of regular milled rice nationwide fell by 13.3% year on year to P44.45 in April, whereas well-milled rice decreased by 10.4% to P50.54. Premium rice dropped by 6.2% to P60.69 per kilo.

“Food supply is projected to have improved compared to last year due to favorable weather conditions, leading to better harvests. This should contribute to stable retail price growth,” commented Moody’s Analytics economist Sarah Tan.

“Regarding utilities, electricity rates were lowered in May, which will provide relief to households and businesses,” Ms. Tan added.

After three consecutive months of hikes, Manila Electric Co. lowered the overall rate for May by P0.7499 per kilowatt-hour (kWh) to P12.2628 per kWh from P13.0127 per kWh in April.

The robust peso and declining global oil prices have reduced energy expenses, stated Aris D. Dacanay, economist for ASEAN at HSBC Global Research.

The peso concluded at P55.745 per dollar at the end of May, appreciating by 9.5 centavos from the P55.84 close at the end of April.

Conversely, Chinabank Research identified price pressures from essential food items like meat, vegetables, fruits, and eggs, though indicated these could have been balanced out by the monthly reductions in prices of rice, fish, sugar, electricity, and liquefied petroleum gas.

Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., noted upward pressures from meat prices and utility expenses may have propelled the headline inflation rate higher last month.

“Prices of some livestock and vegetable products increased during this period, but these were countered by low oil prices in the global markets and reduced electricity generation costs,” remarked Oikonomia Advisory & Research, Inc. economist Reinielle Matt M. Erece.

Mr. Neri also highlighted the “rebound in vegetables and fruit prices amidst the ongoing dry season, which considerably diminished agricultural yields.”

“Moreover, the removal of the maximum suggested retail price (MSRP) for pork contributed to a rise in meat prices this month,” he added.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., indicated headline inflation may have reached its lowest point in May and could rise to 1.9% in August during the typhoon season and surpass 2% for the remainder of the year, anticipating the CPI to settle at 2.6% by year-end.

The central bank projects inflation to average 2.3% this year and 3.3% in 2026, both well within the 2-4% target range.

“Headline inflation is predicted to remain subdued in the upcoming months, primarily supported by consistent softening in key commodity prices and a high base from last year,” Mr. Neri observed.

“However, beneficial base effects — especially for rice — are anticipated to diminish starting in September. This could slowly drive the headline figure towards, if not at, the 3% mark by year-end,” he added.

RATE CUT PROBABLE THIS MONTH

The current inflation trajectory indicates that another cut in rates from the BSP this month “seems increasingly likely,” Mr. Neri stated.

“With inflation remaining below the lower threshold of the BSP’s 2-4% target, we believe the central bank has capacity to lower its policy rate at its June meeting,” Chinabank Research mentioned.

“With inflation declining and the peso strengthening, it appears to be an appropriate moment for the BSP to implement another rate reduction,” Ms. Tan added.

The Monetary Board in April reduced the targeted reverse repurchase (RRP) rate by 25 basis points (bps) to 5.5%, bringing the total cuts to 100 bps since it began its easing cycle in August of last year.

Its next gathering is scheduled for June 19. BSP Governor Eli M. Remolona, Jr. has stated they could enact two further rate cuts this year, still in “baby steps” or increments of 25 bps.

Security Bank Corp. Vice-President and Research Division Head Angelo B. Taningco also projects a 25-bp rate cut at the Monetary Board’s meeting this month amidst the benign inflation landscape.

Mr. Arogo noted the ongoing low inflation and moderate gross domestic product growth in the first quarter is a “strong rationale for the BSP to lower the RRP rate further by 25 bps on June 19.”

“This action would also provide additional support for the domestic economy, which grew slower than anticipated in the first quarter and faces downside risks from global policy uncertainties and heightened US tariffs,” Chinabank Research stated.

“[We] believe the BSP has ample room to lower rates and bolster growth momentum during these challenging times. We foresee up to three more rate reductions this year,” Mr. Mapa remarked.

The Philippine economy expanded by a weaker-than-expected 5.4% in the first quarter.

Meanwhile, Mr. Neri remarked that the BSP’s recent statements regarding transitioning to a point-targeting regime from the current range also indicate “a subtle but significant shift from an increasingly dovish tone last month to a more cautious outlook.”

“This evolving guidance suggests that while the BSP is prepared to cut rates in the near term, further easing will likely be more deliberate and data-dependent, especially as upward risks to inflation may arise later in the year once base effects turn unfavorable again in 2026.”

Mr. Remolona previously mentioned they are examining how to switch to a point target for inflation, from the existing 2-4% target range. He stated they are looking for the target to be slightly lower than the 3% midpoint of the current band.

“The central bank’s subsequent actions post-potential June cut are likely to be more cautious, as external challenges linked to the uncertain global trade environment obscure the policy landscape,” Mr. Neri added.

Source link

“`