“`html

Bitcoin remains robust above the $110,000 threshold after surpassing its previous peak on Wednesday, indicating the possibility of a significant bullish phase. This breakout signifies a crucial psychological and technical landmark, sparking renewed optimism within the crypto sphere. With bulls firmly at the helm, analysts are meticulously observing price movements as BTC ventures into uncharted waters.

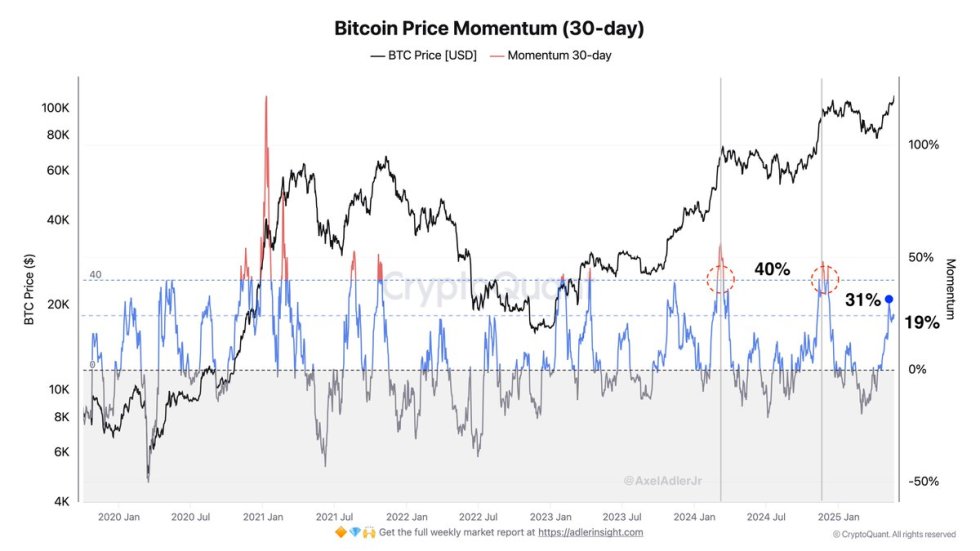

However, in spite of the enthusiasm, the rally is beginning to display initial signs of moderation. As per on-chain analytics from CryptoQuant, the current momentum has diminished by 38% post-breakout, an anticipated technical cooldown following the new highs. Historically, Bitcoin tends to consolidate or pull back soon after exceeding all-time high levels, providing the market a chance to reset prior to resuming its upward trajectory.

Nevertheless, the slowdown is not inherently a bearish indicator. It may illustrate healthy market dynamics, granting participants time to adjust their positions and solidifying the groundwork for a sustained upward movement. As long as BTC stays above significant support levels close to $105K, analysts continue to feel optimistic about the broader bullish framework. Whether this consolidation results in a vigorous rally toward $120K or a short-term pullback is yet to be determined, but one fact is evident: Bitcoin is back in price discovery mode, and the upcoming move could be pivotal.

Bitcoin Confronts Key Challenge Amid Recession Concerns

Bitcoin is transitioning into a critical stage as it trades above the $110K mark, facing both macroeconomic challenges and increasing investor enthusiasm. While apprehensions surrounding a potential recession and tighter financial conditions continue to overshadow the headlines, Bitcoin’s price behavior narrates a different tale—one of stability and resilience. Indeed, BTC has consistently advanced despite rising bond yields, faltering equity markets, and widespread uncertainty, underscoring its evolving position as a hedge against conventional market volatility.

However, for this bullish perspective to sustain, Bitcoin must firmly surpass the $115,000 level. Achieving this would affirm the onset of a new impulsive upward leg and potentially lure more institutional capital as the asset fully enters price discovery mode. Until then, BTC remains in a crucial zone that could determine its trajectory in the near future.

According to leading analyst Axel Adler, the current rally has naturally decelerated, with momentum declining by 38% following the peak breakout. Adler characterizes this as a “technical cooldown,” a typical progression where the market consolidates or pauses after hitting major thresholds. This “breather” allows leveraged positions to unwind, liquidity to reset, and investor sentiment to stabilize ahead of a possible next upward leg.

Despite macroeconomic anxieties, the price pattern remains decidedly bullish, and short-term consolidation may ultimately fortify the basis for another upward surge. If BTC can sustain current levels and absorb the overhead resistance, the pathway to $120K could arrive sooner than anticipated. Until then, all attention remains on Bitcoin’s activity at the $115K threshold—a critical point that could determine whether this rally has further momentum or if a correction is impending.

BTC Stays Above $111K: Momentum Dips Post-Breakout

The 4-hour chart for Bitcoin (BTC/USDT) showcases a robust uptrend, with prices currently stabilizing around $111,000 after achieving a new all-time high at $111,356. Price action persists in a bullish stance, staying above the 34 EMA (green), 50 SMA (blue), and essential support levels at $103,600 and $100,000. This structure suggests a healthy continuation pattern, wherein BTC is taking a pause following an explosive rally from beneath $100K.

Trading volume has lessened slightly, corroborating CryptoQuant’s observation that momentum has cooled by 38%—a standard pause after reaching new peaks. Moving averages exhibit a pronounced upward slope, with the 200 SMA (red) significantly below the current price, indicating strong bullish momentum and considerable separation from longer-term trends.

The ongoing consolidation area resembles a flag or pennant formation, which generally precedes another upward movement if buyers re-enter with volume. Nevertheless, traders ought to keep an eye on any sharp decline below $107K, as this would indicate waning momentum and elevate the possibility of a correction towards the $103,600 support.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist emphasizes providing thoroughly researched, precise, and impartial content. We uphold stringent sourcing standards, and each page is subjected to meticulous review by our team of leading technology specialists and seasoned editors. This approach guarantees the integrity, relevance, and value of our content for our audience.

Source link

“`