“`html

By Luisa Maria Jacinta C. Jocson, Senior Journalist

THE PHILIPPINES’ balance of payments (BoP) shortfall expanded further in April as the administration settled its foreign liabilities, data from the Bangko Sentral ng Pilipinas (BSP) indicated.

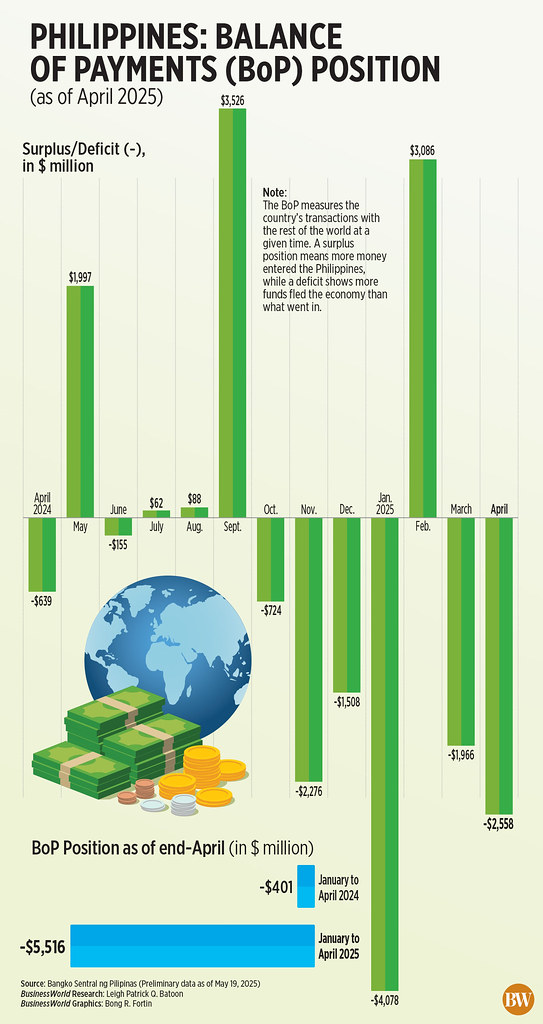

The BSP reported on Monday that the BoP deficit reached $2.56 billion in April, broader than the $639-million gap recorded a year prior and the $1.97-billion deficit in March.

The BoP gauges the nation’s exchanges with the global community. A deficit signifies that more funds left the Philippines, while a surplus denotes that more money entered the nation than exited.

“The BoP shortfall mirrored the National Government’s (NG) withdrawals from its foreign currency deposits with the BSP to fulfill its external debt responsibilities and finance its various expenditures, along with the BSP’s net foreign exchange dealings,” the central bank explained.

Recent data from the BSP revealed that the Philippines’ total external debt increased by an annual 9.8% to $137.63 billion as of the end of December 2024.

This elevated the external debt-to-gross domestic product (GDP) ratio to 29.8% at the close of 2024, up from 28.7% in the preceding year.

The nation’s BoP situation recorded a $5.52-billion shortfall in the first four months of 2025, escalating from the $401-million gap a year earlier.

“According to preliminary figures, this year-to-date BoP deficit reflected primarily the growing trade in goods deficit,” the central bank noted.

The nation’s trade balance in goods showed a $4.13-billion deficit in March, which is 23% higher than a year earlier. This propelled the first-quarter trade deficit to $12.71 billion, also expanding by 12.8% year on year.

“This decline was somewhat tempered, however, by the steady net inflows from personal remittances from overseas Filipinos and external borrowings by the NG,” it mentioned.

Cash remittances climbed by 2.6% in March to $2.81 billion, albeit this marked the slowest growth in nine months.

The NG’s total borrowings decreased by 7.15% to P192.45 billion in March as gross external debt dropped by 31.89%.

Simultaneously, the BoP indicated a final gross international reserve (GIR) level of $105.3 billion at its end-April status, lower than $106.7 billion at the end of March.

“This latest GIR figure offers a strong external liquidity cushion,” the central bank asserted.

The dollar reserves were sufficient to cover 3.7 times the nation’s short-term external obligations based on residual maturity.

A substantial level of foreign exchange reserves protects an economy from market fluctuations and assures the country’s capacity to repay debt in case of an economic downturn.

The GIR was also equivalent to 7.3 months’ worth of imports of goods and payments for services and primary income.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort pointed out that the expanding BoP deficit was a result of the ongoing trade gap and repayment of foreign currency debts along with other foreign commitments.

However, he also highlighted the decrease in foreign investments amid instabilities in financial markets due to the United States’ tariff regulations.

For the upcoming months, Mr. Ricafort anticipated that the BoP situation could improve thanks to proceeds from the NG’s foreign-currency debt, which could augment the GIR.

He also mentioned “continued growth in OFW remittances, BPO revenues, exports, foreign tourism earnings, and other structural US dollar inflows into the country.”

“Looking ahead, any progress in BoP data and in GIR data for the forthcoming months could still assist in providing a greater buffer for the peso exchange,” Mr. Ricafort concluded.

This year, the BSP projects the nation’s BoP position to culminate at a $4-billion deficit, equating to -0.8% of gross domestic product.

The BoP position recorded a surplus of $609 million in 2024, plummeting by 83.4% from the $3.672-billion surplus at the end of 2023.

Source link

“`