“`html

On-chain metrics indicate that the largest whales on the Bitcoin network have diminished their purchasing activities lately. Here’s the potential implications for BTC.

Bitcoin Accumulation Trend Score Indicates Slowdown For Mega Whales

In a recent update on X, the on-chain analytical company Glassnode has presented the latest information regarding the Accumulation Trend Score for different Bitcoin investor categories. The “Accumulation Trend Score” mentioned pertains to a metric that indicates whether BTC investors are accumulating or selling.

The metric assesses its value through not only examining balance variations within investor wallets but also considering the dimensions of the wallets themselves. This signifies that larger investors have a greater influence on the metric.

When the Accumulation Trend Score exceeds 0.5, it indicates that substantial investors (or alternatively, a significant number of small holders) are in an accumulation phase. Conversely, a score below this threshold suggests a predominance of distribution within the market. These trends are most intense at the extremes of 0 and 1.

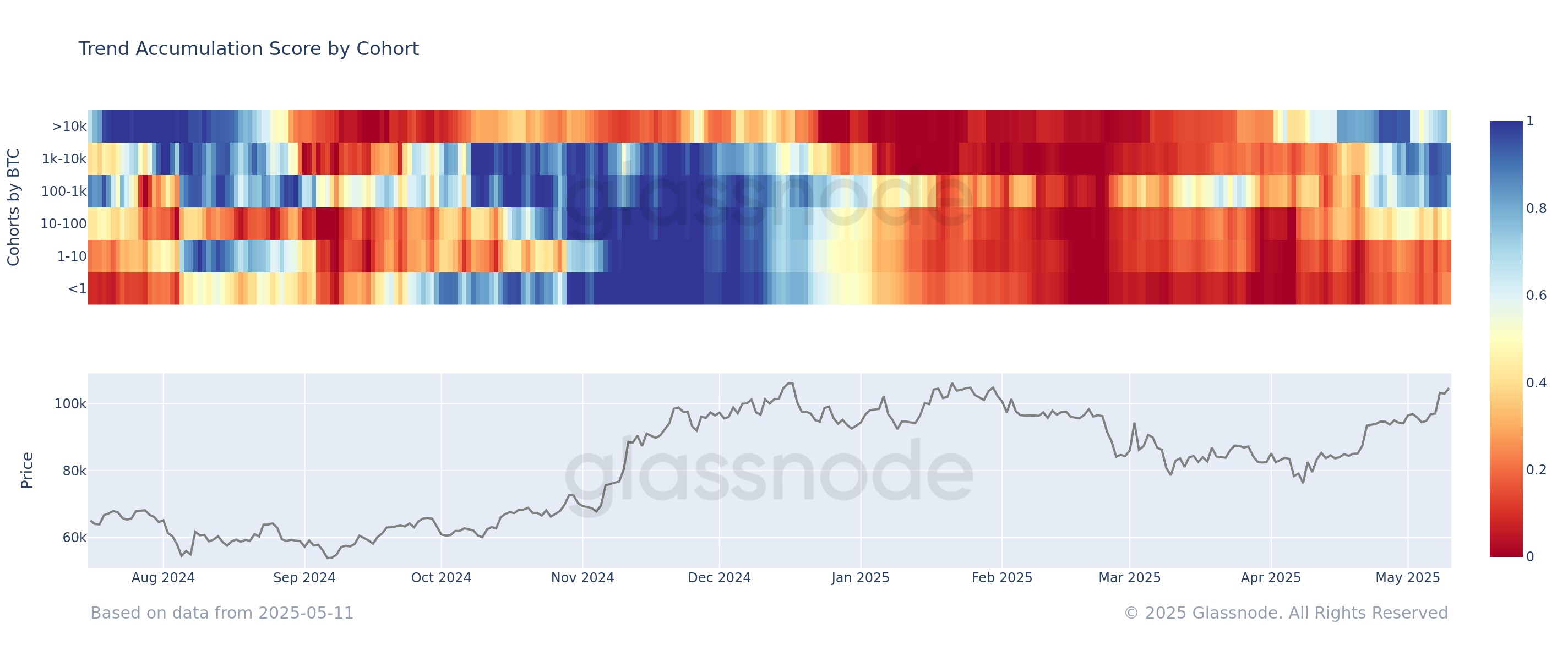

Here’s the chart shared by the analytics company, illustrating the trend in the Accumulation Trend Score separately for the various Bitcoin holder groups over the previous year:

The behavior appears to have varied across these groups recently | Source: Glassnode on X

As depicted in the chart above, the investors at the lower end of the market (those with below 1 BTC and 1 to 10 BTC) have their Accumulation Trend Score beneath 0.5, indicating they are in a distribution phase.

Conversely, the larger cohorts are experiencing an accumulation phase. The metric is currently at 0.8 for the sharks (investors holding 100 to 1,000 BTC) and at 0.9 for the whales (1,000 to 10,000 BTC), signifying a robust buying trend.

One group notably diverges in its Accumulation Trend Score, namely the ‘mega whales‘ possessing more than 10,000 BTC. The chart indicates this cohort transitioned from distribution to accumulation earlier in the year, preceding the rest of the market and achieving an almost perfect score on the metric.

However, recently, this group has exhibited another change, as the metric’s value has decreased to around 0.5 for its participants. This suggests the cohort’s trend is currently neutral. It’s feasible that these massive investors scaling back on accumulation could negatively affect the ongoing Bitcoin rally.

That said, at this moment, the sharks and whales continue to bolster the momentum. During the rally in the last few months of 2024, the mega whales engaged in mild distribution, while the rest of the market persisted in accumulating, providing impetus for the ascent.

The rally ceased when the mega whales initiated substantial distribution. Just as the purchasing from the cohort this year preceded the others, this selloff likewise occurred before the rest could react.

Given this astute behavior from the mega whales, their Bitcoin Accumulation Trend Score might be worthy of monitoring.

BTC Price

The Bitcoin rally has stalled over the past several days as the cryptocurrency remains stationed around the $104,000 threshold.

The value of the coin appears to have been moving sideways lately | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist revolves around offering meticulously researched, precise, and impartial content. We adhere to rigorous sourcing criteria, and each page undergoes thorough evaluation by our team of leading technology experts and seasoned editors. This methodology ensures the integrity, relevance, and value of our content for our audience.

Source link

“`