“`html

Reasons to place confidence

Rigorous editorial standards emphasizing precision, significance, and neutrality

Developed by sector specialists and thoroughly vetted

The utmost criteria in journalism and publishing

Rigorous editorial standards emphasizing precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP is capturing attention once more following a remarkable exhibition of strength in recent days, recovering from lows of $2.08 earlier this week to regain $2.4 at the present written time. This upward trend, now exceeding 15% increases from its test of the $2 support, has revealed an intriguing historical pattern on XRP’s daily chart.

A contrast of XRP’s present price structure with its 2017 path shows that an uncommon setup may be signaling a substantial breakout is imminent, with a price objective as lofty as $9.

Related Reading: 3.5 Million TRUMP Tokens Moving—Trump Team Makes A Major Move

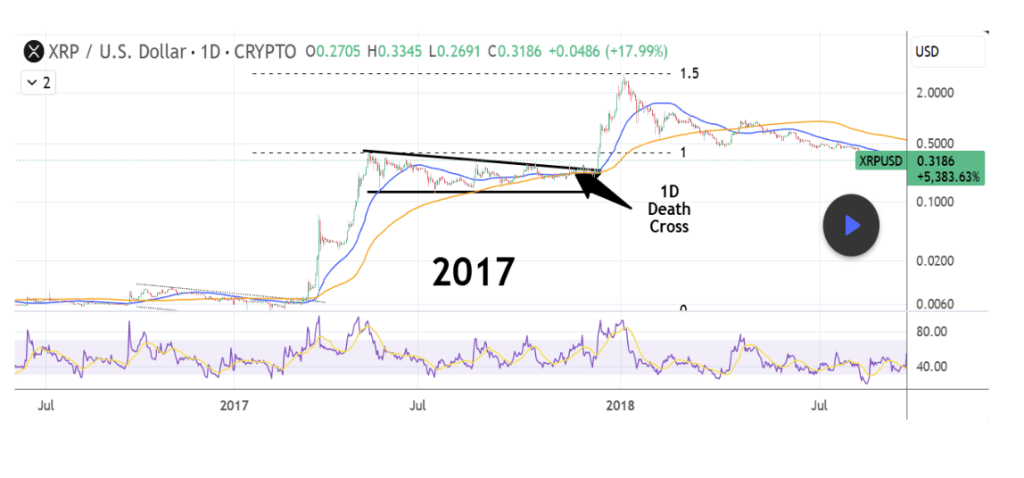

XRP Price Displays 1D Death Cross Signal, But Historical Prices Indicate A Different Outcome

At first glance, a death cross has manifested on the XRP daily candlestick timeframe chart. This type of cross occurs when the 50-day moving average slips below the 200-day moving average, and is ordinarily interpreted as a bearish indicator. Nevertheless, according to a cryptocurrency analyst on the TradingView platform, this might not hold true for XRP.

An in-depth examination of historical examples from 2017 implies that this technical signal may not be as detrimental for XRP as it may seem. Back then, XRP displayed nearly identical trading behavior within a descending triangle just prior to the death cross occurring. That juncture marked a misleading change, as XRP’s price action swiftly reversed direction and surged upwards. In the weeks following the 2017 death cross, XRP achieved the 1.5 Fibonacci extension zone, yielding returns exceeding 1,350% from its pre-breakout level of $0.23 to its eventual all-time high of $3.4.

Once again, XRP has been consolidating within a narrow descending triangle in the 2025 setup preceding the current death cross which is the first in over a year. Despite the bearish implications associated with the death cross, the similarities in chart structure with the 2017 scenario and timing have rendered this formation a bullish wild card.

A similar manifestation of the 2017 death cross rally would elevate the XRP price to new all-time peaks at the 1.5 Fibonacci extension. In terms of a price objective, the analyst remarked that the 1.5 Fibonacci extension for this year aligns near the $9.00 price point, which would signify a 325% increase from XRP’s current valuation.

XRP 2017 Price Chart: Image From TradingView

XRP 2017 Price Chart: Image From TradingView XRP 2025 Price Chart: Image From TradingView

XRP 2025 Price Chart: Image From TradingView

Indicators Remain Neutral Yet Encouraging

Significantly, the XRP price showcases a neutral yet hopeful technical forecast across higher timeframes. XRP maintains a Relative Strength Index (RSI) of 54.799 on the weekly timeframe. This is mid-range and indicates that there’s ample room for growth before XRP becomes overbought. The MACD reading at 0.197 reflects mild upward momentum, while the ADX stands at 30.423.

Related Reading

At the time of writing, XRP trades at $2.38. The analyst’s optimistic outlook heavily hinges on whether institutional interest aligns with the technical breakout.

Featured image from Unsplash, chart from TradingView

Source link

“`