PHILIPPINE ECONOMIC expansion might have increased in the first quarter due to easing inflation and accelerated government expenditure prior to the electoral restrictions, a BusinessWorld survey indicated.

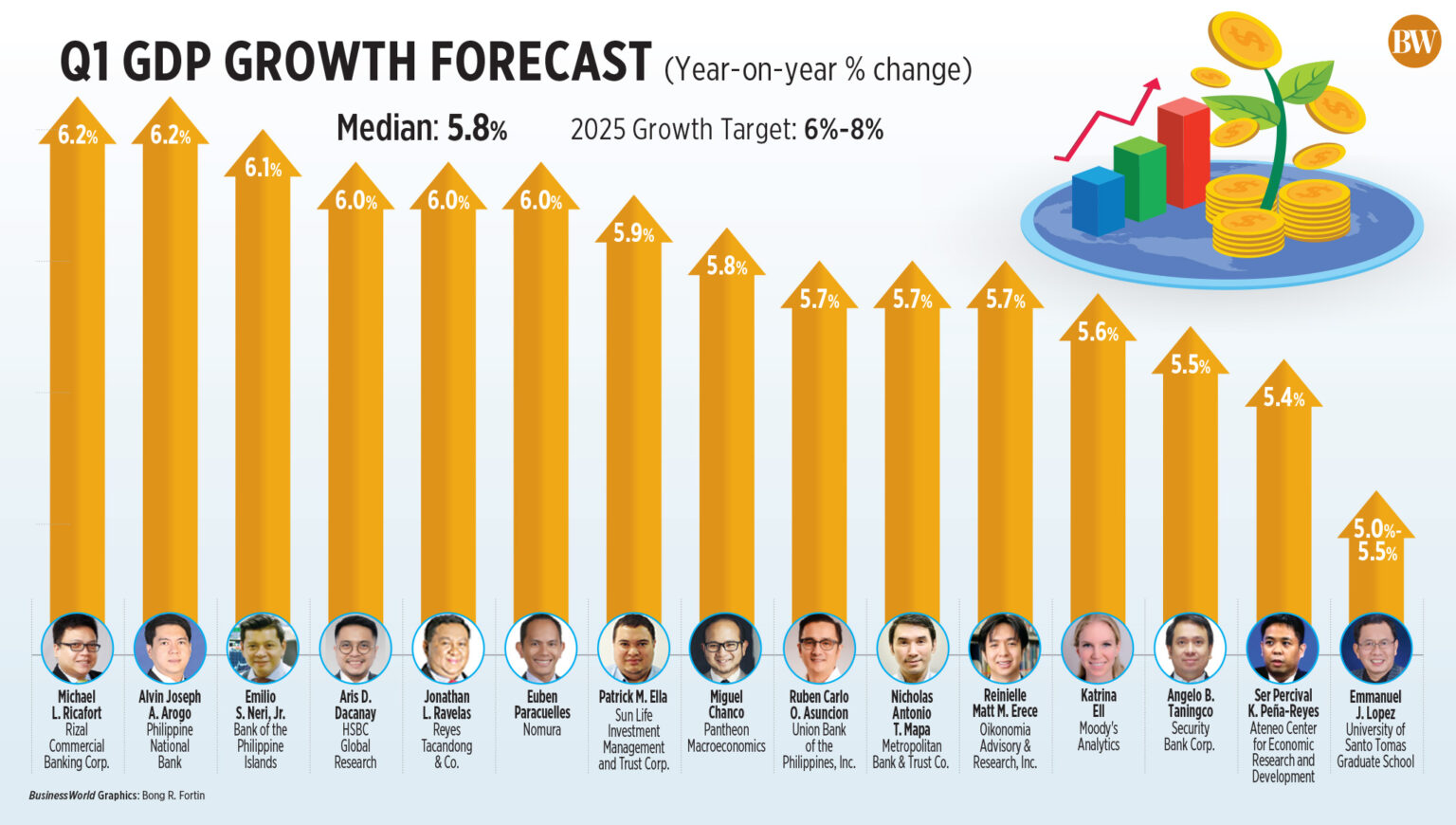

The gross domestic product (GDP) of the Philippines is anticipated to have grown by 5.8% from January to March, based on the median projections of 15 economists and analysts surveyed by BusinessWorld, up from the adjusted 5.3% in the fourth quarter of 2024.

Nonetheless, this would be slightly slower than the 5.9% growth experienced in the first quarter of 2024.

It would also fall short of the government’s target growth range of 6%-8% for the entire year.

The Philippine Statistics Authority will publish preliminary first-quarter GDP figures on May 8.

The growth of the economy may have been bolstered by declining inflation and increased government spending ahead of the ban on the disbursal of public funds that commenced on March 28.

“Consumer spending could be aided by reduced inflation, while government accelerated expenditures likely stimulated economic activities,” remarked Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co.

Inflation averaged 2.2% in the first quarter, as the rise in food and transportation costs moderated. In March alone, inflation registered at 1.8%, the slowest in five years, coinciding with the 1.6% noted in May 2020.

“Growth in private consumption likely advanced due to improved purchasing power from a sustained decline in general inflation,” stated Euben Paracuelles, an analyst at Nomura Global Markets Research.

Final household consumption expenditure, representing over 70% of the economy, expanded by 4.7% in the fourth quarter, slowing from 5.2% in the third quarter and 5.3% in the same quarter of 2023.

“The [first-quarter GDP] is propelled by heightened consumption and government expenditure mainly on infrastructure. This is particularly evident as fiscal initiatives enhance growth,” stated Reinielle Matt M. Erece, an economist at Oikonomia Research and Advisory, Inc.

Government spending surged by 23.89% in the first quarter to P1.477 trillion, already constituting almost a quarter of the P6.2-trillion disbursement proposal for the year.

Separate data indicated that state expenditure on infrastructure rose by 23.1% to P148.3 billion in the January-to-February timeframe, as agencies ramped up disbursements prior to the ban.

“The (GDP) enhancement is partly attributed to low base effects but also reflects election-related spending and increased public sector capital expenditure disbursements,” Mr. Paracuelles noted.

Election-related expenditures are also expected to have hastened consumer spending, as the 90-day campaign period for national candidates commenced in February. The campaign for local candidates began on March 28.

“Election expenditures should boost [consumption], while government spending will persist,” observed Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co.

In prior election years, the Philippines achieved notable GDP growth rates — 7.1% in 2016 (up from 6.3% in 2015), and 7.1% in 2022 (up from 5.7% in 2021).

Meanwhile, reductions in rates by the Bangko Sentral ng Pilipinas (BSP) may also have elevated investment activity.

“Another aspect is lower rates enhancing private investments,” stated Patrick M. Ella, economist at Sun Life Investment Management and Trust Corp.

The BSP reduced rates by 25 basis points at each of its last three meetings since August 2024, lowering the benchmark to 5.75% by year-end. It unexpectedly maintained rates at its February meeting.

TRADE TENSIONS

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, noted that weak business sentiment in the first quarter was a hindrance to overall spending and growth, as companies braced for US tariffs.

“In light of ongoing global trade uncertainties, the question remains whether the anticipated first-quarter GDP growth that will exceed gains in the second half of 2024 is the best we can reach this year. We hope to observe more BSP rate reductions that will alleviate the high real interest rate environment, and enhance growth resilience amidst Trump’s 2.0 tariff hikes,” Mr. Asuncion commented.

Analysts also indicated that growth may have been impacted by the expanded trade deficit in the first quarter.

“We believe the negative growth contributors include the widening trade deficit with imports outpacing exports and sluggish capital formation amidst declining business confidence,” remarked Angelo B. Taningco, Vice-President and Head of Research Division at Security Bank Corp.

In the first quarter, the trade deficit stood at $12.71 billion, expanding by 12.8% from the $11.26-billion gap a year earlier. Exports increased by 5.9% to $19.27 billion in the initial three months of 2025, while imports advanced by 8.4% to $31.98 billion.

HSBC economist for ASEAN Aris D. Dacanay suggested that goods exports may have improved in the first quarter as businesses frontloaded their acquisitions to build inventory ahead of the US tariff announcement.

“The Philippines is relatively better insulated than others in Asia from the chaotic US tariff policy and projected weakness in global goods trade since domestic consumption constitutes a significant portion of GDP,” stated Katrina Ell, Director and Head of Asia-Pacific economics at Moody’s Analytics.

In February, US President Donald J. Trump initiated tariff threats against Mexico, Canada, China, and other trading partners. Some tariffs were enacted, while others were deferred.

Mr. Trump announced a baseline 10% tariff that was enforced on all trading partners, along with higher “reciprocal tariffs” in April.

The US imposed a 17% reciprocal tariff on the Philippines, the second lowest within Southeast Asia. However, Mr. Trump delayed the steeper tariffs until July to permit countries to negotiate with the US.

For the remainder of the year, Mr. Erece expressed expectations that economic growth could be “negatively affected” once the higher tariffs come into force.

“This will primarily impact exports unless trade discussions with the US prove successful. Investments might also be influenced, particularly foreign direct investments as investors contemplate where to allocate capital, manufacturing facilities, and funds amidst uncertainty,” Mr. Erece remarked.

“We still believe that these concerns will be counterbalanced by heightened consumption and infrastructure.” — M.M.L.Castillo