PHILIPPINE automotive sales ascended by 7.6% in March as consistent commercial vehicle sales balanced a double-digit decline in passenger car sales, an industry report indicated.

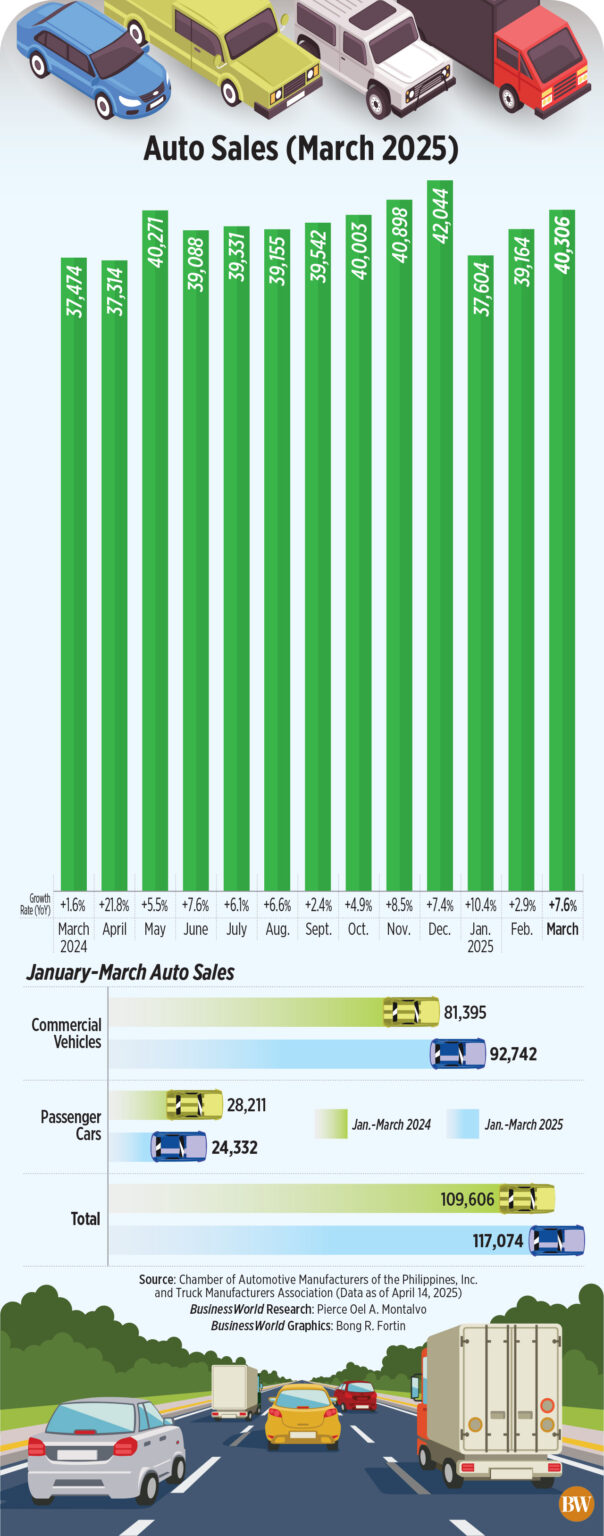

A collective report from the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA) revealed that new vehicle sales rose to 40,306 units in March, up from 37,474 units in the same month a year prior.

Compared to the previous month, car sales also increased by 2.9% from 39,164 units sold in February.

“Vehicle sales have continued to rise but are starting to stabilize on a year-to-date basis, aligning closely with the gross domestic product growth of about 6% for 2025,” stated Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort in a Viber message.

Data from CAMPI-TMA indicated a 16.6% decrease in passenger car sales in March, falling to 8,449 from 10,127 the previous year. Passenger cars constituted 21% of total sales in March.

Month-on-month, passenger car sales increased by 3.6% from 8,154 cars sold in February.

Mr. Ricafort observed that the reduction in passenger car sales highlighted a “greater affinity for sport utility vehicles, pickups, and vehicles with higher clearance due to the series of storms, typhoons, and floods during the latter part of 2024.”

Conversely, commercial vehicle sales, which represented 79% of the total, saw a rise of 16.5% to 31,857 in March, up from 27,347 the previous year.

On a month-to-month basis, commercial vehicle sales climbed by 2.7% compared to 31,010 in February.

When analyzed, light commercial vehicle sales increased by 18.2% year-on-year to 23,754, while Asian utility vehicle (AUV) sales rose by 9.9% to 7,057.

Sales of light-duty trucks and buses surged 40% to 626 in March from 447 units last year. Meanwhile, sales of medium-duty trucks and buses decreased by 3.9% to 320 from 333 last year.

In March, heavy-duty truck and bus sales soared 122.2% to 100 units from 45 units sold last year.

For the first quarter of the year, vehicle sales increased by 6.8% year-on-year to 117,074 units, up from 109,606 in the same period in 2024.

Commercial vehicle sales rose by 13.9% to 92,742, while passenger car sales fell by 13.7% to 24,332 in the January-to-March timeframe.

As of the end of March, Toyota Motor Philippines Corp. continued to lead the market with a 47.42% share after an 11.8% increase in sales to 55,513 units.

Mitsubishi Motors Philippines Corp. secured second place with a 12.1% rise in sales to 23,382 units in the January-to-March timeframe. It accounted for nearly 20% market share.

Holding the third position is Nissan Philippines, Inc., which experienced a 15% decrease in sales to 6,722 units within the first three months.

Completing the top five were Suzuki Phils., Inc., which saw a 23.8% sales increase to 5,441 units, and Ford Motor Co. Phils., Inc., which recorded a 30.7% decline in sales to 5,219 units.

RCBC’s Mr. Ricafort mentioned that the industry is witnessing a growing interest in electrified vehicles (EVs), hybrid cars, and autonomous vehicles.

“The Philippines still has to catch up with other nations regarding increasing the demand for EVs and hybrid vehicles, particularly given heightened competition from lower prices from China, Vietnam, and other countries,” he expressed.

“Newer models, a wider range of brands, low down payments, and more affordable vehicle financing options are also continuing to spur demand or sales of vehicles,” he added.

The CAMPI-TMA report indicated that 1,895 EVs were sold in March, culminating in three-month sales of 5,311 units. This accounted for a 5.73% market share.

Specifically, hybrid EVs comprised 4,554 units sold in the first three months, with 692 battery EVs and 75 plug-in hybrid EVs sold as of the end of March. — Justine Irish D. Tabile