Bitcoin price variations are often assessed through on-chain metrics, technical indicators, and macroeconomic shifts. Nonetheless, one of the most overlooked yet critical elements influencing Bitcoin’s price movement is Global Liquidity. Numerous investors may be misapprehending or underappreciating this measure and its role in BTC’s cyclical patterns.

Influence on Bitcoin

With rising conversations on platforms like Twitter (X) and analysts scrutinizing liquidity graphs, comprehending the connection between Global Liquidity and Bitcoin has become vital for traders and long-term stakeholders. However, recent discrepancies imply that conventional interpretations may necessitate a more sophisticated perspective.

The Global M2 money supply denotes the entire liquid money supply, which includes cash, checking deposits, and easily transformable near-money assets. Ordinarily, when Global M2 expands, capital seeks higher-yielding investments, encompassing Bitcoin, stocks, and commodities. In contrast, when M2 contracts, risk assets frequently see a drop in value due to stricter liquidity circumstances.

Historically, we’ve observed that Bitcoin’s price tends to shadow the Global M2 expansion, increasing during liquidity boosts and struggling during contractions. However, in this cycle, a deviation has occurred: despite a consistent rise in Global M2, Bitcoin’s price movements have been erratic.

Annual Change

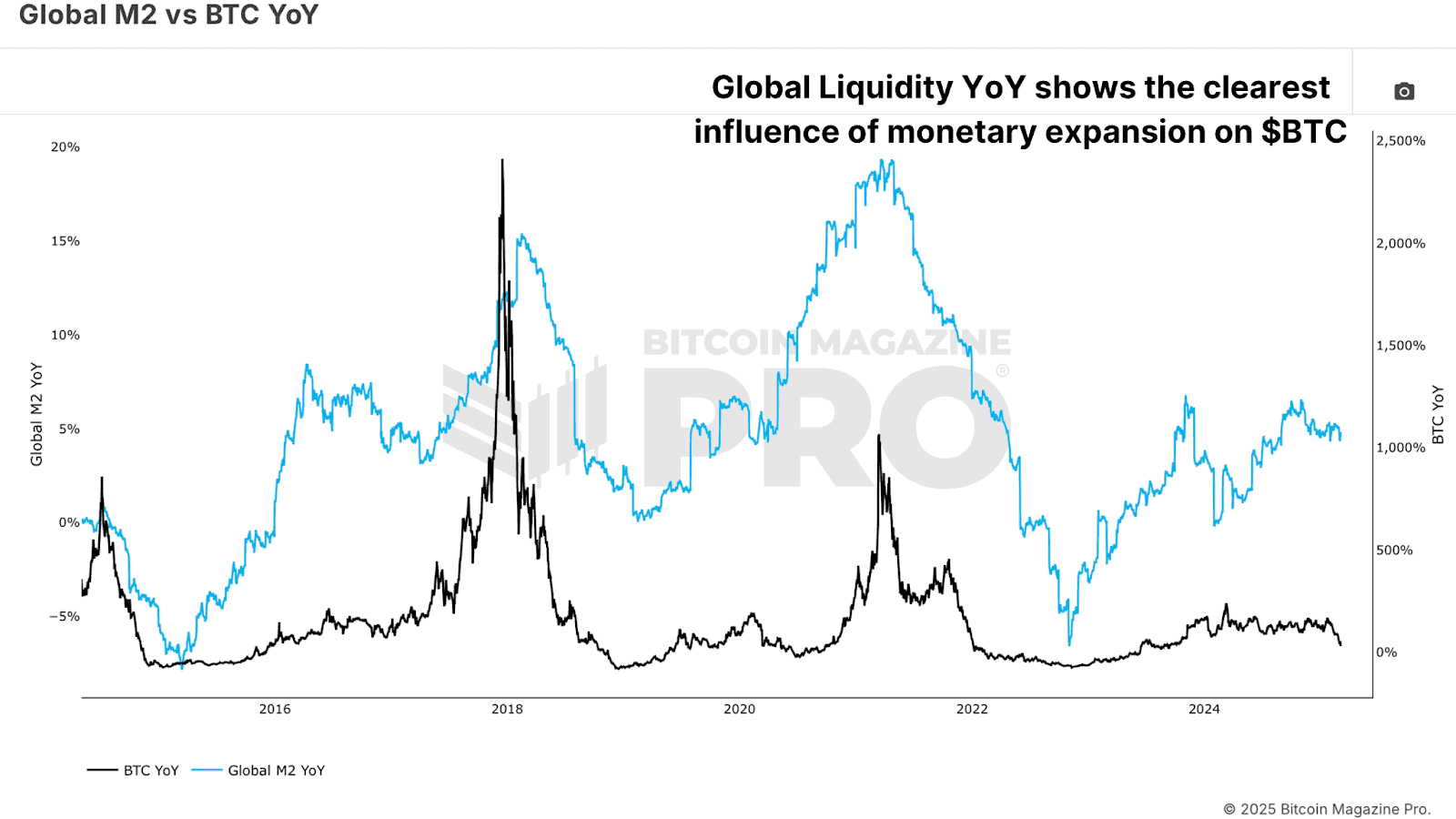

Instead of merely monitoring the absolute figure of Global M2, a more insightful methodology is to examine its annual rate of change. This approach considers the velocity of liquidity growth or shrinkage, clarifying its correlation with Bitcoin’s performance.

When we juxtapose the Bitcoin Year-on-Year Return (YoY) with Global M2 YoY Change, a significantly stronger correlation appears. Bitcoin’s most robust bull markets coincide with periods of swift liquidity growth, whilst contractions typically precede price drops or elongated consolidation phases.

For instance, during Bitcoin’s consolidation phase in early 2025, Global M2 was consistently increasing, yet its rate of change remained stable. Only when M2’s growth noticeably accelerates can Bitcoin potentially surge towards new heights.

Liquidity Delay

Another essential observation is that Global Liquidity does not affect Bitcoin immediately. Studies indicate that Bitcoin lags behind alterations in Global Liquidity by roughly 10 weeks. By advancing the Global Liquidity metric by 10 weeks, the association with Bitcoin significantly improves. Nevertheless, further adjustments reveal that the most precise lag is approximately 56 to 60 days, or close to two months.

Bitcoin Prognosis

Throughout a majority of 2025, Global Liquidity has been experiencing a flattening phase following significant growth in late 2024 that elevated Bitcoin to new heights. This flattening coincided with Bitcoin’s consolidation and retracement to around $80,000. However, if historical patterns are accurate, a recent uptick in liquidity growth should translate into another upward movement for BTC by late March.

Final Thoughts

Observing Global Liquidity serves as a vital macro indicator for predicting Bitcoin’s path. Nevertheless, rather than depending on static M2 data, concentrating on its rate of change and recognizing the two-month delay effect provides a far more accurate predictive framework.

As global economic conditions shift and central banks modify their monetary strategies, Bitcoin’s price movements will remain influenced by liquidity trends. The weeks ahead will be crucial; Bitcoin might be ready for substantial movement if Global Liquidity continues its renewed acceleration.

Liked this? Delve deeper into Bitcoin price movements and market cycles in our latest guide on mastering Bitcoin on-chain data.

Access live data, charts, indicators, and comprehensive research to stay ahead of Bitcoin’s price movements at Bitcoin Magazine Pro.

Disclaimer: This article is intended for informational purposes only and should not be interpreted as financial advice. Always conduct your own research before making any investment decisions.