By Luisa Maria Jacinta C. Jocson, Journalist

NET INFLOWS of foreign direct investments (FDI) into the Philippines slightly rose by only 0.1% in 2024, yet dramatically dropped in December to its lowest monthly count in 11 years, amid instability in global trade, as per data from the central bank.

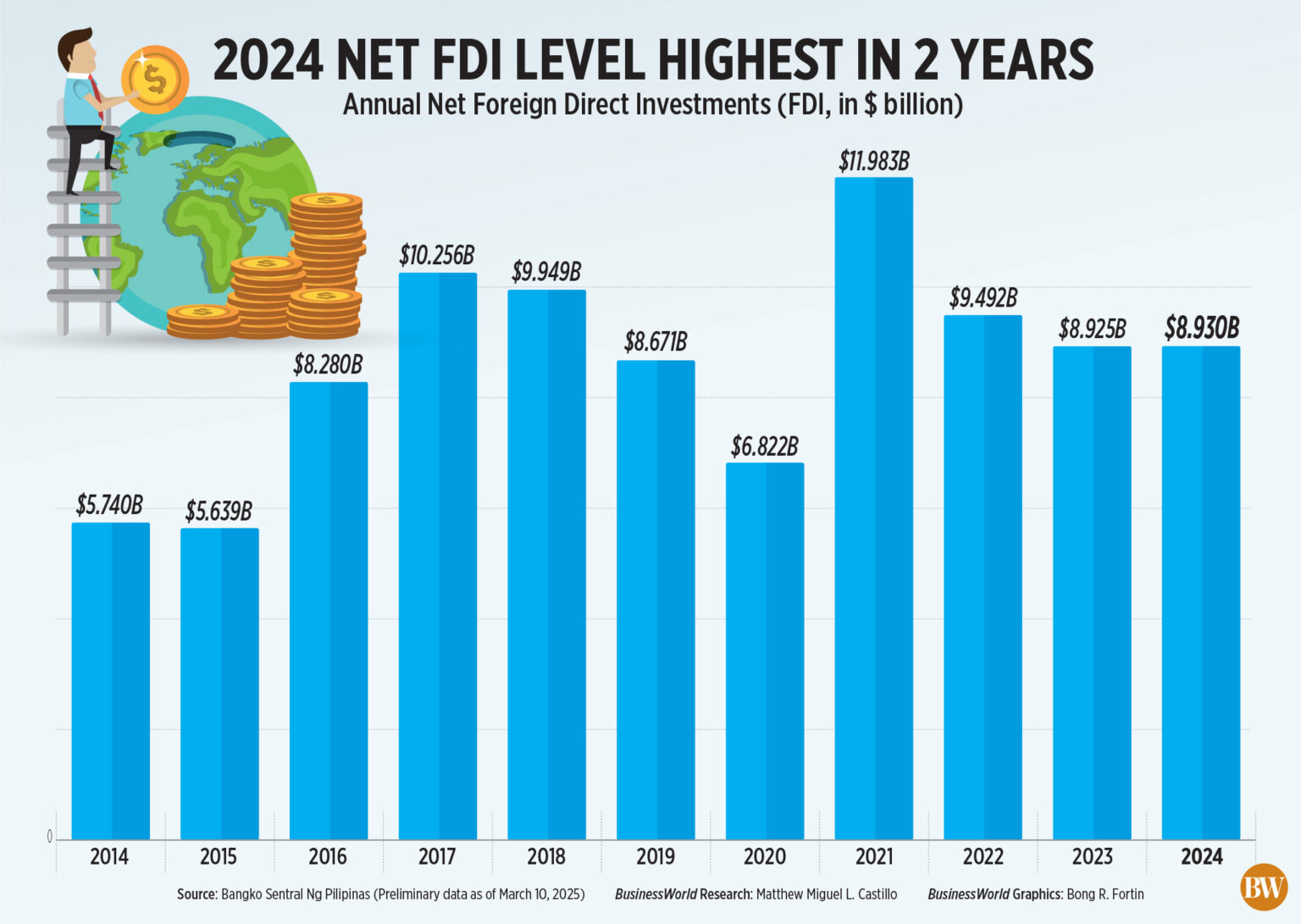

Initial figures from the Bangko Sentral ng Pilipinas (BSP) revealed that FDI net inflows increased marginally to $8.93 billion in 2024 from $8.925 billion in 2023, breaking a two-year streak of declining inflows.

The 2024 FDI figure was also the highest in two years, albeit falling short of the BSP’s prediction of $9 billion.

Investment in equity and investment fund shares surged by 13.1% to $2.7 billion in 2024 from $2.39 billion in 2023.

Net foreign investments in equity capital grew by 42.4% to $1.54 billion last year from $1.08 billion in 2023.

Contributions rose by 4.3% to $2.17 billion, while withdrawals decreased by 37.1% to $628 million.

BSP data indicated that these contributions primarily originated from Japan (38%), the United Kingdom (35%), the United States (10%), and Singapore (8%).

Investments were predominantly directed toward manufacturing (68%), followed by real estate (12%), and information and communication (5%) sectors.

On the other hand, net investments in debt instruments amounted to $6.23 billion, down by 4.7% compared to $6.53 billion in 2023.

Earnings reinvestment also fell by 11.2% to $1.17 billion from $1.31 billion.

DECEMBER DECLINE

In December alone, FDI net inflows tumbled by 85.2% to $110 million from $743 million in the same month of 2023.

Month-on-month, inflows similarly dropped by 88% from $922 million.

December recorded the lowest net FDI inflow in 11 years or since the $102.16 million noted in December 2013.

“Despite net equity capital investments rising among nonresidents, FDI diminished due to increased debt repayments by local firms to their foreign direct investors,” the BSP stated.

The heightened debt repayments resulted in net investments in debt instruments facing an outflow of $19 million in December, a turnaround from the $618-million inflow during the same month in 2023.

Reinvestment of earnings decreased by 14.7% year-over-year to $80 million in December from $94 million a year prior.

Conversely, net investments in equity capital, excluding reinvested earnings, soared by 58% to $49 million in December from $31 million the previous year.

This occurred as equity capital contributions shrank by 19.4% to $185 million, while withdrawals fell by 31.5% to $136 million.

In terms of source, the majority of equity capital contributions in December came from Singapore (42%), followed by Japan (23%), and the United States (16%).

These investments were primarily allocated to information and communication (40%), manufacturing (20%), financial and insurance (13%), construction (9%), and real estate industries (8%).

Conversely, investments in equity and investment fund shares rose by 3.3% to $129 million in December from $125 million.

“The significant drop in net FDI inflows in December is alarming, as it signifies both immediate financial pressures on local enterprises and potential changes in investor attitudes towards the economy,” said Philippine Institute for Development Studies Senior Research Fellow John Paolo R. Rivera.

He remarked that increased debt repayments indicate that local firms are “prioritizing deleveraging over capital reinvestment, which may mirror tighter financial conditions or anxieties regarding profit margins.”

“Uncertainty in policy and global economic dangers may have adversely affected investor sentiments, prompting companies to postpone or reduce expansion strategies in the Philippines,” Mr. Rivera further commented.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort stated that the decline in investment flows might stem from uncertainties related to the protectionist policies enacted by US President Donald J. Trump.

This might have “incentivized heightened investments and employment within the US rather than abroad, thus potentially dampening global FDI,” he added.

Before taking office in January, Mr. Trump announced intentions to impose tariffs on major trading allies like China, Canada, and Mexico, in addition to a general reciprocal tariff on all nations that tax US imports.

Mr. Ricafort also referenced the strife between China and the Philippines, alongside weather disturbances that may have impeded investment activities.

“The reduction in FDI might also reflect challenges in competitiveness, including elevated operational costs, infrastructure constraints, and worries about regulatory consistency,” Mr. Rivera noted.

Looking ahead, Mr. Ricafort suggested that investment flows could benefit from the enactment of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy Act.

“This could motivate foreign investors to make more resolute decisions regarding their investments in the country due to enhanced incentives for foreign involvement,” he added.

Further reductions in interest rates by the US Federal Reserve and BSP might also reduce financing costs and draw in more FDIs in the nation, Mr. Ricafort stated.

Despite the unexpected policy halt in February, the BSP has indicated it’s still adopting an easing stance.

BSP Governor Eli M. Remolona, Jr. mentioned the likelihood of up to 50 basis points in rate cuts this year. The central bank kept the key rate steady at 5.75% the previous month, attributing it to global trade uncertainties.

“Elevated global interest rates render borrowing pricier, discouraging new investments,” Mr. Rivera commented.

Mr. Rivera observed that countries such as Vietnam and Indonesia may have lured more FDI “due to stronger incentives or a more accommodating business climate.”

“Investors could be awaiting clarity regarding key economic reforms, tax regulations, and regulatory frameworks before committing resources,” he added.

Conversely, Mr. Ricafort noted that the tariff conflict would persist in impacting FDI inflows in the upcoming months.

“(These) all drive foreign investors to position themselves in the US to avoid heightened import tariffs, leading to job creation in the US as part of Trump’s America-first policy,” he remarked.

The central bank anticipates concluding 2025 with a $10-billion net FDI inflow.

The BSP highlighted that its FDI data differ from the investment data provided by other government entities, as it encompasses actual investment flows.

“In contrast, the approved foreign investment data released by the Philippine Statistics Authority is sourced from Investment Promotion Agencies and represents investment commitments, which may not always be fully actualized within a specified timeframe.”