Reasons to have confidence

Rigorous editorial standards aimed at precision, significance, and neutrality

Developed by seasoned professionals and thoroughly evaluated

The utmost standards in journalism and publication

Rigorous editorial standards aimed at precision, significance, and neutrality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In cryptocurrency, sharp price volatility is common when policies and fresh regulations are disclosed. This market behavior was highlighted this week, right after U.S. President Donald Trump revealed plans for a strategic crypto reserve that encompasses Ethereum, Solana, ADA, Ripple’s XRP, and, notably, Bitcoin.

Further Reading

The response from cryptocurrencies was swift, with Ethereum being among the premier assets that both soared and plummeted drastically in a matter of days. On March 2nd, ETH was valued at $2,191, surged to a high of $2,542 on March 3rd, before retreating below $2,300 at the day’s end and stabilizing around the $2,050 mark the following day.

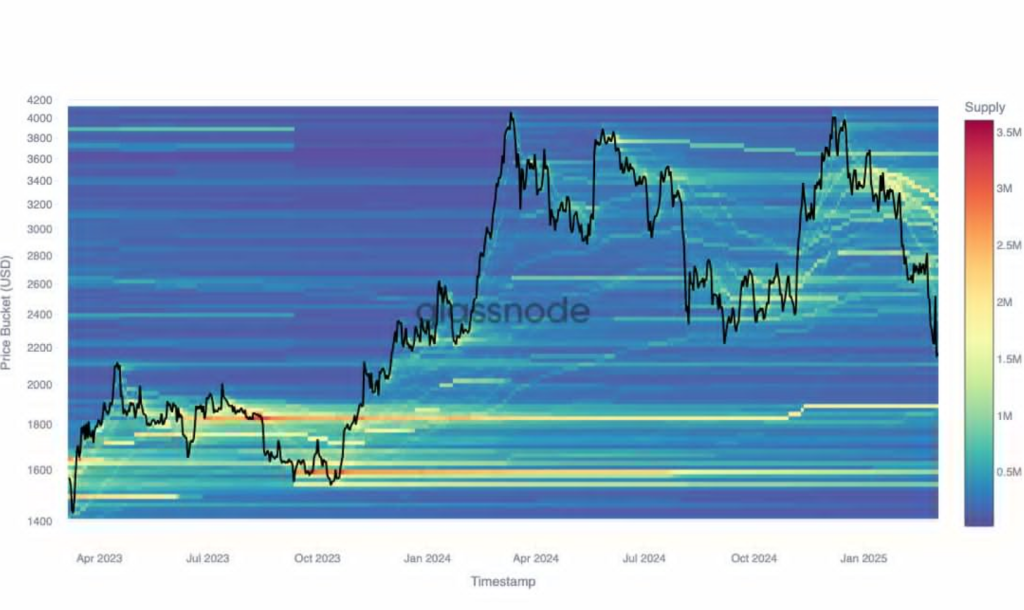

According to Glassnode, the recent fluctuations in crypto prices revealed some key strategies employed by ETH holders.

A Surge of Activity Among ETH Holders

Data from Glassnode indicates that ETH holders and traders altered their portfolios amidst the recent price fluctuations. Following its analysis over three months, Ether holders who obtained their tokens at $3,500 modified their holdings in February.

#Ethereum investors actively managed their exposure in this turbulent timeframe. After a spike to $2.5K, $ETH fell back to $2.05K – levels not seen since Nov 2023. Cost Basis Distribution (CBD) illustrates how capital shifted across price brackets and who capitalized on the drop. 🧵👇 pic.twitter.com/vl6AdghfRO

— glassnode (@glassnode) March 5, 2025

These investors initiated their positions at a peak rate of $2,500 and continued to hold when ETH fell back to $2,050. Glassnode’s data shows these investors collectively own 1.75 million ETH, with an average purchase price of $3,200. Thus, their holdings are currently down by 10% from their initial buy-in.

Furthermore, Glassnode reveals that on March 1st, traders acquired 500k ETH at an average cost of $2,200. However, this cohort quickly redistributed their assets when ETH reached $2,500.

The recent price movements of Ethereum have disclosed a significant price resistance at $2,800, where market participants amassed 800k tokens. Consequently, crypto holders and investors are keenly observing this level should ETH experience a rebound shortly.

Increasing Accumulation Among ETH Whales

Market analysts also emphasize the heightened trading activity and accumulation within cryptocurrency wallets. Crypto commentator Ted noted that a crypto whale recently acquired 17,855 ETH valued at approximately $36 million, with an average purchase price of $2,054.

The whale’s ETH holdings are now worth $2.5 billion. This transaction reinforces the current accumulation trend, indicating that the present price may represent a “buying opportunity”.

Is It Time to Acquire ETH?

At present, ETH is trading within the range of $2,100 to $2,300, which remains beneath its Monday value of $3,500. An analyst from CryptoQuant suggests that Ethereum is in a possibly advantageous state following its recent price fluctuations. The analyst pointed out that Ethereum’s MVRV ratio has dipped below 1, indicating that the asset is undervalued.

Further Reading

This threshold commonly signals the potential for a price rise in previous bullish markets. Moreover, it was highlighted that a growing number of ETH addresses are acquiring additional tokens. These wallets retain ETH rather than selling, indicating that institutional participants are expanding their holdings.

Nonetheless, the CryptoQuant analyst approaches ETH with caution, noting that macroeconomic factors could still affect cryptocurrency prices. They emphasized the potential consequences of tariff policies and monetary tactics on ETH and altcoin valuations.

Featured image from Reuters, chart from TradingView