South Africa Reserve Bank (SARB) governor’s inquiry, “Why not a strategic beef reserve?” during the 2025 World Economic Forum in Davos might have been a rhetorical device, yet Lesetja Kganyago’s seemingly sarcastic comment regarding “strategic bitcoin reserves” unintentionally highlighted the necessity for Africa to reassess its economic approaches in light of global financial changes. In an era increasingly characterized by digital advancements, the ideas of currency and value retention are swiftly transforming. Africa is accustomed to resource-driven economies. From oil and gold to beef and cocoa, the continent has historically depended on natural resources for its economic vitality. Nevertheless, these resources present various difficulties. International commodity rates are incredibly vulnerable to market variations, geopolitical strife, and climate fluctuations. For example, beef prices can fluctuate dramatically due to disease outbreaks or trade embargoes, mirroring how fiat currencies fluctuate and remain unpredictable when exchanged against digital currencies like bitcoin, influenced by regional financial regulations and currency depreciation. According to the Food and Agriculture Organization (FAO), beef prices have experienced annual volatility of up to 30% due to factors such as foot-and-mouth disease and export prohibitions.

Image Source : FAO

Even though Brian Armstrong, CEO of Coinbase, addressed Kganyago’s question with a persuasive point: Bitcoin is not merely a superior currency than gold; it is also more transportable, divisible, and utility-oriented. Throughout the previous decade, Bitcoin has outshined every major asset category, firmly establishing itself as a better store of value. For Africa, a region frequently sidelined in the global financial framework, a Strategic Bitcoin Reserve might be the essential factor for achieving economic autonomy, encouraging innovation, and ensuring sustained prosperity. How?

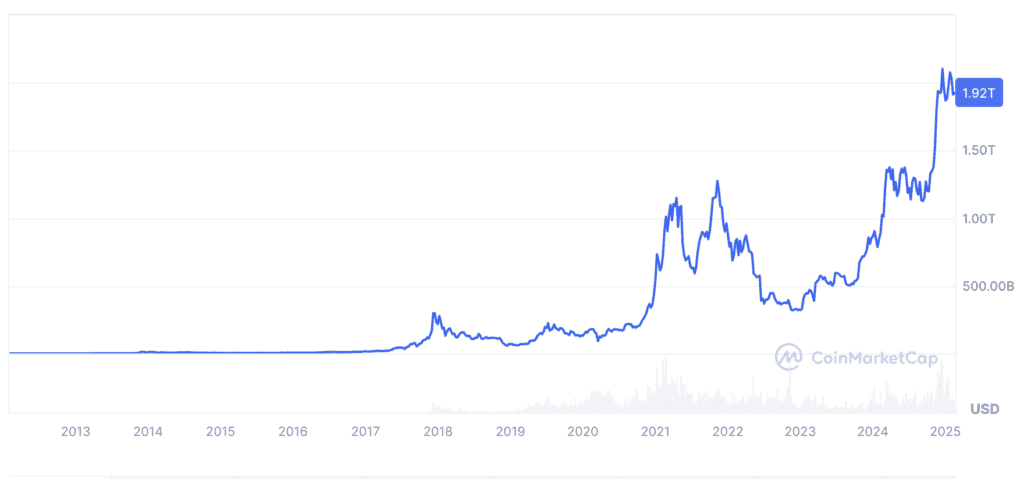

It’s critical to be factual and pragmatic in our analogy. Bitcoin exists in a digital format and does not necessitate physical storage, while goods like beef and mutton are subject to perishability and require significant upkeep. The World Bank estimates that food loss after harvest in Africa stands at $48 billion annually, emphasizing the inefficiencies tied to commodity-based reserves. While commodities hold inherent value, their practicality is confined to particular sectors. In contrast, Bitcoin serves as a global, borderless asset with functionalities in finance, technology, and more, making it particularly well-suited as a strategic reserve asset. With a limited supply of 21 million coins, Bitcoin is naturally deflationary, unlike fiat currencies that can be printed without limit or beef, which has unlimited reproductive potential. According to CoinMarketCap, Bitcoin’s market capitalization has surged from under 1 billion in 2013 to more than 1 trillion in 2025, showcasing its swift adoption and value increase.

Image Source : CoinMarketCap

WHY BITCOIN OVER BEEF?

Bitcoin can be sent across borders in mere minutes and fragmented into smaller segments (satoshis), rendering it more efficient than gold or beef. Over the last decade, Bitcoin has yielded an average yearly return surpassing 200%, outperforming gold, equities, and real estate. A research report from Fidelity Investments revealed that Bitcoin’s risk-adjusted returns are better than those of conventional assets, which makes it an appealing choice for long-term wealth conservation. Around the globe, countries are starting to acknowledge Bitcoin’s viability as a source asset. El Salvador made headlines in 2021 by adopting Bitcoin as an official currency, while nations such as Switzerland and Singapore have incorporated Bitcoin into their financial frameworks. We are now in 2025, and The United States “Strategic Bitcoin Reserve” Bill is already under consideration. According to a 2023 Chainalysis report, Africa ranks as one of the fastest-emerging cryptocurrency markets, with Nigeria, Kenya, and South Africa as the frontrunners in adoption.

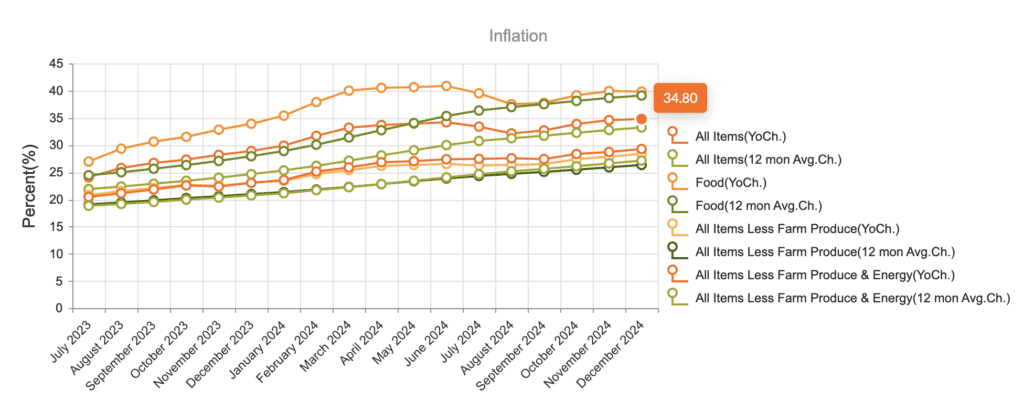

Bitcoin’s deflationary characteristic makes it a valuable protection against inflation, a phenomenon that has troubled numerous African economies. For instance, Nigeria’s inflation rate reached 34.80% in 2024, diminishing the purchasing power of the Naira. A Bitcoin reserve could safeguard national assets from such depreciation. By dedicating merely 1% of its reserves to Bitcoin, Africa could release billions in value. For example, if the continent’s total foreign reserves of 500 billion included 5 billion in Bitcoin, a tenfold increase in Bitcoin’s value would yield $50 billion in profits. Unlike beef production, which contributes to deforestation and greenhouse gas emissions, Bitcoin mining can be fueled by renewable energy sources. As per the Cambridge Bitcoin Electricity Consumption Index, 58.5% of worldwide Bitcoin mining was powered by renewable energy sources as of 2021. Africa’s extensive solar and hydroelectric capabilities present an excellent opportunity for eco-friendly Bitcoin mining endeavors. Storing and managing Bitcoin reserves is significantly more cost-efficient than overseeing commodity reserves. There are no storage expenses, no likelihood of spoilage, and no necessity for intricate logistics.

Image Credit: Central Bank of Nigeria.

The implementation of Bitcoin as a legal currency in El Salvador yields significant lessons for Africa. In spite of early doubts, Bitcoin has enhanced tourism and international investment within El Salvador. As reported by the Central Reserve Bank of El Salvador, earnings from tourism surged by 30% in the year following the adoption of Bitcoin. More than 70% of Salvadorans lacked access to banking infrastructures before this. Bitcoin has facilitated the inclusion of millions into the global financial system. By diminishing dependency on the U.S. dollar, El Salvador has made a daring move toward economic self-sufficiency. Numerous African countries depend heavily on the U.S. dollar for transactions and reserves, rendering them susceptible to outside economic directives. Bitcoin presents a decentralized option that lessens dependence on conventional financial frameworks.

By creating a Strategic Bitcoin Reserve, Africa can safeguard its economic prospects, shield its assets from inflation, and establish itself as a worldwide frontrunner in the digital financial space. It is time for Africa to transition from outdated financial frameworks and welcome the future of currency. As Brian Armstrong insightfully noted, Bitcoin represents not only a superior monetary form but serves as the bedrock of a revamped financial paradigm. For Africa, the resolution is unmistakable: Bitcoin, rather than beef, is the route to wealth. Bitcoin embodies a revolutionary asset class that provides unmatched benefits compared to traditional commodities like beef or lamb.

This article is penned by Heritage Falodun. The views expressed are strictly their own and may not necessarily align with those of BTC Inc or Bitcoin Magazine.