THE NATIONAL GOVERNMENT’S (NG) budget shortfall decreased compared to the previous year in 2024, yet surpassed the target by 1.48%, the Bureau of the Treasury (BTr) announced.

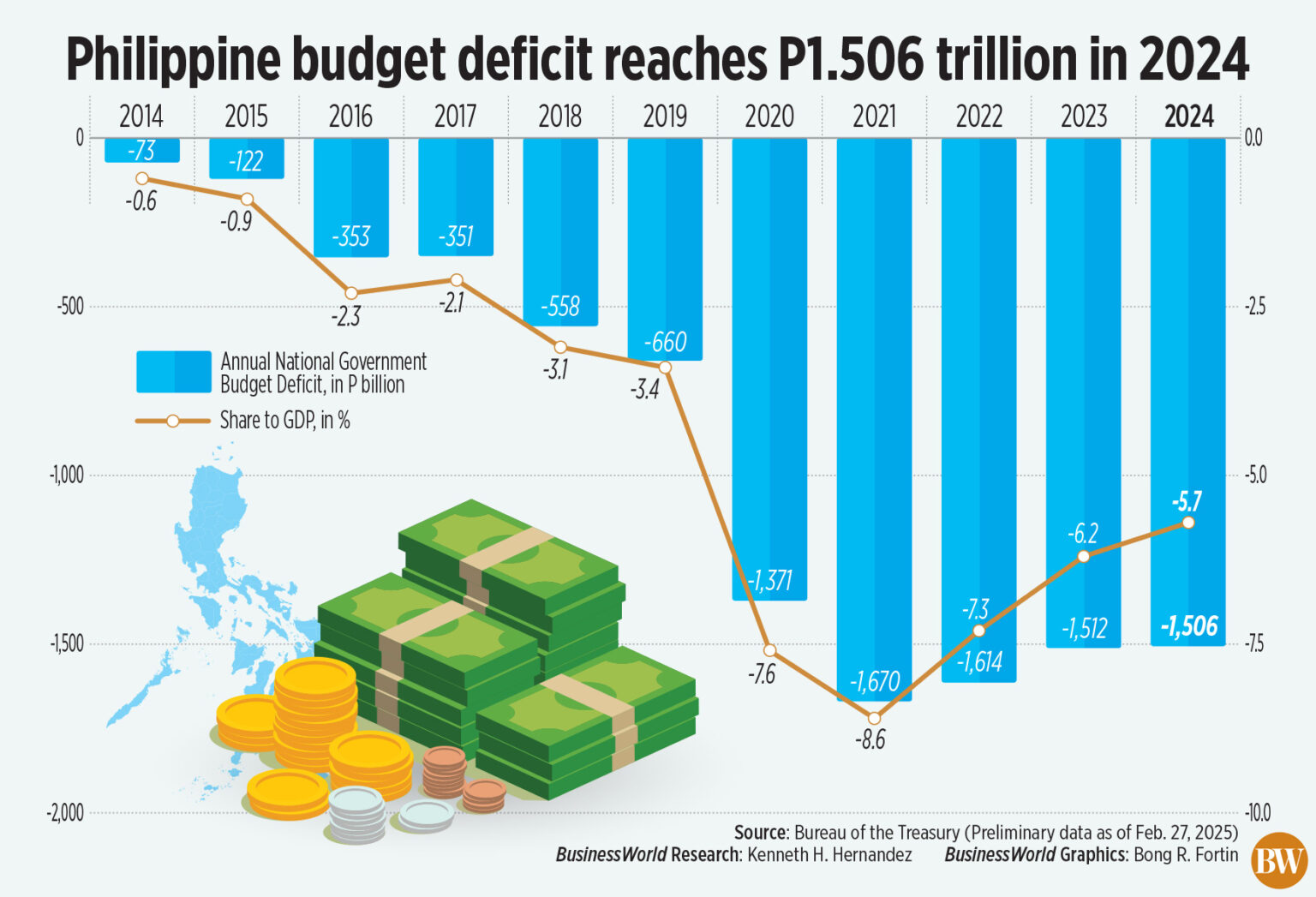

Figures from the Treasury published on Thursday indicated that the budget shortfall contracted by 0.38% or P5.7 billion, bringing it to P1.506 trillion in 2024, down from P1.512 trillion in 2023.

Nevertheless, it went beyond the P1.48-trillion deficit limit established by the Development Budget Coordination Committee.

“The slight discrepancy relative to the P1.484-trillion deficit program was mainly due to a higher outturn in governmental expenditures, including those charged to unprogrammed appropriations, along with settling accounts payables,” stated the Treasury.

By the close of 2024, the deficit as a proportion of gross domestic product (GDP) settled at 5.7%, lower than the 6.2% recorded at the end of 2023 but slightly above the target of 5.6%.

Data from BTr revealed that revenue collection surged by 15.56% to P4.42 trillion, exceeding its P4.27-trillion goal due to better-than-expected nontax revenue collections.

“This is equivalent to 16.72% of GDP, marking the highest revenue effort in the past 27 years, since 1997,” the Treasury remarked.

Tax revenues increased annually by 10.83% to P3.8 trillion in 2024 but fell short of the P3.82-trillion target by 0.51%.

Collections by the Bureau of the Internal Revenue (BIR) rose by 13.29% year-on-year to P2.852 trillion, propelled by enhanced value-added tax (VAT) collections. It surpassed the P2.849-trillion goal by 0.09%.

Conversely, the Bureau of Customs’ (BoC) revenues increased by 3.79% to P916.7 billion in 2024 but missed the P939.7-billion target by 2.45%

The BTr attributed the reduced Customs collections to a lowered tariff on rice and selected electric vehicles, in addition to the extension of lower tariffs on meat products.

“The growth is credited to an increase across duties, VAT, and excise collections, which stemmed from the bureau’s enhanced digitization, inspection, and border protection initiatives enacted throughout the year,” the BTr added.

Meanwhile, nontax revenues escalated by 56.61% to P618.3 billion in 2024, surpassing the full-year target of P449.6 billion by 37.53%.

“The unexpectedly positive outcome was mainly due to strengthened initiatives to generate windfall collections such as the Public-Private Partnership (PPP) concession fee (P30 billion) and the P167.2-billion fund balance transfers from the Philippine Health Insurance Corp. (PHIC) and Philippine Deposit Insurance Corp. (PDIC),” stated the Treasury.

“Excluding the fund balance transfers, total nontax collections of P451.1 billion still exceeded the adjusted full-year program by 0.33% (P1.5 billion).”

The Treasury’s income increased by 24.48% to P283.4 billion last year and surpassed the P187-billion target by 51.52%. This was attributed to “increased dividend remittances, interest advances from government-owned and -controlled corporations, guarantee fees, and the NG share from the Philippine Amusement and Gaming Corp. profits.”

Revenue from other agencies more than doubled to P335 billion from P167.2 billion in 2023, also exceeding its P262.6-billion program by 27.56%.

Simultaneously, government expenditures rose by an annual 11.04% to P5.925 trillion in 2024, which was 2.97% higher than its P5.754-trillion annual program.

“The robust disbursement performance was significantly driven by infrastructure and other capital expenditures of the Department of Public Works and Highways (DPWH),” noted the BTr.

It also mentioned the “maintenance and other operating expenses for various health and social protection programs, along with personnel services expenditures due to the implementation of the first tranche of salary adjustments for eligible civilian government employees.”

Primary spending — which means total expenditures minus interest payments — elevated by 9.65% to P5.16 trillion last year, exceeding the programmed P4.999 trillion by 3.43%.

Interest payments (IP) surged by 21.48% to P763.3 billion due to the “higher interest rates and less favorable foreign exchange rate conditions.” However, this was 0.02% lower than the revised program of P763.4 billion.

DECEMBER DEFICIT

In December alone, the NG’s budget deficit also significantly decreased by 17.82% to P329.5 billion from P401 billion in the same month in 2023.

Revenue collection increased by 20.99% to P314.7 billion in December, with tax revenues increasing by 2.01% to P251.6 billion.

When broken down, BIR collection rose by 5.48% to P183.8 billion, while Customs collection decreased by 6.38% to P66.7 billion.

Meanwhile, nontax revenues skyrocketed by 369% to P63.1 billion, while Treasury revenues surged by 348% to P50.7 billion.

Conversely, government spending declined by 2.55% to P644.2 billion in December.

Primary spending fell by 2.36% to P586.2 billion, while interest payments decreased by 4.45% to P58 billion.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort expressed that the somewhat reduced deficit in 2024 mainly reflected heightened governmental expenditures.

“Rising prices and election-associated expenditures could have partially contributed to the increase in government outlays in 2024,” he remarked.

Security Bank Corp. Chief Economist Robert Dan J. Roces mentioned in a Viber message that the fiscal performance “exhibits a delicate balancing act between revenue mobilization and expenditure management amid macroeconomic challenges.”

“While the deficit narrowed slightly to P1.506 trillion, this achievement is commendable considering the substantial 21.48% increase in interest payments that generated notable expenditure pressure,” he commented.

“The narrowing deficit trend, despite not meeting the exact target, still signifies substantial fiscal consolidation progress, with the deficit-to-GDP ratio improving from 6.2% to 5.7%, continuing the favorable trend since the post-pandemic high of 8.6% in 2021,” Mr. Roces added. — A.R.A. Inosante