On-chain information reveals that substantial Bitcoin holders are taking advantage of the reduced prices as they have resumed their accumulation efforts.

Bitcoin Whales Are Now in Net Acquiring Mode

As per data sourced from the market analysis platform IntoTheBlock, the Large Holders are currently purchasing BTC. The on-chain metric of significance in this context is the “Large Holders Netflow,” which monitors the net volume of the asset that’s being added to or removed from the wallets associated with Large Holders.

The analytics firm characterizes ‘Large Holders’ as the entities possessing at least 0.1% of the total supply of the cryptocurrency within their accounts. At the current conversion rate, this quantity amounts to about $1.67 billion, indicating that only the addresses owned by the most significant investors in the market would belong to this group.

When the value of the Large Holders Netflow is positive, it indicates that these massive entities are experiencing net gains in their wallets. Such net acquisitions from this group can naturally signal a bullish sentiment for BTC’s value.

Conversely, a negative indicator could result in a bearish trend for the cryptocurrency, suggesting that the largest holders have opted to engage in some selling.

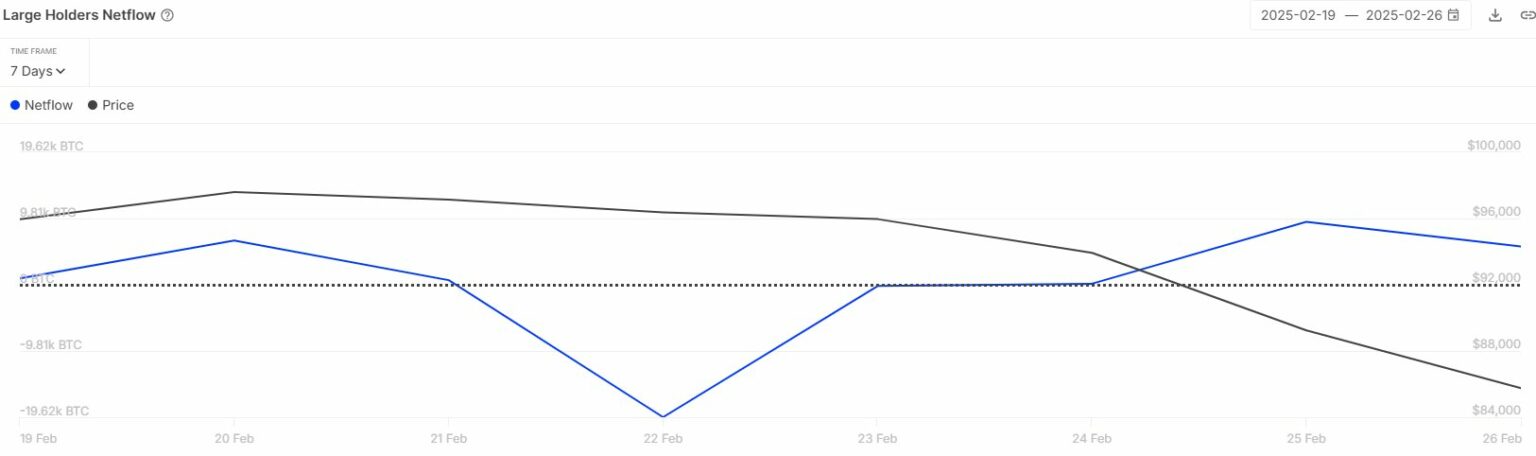

Now, here’s the chart provided by the analytics firm, illustrating the trend in the Bitcoin Large Holders Netflow over the past week:

As shown in the preceding graph, the BTC Large Holders Netflow had gone negative earlier in the week, indicating that these colossal whales had moved towards net distribution.

The price of the cryptocurrency had subsequently aligned with its plunge when this selling occurred, making it seem likely that this group contributed to the bearish price movements.

Although these influential entities may have partially contributed to the market downturn, they have now reversed their stance and commenced buying again, as the indicator’s value has returned to the positive territory.

According to the analytics firm, the Large Holders have accumulated nearly 15,000 tokens of the asset into their portfolios since BTC fell below the $90,000 threshold. Therefore, it appears this group perceives the current low prices as a favorable accumulation opportunity for Bitcoin.

It’s conceivable that this buying frenzy from the whales could ultimately have a bullish impact on BTC, akin to the effect of the previous selloff, but thus far, the coin has merely continued to decline.

BTC Price

Bitcoin has further deepened its losses with an additional 2% decrease in the last 24 hours, bringing its price down to the $84,500 mark.