In a communication published on February 25, 2025, Matt Hougan—Chief Investment Officer (CIO) at Bitwise Asset Management—established notable parallels between the current crypto market and his observations from July 2024. Entitled “Short-Term Pain, Long-Term Gain (Redux),” Hougan’s recent evaluation indicates that, notwithstanding the present downturn, the sector’s fundamental attributes remain as persuasive as ever.

Crypto Reflections From July 2024

Hougan commenced his memorandum by reminiscing about the landscape in July 2024, when he authored an earlier article titled “Short-Term Pain, Long-Term Gain.” That period saw crypto markets in turmoil: “Bitcoin, which had surged above $73,000 in March 2024, had dropped to approximately $55,000, a decline of 24%. Ethereum had decreased by 27% during the same timeframe.”

At that juncture, Hougan remarked that “the crypto market is currently experiencing a paradoxical situation. The short-term news is unfavorable, while the long-term outlook is optimistic.” He also referenced factors such as prospective ETF inflows, the impending Bitcoin halving, and increasingly favorable policy-making in Washington, D.C., which stood in contrast to immediate threats like Mt. Gox distributions and government liquidations of Bitcoin.

Related Reading

This analysis proved to be prescient. “Shortly after I composed the memo, Bitcoin hit its lowest point and subsequently soared to $100,000,” Hougan stated. In his latest commentary, he observes a similar dichotomy: adverse short-term occurrences juxtaposed with robust long-term tailwinds.

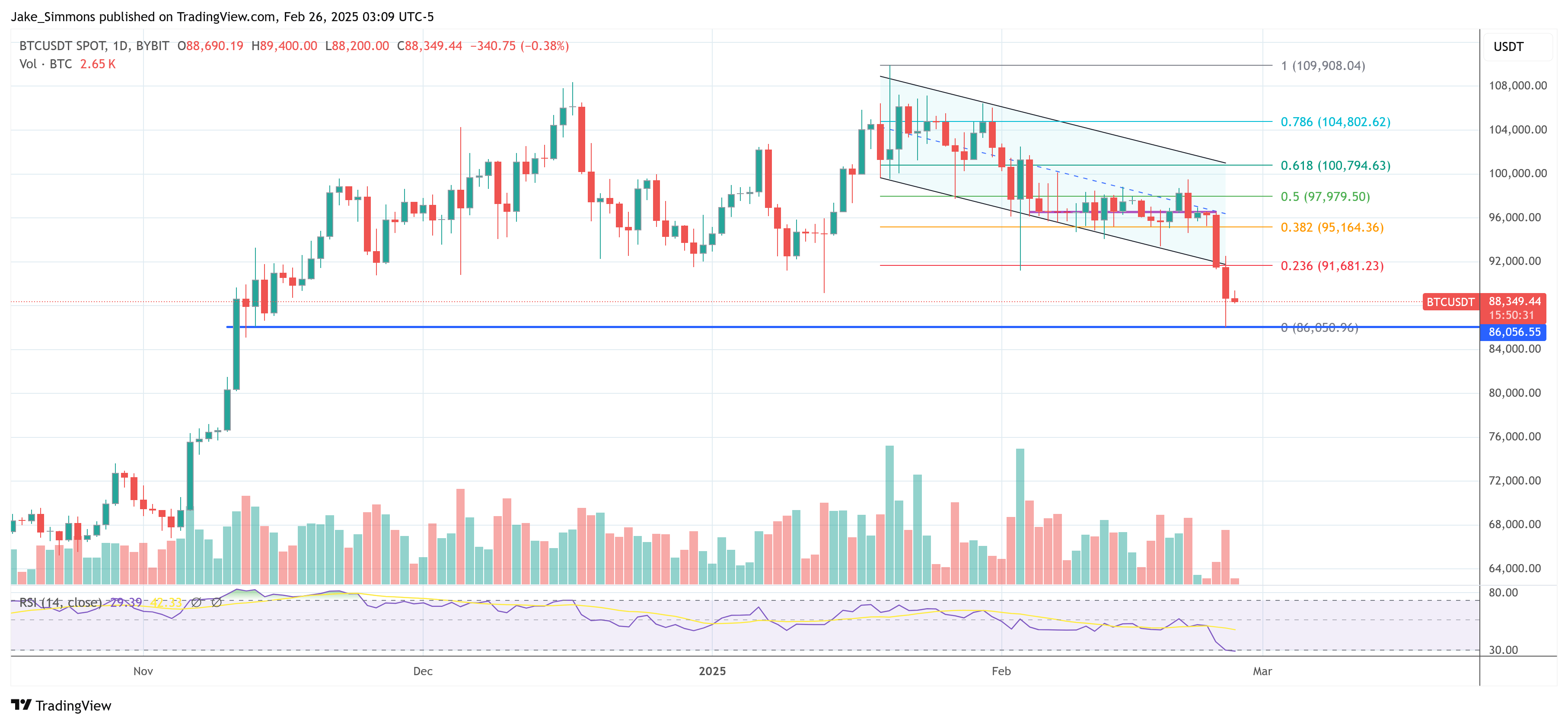

Yesterday, the crypto markets faced renewed challenges: Bitcoin fell at one point by over 10% to a low of $86,050, Ethereum dropped by 18%, and Solana decreased by 21%. The immediate catalyst: last weekend’s breach at Bybit, a Singapore-based exchange, which experienced a $1.5 billion theft of Ethereum through a phishing scheme.

Although Bybit utilized its reserves to make clients whole, the incident sent shockwaves throughout the industry. The breach followed a string of memecoin frauds, including Libra, endorsed by Argentine President and noted crypto supporter Javier Milei. The memecoin led to billions in losses for investors, which Hougan described as a “multi-billion-dollar scam.”

Furthermore, Melania, a project associated with First Lady Melania Trump, also collapsed, incurring significant losses for token holders. The memecoin linked to US President Donald Trump faced no better fate.

“Collectively, these incidents likely signify the conclusion of the recent memecoin frenzy,” Hougan remarked. While numerous institutional and long-term crypto participants may regard the memecoin segment with skepticism, its trading volume and hype have invigorated overall market activity—especially within the Solana ecosystem.

Related Reading

Notwithstanding the unfavorable press, Hougan points to a solid foundation supporting crypto markets. Initially, Hougan emphasizes the pro-crypto regulation established during the Trump administration. He believes, “We are witnessing the initial stages of a significant shift in Washington’s perception of crypto.” He cites the US Securities and Exchange Commission’s recent choice to dismiss high-profile lawsuits against entities like Coinbase as well as ongoing legislative movements regarding stablecoins and market structure. Such advancements, he contends, will facilitate crypto’s entry into conventional finance.

Additionally, institutional participation continues to expand. Major purchasers—including asset managers, corporations, and even governments—persist in accumulating Bitcoin. Hougan states that thus far this year, “investors have funneled $4.3 billion into bitcoin ETFs,” and he anticipates this figure to swell to $50 billion by year-end.

Hougan also predicts a surge in stablecoins. The assets managed within stablecoins have risen to a historic $220 billion, reflecting a 50% increase from the previous year. With favorable legislation traversing through Congress, Hougan believes the sector could escalate to $1 trillion by 2027.

Finally, the Bitwise CIO foresees a renaissance in DeFi and tokenization. Lending, trading, prediction markets, and derivatives are experiencing record elevated usage. Simultaneously, the tokenization of real-world assets is reaching all-time highs in assets under management, indicating that blockchain-based representations of traditional securities and commodities may be on the increase.

Hougan revisits his July 2024 thesis to underscore the present opportunity. On the downside, markets must contend with the repercussions of Bybit’s significant breach and the fallout from numerous memecoin ventures. Conversely, regulatory clarity, institutional inflows, stablecoin growth, and DeFi advancements persist unabated.

“This is what I refer to as a no-brainer,” Hougan remarked, emphasizing his position that substantial long-term aspects overwhelmingly eclipse the short-term challenges. He does issue a tempered caution, suggesting that this pullback might be more pronounced than last summer’s decline: “The memecoin boom was substantial, and the aftereffects could be more severe. It may take days, weeks, or months to navigate through it.”

Yet his conclusion remains steadfast: the long-term growth narrative is still intact. “When that occurs, I prefer my investment on the long-term,” he asserted, reiterating that patience can be beneficial in a market frequently influenced by headline-induced volatility.

At the time of publication, BTC was trading at $88,349.

Featured image generated with DALL.E, chart from TradingView.com