By Luisa Maria Jacinta C. Jocson, Reporter

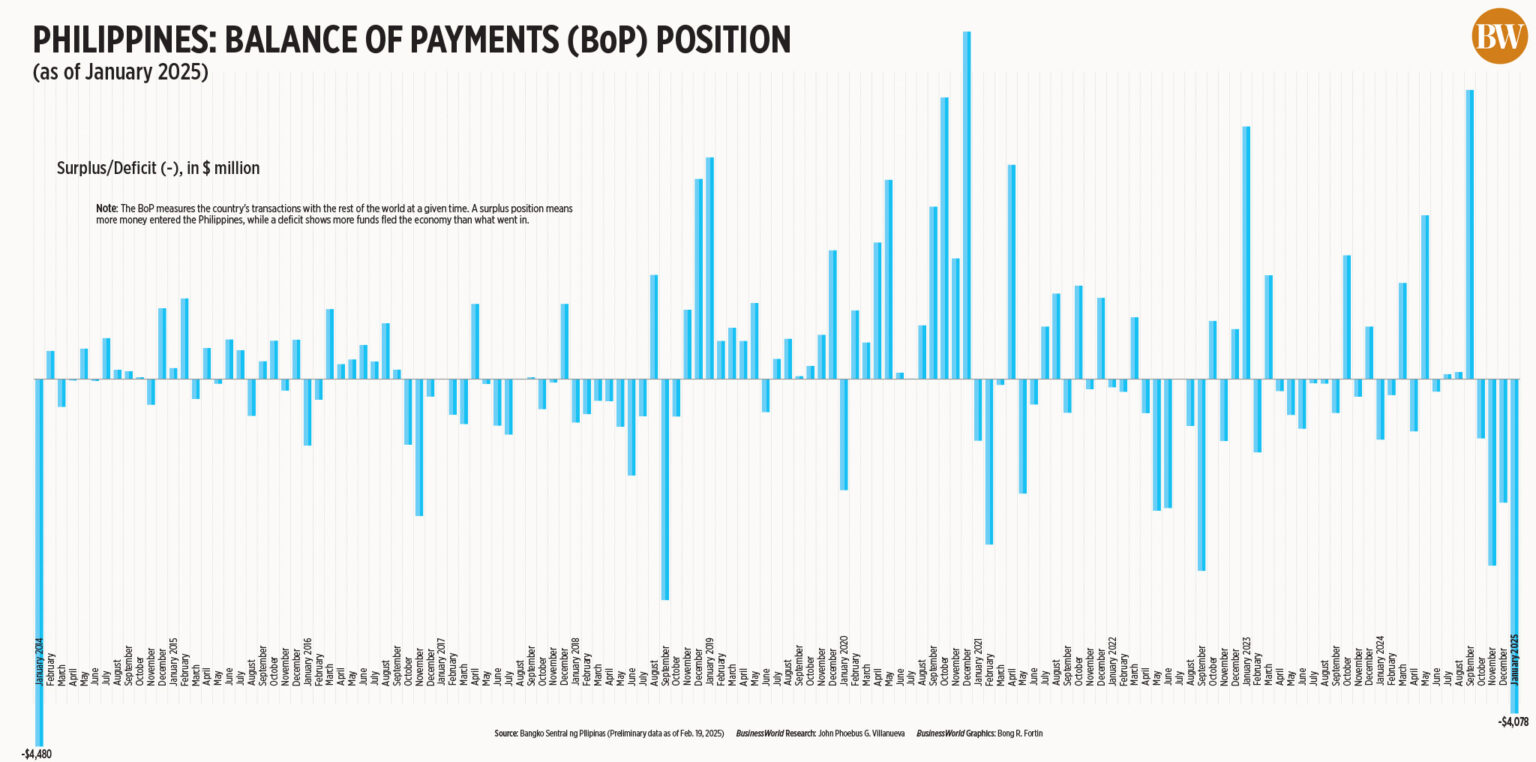

THE PHILIPPINES recorded its most significant balance of payments (BoP) deficit in January in over ten years, according to preliminary data from the Bangko Sentral ng Pilipinas (BSP).

The BoP deficit reached $4.1 billion in January, surging from the $740-million shortfall in the same month last year.

It was also nearly three times the $1.5-billion deficit reported in December.

This represented the broadest BoP deficit in 11 years, or since the $4.48-billion deficiency in January 2014.

The BoP outlines the nation’s transactions with the global community. A deficit indicates that more capital exited the nation, while a surplus indicates that more funds entered.

“The BoP deficit in January 2025 resulted from the BSP’s net foreign exchange activities and withdrawals by the National Government (NG) from its foreign currency reserves with the BSP to fulfill its external debt responsibilities,” the central bank stated.

Recent figures from the Bureau of the Treasury revealed that the NG’s total debt surged to P16.05 trillion at the conclusion of 2024, marking a 9.8% increase from P14.62 trillion at the end of 2023.

Previous BSP data indicated that the nation’s external debt reached a record of $139.64 billion as of the end of September. This escalated the external debt-to-GDP ratio to 30.6% by the conclusion of the third quarter.

The external debt service burden soared by 14% to $15.735 billion during the 11-month period, as per the latest central bank findings.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., noted that the expanded BoP deficit was also influenced by the recent volatility of the peso.

The peso depreciated to P58.365 by the end of January, weakening by 52 centavos from the P57.845 close at the end of December.

“The BoP deficit for January is mainly attributed to interest and debt repayments, which can also be viewed as foreign exchange intervention by the central bank to stabilize the Philippine peso against the US dollar,” remarked Oikonomia Advisory and Research, Inc. economist Reinielle Matt M. Erece.

“This necessitates substantial withdrawals from the nation’s cash reserves to fulfill its obligations and meet its targets,” he added.

As of its end-January status, the BoP indicates a gross international reserve (GIR) total of $103.3 billion, a 2.8% decline from $106.3 billion as of the end of 2024.

Mr. Ricafort stated that the relatively higher GIR provided “better cushioning for the peso exchange rate against the US dollar.”

This was bolstered by the “ongoing growth in the country’s structural US dollar inflows, particularly from overseas Filipino worker remittances, business process outsourcing earnings, foreign tourism revenues, and foreign investments, among others.”

Despite the drop, the dollar reserves are sufficient to cover 7.3 months’ worth of goods imports and payments for services and primary income.

The reserves can also accommodate roughly 3.7 times the nation’s short-term external debt based on residual maturity.

Looking ahead, the BoP position may improve due to the NG’s latest global bond issuance, Mr. Ricafort commented.

The Philippines secured $3.3 billion from the sale of dual-tranche US-dollar global bonds, along with a euro sustainability bond, in late January.

In 2024, the nation’s overall BoP position recorded a surplus of $609 million, a decrease of 83.4% from the $3.672-billion surplus at the end of 2023.

This year, the BSP anticipates a $2.1-billion surplus position, equating to 0.4% of economic output.