By Justine Irish D. Tabile, Reporter

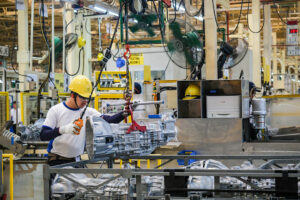

THE PHILIPPINE administration is finalizing an incentive scheme aimed at motivating automotive manufacturers to enhance their production activities in the nation, as stated by the Office of the Special Assistant to the President for Investment and Economic Affairs (OSAPIEA).

OSAPIEA head Frederick D. Go mentioned that the government would soon launch the Revitalizing the Automotive Industry for Competitiveness Enhancement (RACE) initiative.

“The former administration initiated the Comprehensive Automotive Resurgence Strategy (CARS) program, which has concluded, but we intend to keep advocating for the automotive sector,” he informed journalists on Monday.

Mr. Go indicated that the RACE initiative would offer incentives to companies that produce new vehicle models domestically.

This program will be managed by the Department of Trade and Industry (DTI), in contrast to CARS, which was set up through an executive order.

“We crafted RACE as a departmental initiative,” Mr. Go stated, highlighting that funding has been designated for the program through the 2025 General Appropriations Act.

The RACE program has been allocated P250 million as part of DTI’s budget for domestically financed projects.

Established through Executive Order No. 182 by former President Benigno S. Aquino III, the CARS initiative aimed to entice fresh investments in the automobile sector.

It allocated three positions for automotive manufacturers, which were mandated to generate at least 200,000 units of a registered model to qualify for the incentives.

Nevertheless, only two slots were occupied — Toyota Motor Philippines Corp. (TMP), which assembles the Vios sedan, and Mitsubishi Motors Philippines Corp. (MMPC), which produces the Mirage hatchback and Mirage G4 sedan.

Mr. Go suggested that the RACE program could accommodate more than three participants.

“We have gained insights from CARS… The (RACE) initiative is somewhat different, but the goal remains to increase local components in the vehicle to qualify for the (incentives),” he added.

With the new initiative underway, TMP and MMPC are once again anticipated to enroll new models under RACE.

“We have conveyed to DTI our intention to register the Next Generation Tamaraw as an additional CARS model if regulatory support is provided (CARS extension), especially regarding reasonable flexibility for new production models,” TMP indicated in a statement.

“Should the DTI develop a new CARS-like program instead of extending the current initiative, we would happily seize that opportunity to enhance the sustainability of the Tamaraw for us automotive manufacturers, as well as our component producers and even body builders,” it added.

TMP has recently invested P5.5 billion in its Laguna facility to boost vehicle output and enhance both local and outsourced component productions, alongside establishing a new conversion plant.

In a recent visit to President Ferdinand R. Marcos, Jr., Mitsubishi Motors Corp. (MMC) pledged a P7-billion investment in the Philippines over the next five years.

The investment strategy is reported to encompass a new production model at its Laguna facility, according to the Presidential Communications Office (PCO). PCO stated that MMC would participate in the RACE program.

Meanwhile, the Philippine Parts Maker Association, Inc. (PPMA) urged the government to establish a favorable environment for automotive manufacturing and assembly, so the Philippines could remain competitive with its ASEAN counterparts.

“The moment for action is now. Without immediate measures… the Philippines risks falling further behind its ASEAN rivals,” the group remarked in a statement on Monday.

“The necessity to adapt and progress in the automotive sector is paramount. More decisive actions are crucial to cultivate a sustainable and competitive automotive industry in the Philippines,” it added.

Data from the ASEAN Automotive Federation revealed that the Philippines produced 116,650 motor vehicles within the first 11 months of 2024, positioning it fifth in terms of output volume among six ASEAN nations.

Thailand led in car production, reaching 1.36 million units from January to November, followed by Indonesia (885,516), Malaysia (725,173), and Vietnam (157,115).

“Our sector is in jeopardy. We must swiftly implement initiatives to rejuvenate our auto parts manufacturing capabilities, or we will persist in lagging behind our ASEAN neighbors,” stated PPMA President Ferdinand I. Raquelsantos.

“The DTI plays a vital role in this scenario, promoting initiatives that can not only sustain but also improve the automotive parts manufacturing sector is essential,” he added.

Previously, the PPMA indicated that the government could bolster the industry by imposing a 30% local content requirement for vehicles assembled in the Philippines and granting incentives, such as income tax holidays and duty exemptions on raw materials.

It also suggested tax credits for exports, accelerated depreciation for machinery, and enhanced research and development deductions.