By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION might have accelerated in December due to rising costs of food and utilities, although the overall annual inflation is expected to remain within the 2-4% target range, analysts indicated.

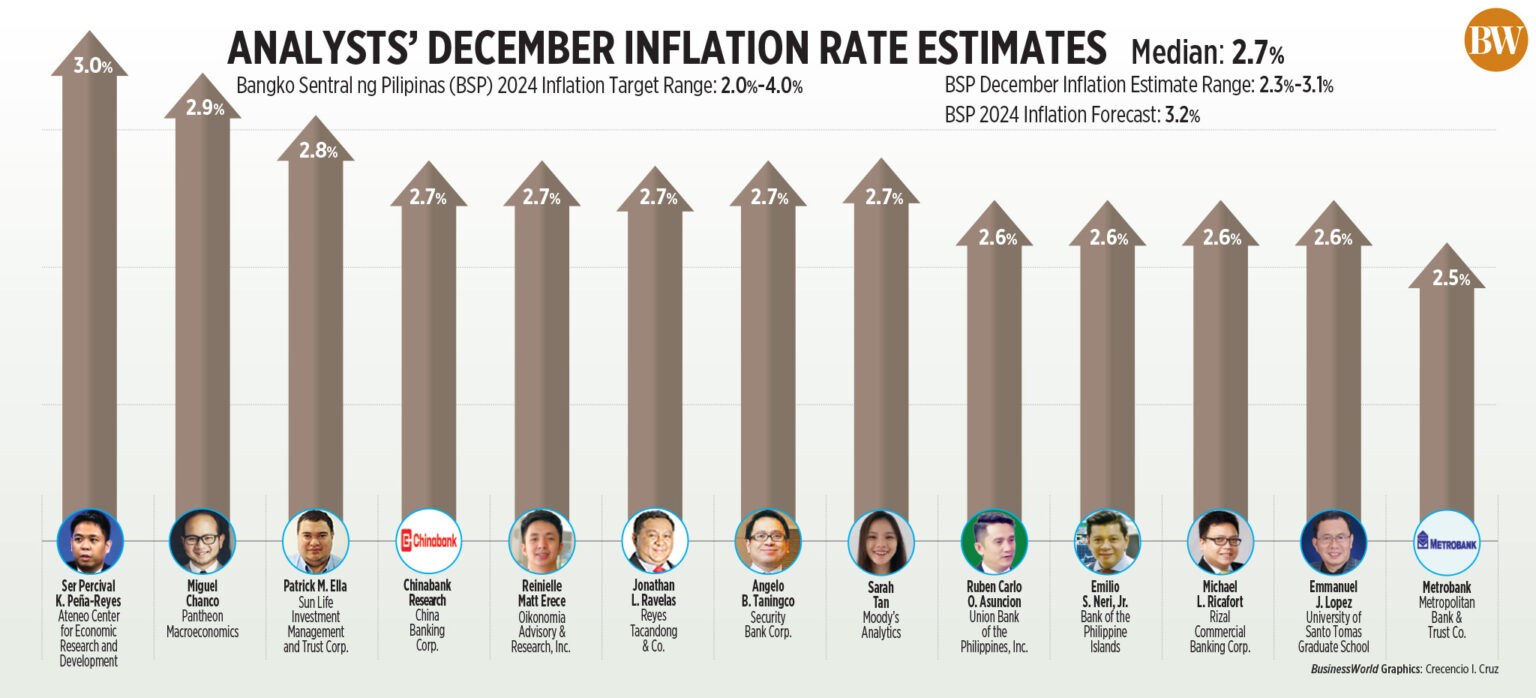

A BusinessWorld survey involving 13 analysts produced a median prediction of 2.7% for the consumer price index (CPI) in December.

This is aligned with the 2.3%-3.1% projection set by the Bangko Sentral ng Pilipinas (BSP) for the month.

Should this prediction hold true, December inflation would surpass the 2.5% recorded in November, yet would be slower than the 3.9% noted in the equivalent month of 2023.

Furthermore, December would signify the third consecutive month of monthly inflation acceleration.

The Philippine Statistics Authority (PSA) is scheduled to unveil December and full-year inflation statistics on January 7.

“Our estimate indicates that inflation rose to 2.7% in December from 2.5% in the prior month, likely resulting in a full-year inflation rate of 3.2% for 2024,” stated Chinabank Research.

“We project inflation to rise 2.7% year on year in December, resulting in a full-year inflation rate of 3.2%,” articulated Sarah Tan, an economist from Moody’s Analytics.

Angelo B. Taningco, Vice-President and Head of Research Division at Security Bank Corp., indicated that food inflation would likely remain the primary factor influencing the total CPI in December.

“The increase from November’s 2.5% will be spurred by heightened price pressures in the food and electricity sectors,” Ms. Tan noted.

She elaborated that this was a consequence of the devastation wrought by typhoons that impacted the nation from late October through November.

“These storms occurred following the usual peak typhoon period, which lasted until October. Lowland vegetables and rice were among the crops most severely affected as the typhoons traversed crucial agricultural zones,” she explained.

“The overall effect on food production will persist, influencing December’s inflation results,” she added.

According to the Philippine Atmospheric, Geophysical, and Astronomical Services Administration, six typhoons entered the Philippines’ Area of Responsibility in November.

“We observed rising prices for select key food items, including vegetables and fish, along with increases in electricity tariffs and the costs of LPG and petroleum,” Chinabank Research reported.

Mr. Taningco mentioned that increases in electricity fees and fuel prices may have also played a role in the December inflation figures.

In December, fuel price adjustments yielded a net increase of P1.40 per liter for gasoline and P1.45 per liter for diesel. Conversely, kerosene prices showed a net decrease of P0.80 per liter.

Furthermore, Manila Electric Co. (Meralco) raised the overall rate by P0.1048 per kilowatt-hour (kWh) to P11.9617 per kWh in December, up from P11.8569 in November.

Oikonomia Advisory & Research, Inc. economist Reinielle Matt Erece also highlighted the effect of holiday expenditures on December inflation.

“The minor increase in December CPI might stem from seasonal demand, particularly for the wide range of food items, notably ‘noche buena’ delicacies, which typically experience cyclical upticks,” stated Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc.

FULL-YEAR WITHIN TARGET

Despite the acceleration of inflation in December, full-year inflation is anticipated to firmly remain within the 2-4% target.

“We remain optimistic that in spite of this uptick, the full-year inflation will hover around 3.2%, still within the BSP’s targets,” indicated Mr. Erece.

The BSP predicts that inflation will average 3.2% in 2024.

Moreover, it anticipates inflation to stay within the target from 2025 to 2026, with baseline and risk-adjusted forecasts for both years expected to remain in the 2-4% range.

“Looking forward, we foresee inflation persisting within the BSP’s 2-4% target range, backed by reduced tariffs on rice imports,” Chinabank Research remarked.

“The average inflation for 2024 is projected at the midpoint of the BSP’s inflation target, with expectations of slower inflation at 3% for 2025,” Mr. Asuncion stated.

This would facilitate continued monetary easing in 2025, he further noted.

“In the forthcoming months, inflation could sustain at around 2% levels through early 2025, comfortably within the BSP’s inflation target range of 2-4%, which might justify additional BSP rate reductions,” claimed Michael L. Ricafort, Chief Economist at Rizal Commercial Banking Corp.

According to Mr. Taningco, the central bank is likely to adopt a “gradual pace” for rate cuts.

In 2024, the BSP has implemented a total of 75 basis points (bps) in rate reductions since initiating its easing cycle in August.

“We anticipate that monetary policy easing will persist into 2025, although the BSP will remain cautious in monitoring global developments that could rejuvenate inflation and weaken the peso’s value,” Ms. Tan remarked.

In 2024, the peso checked in at a record low of P59 on three occasions (November 21, November 26, and December 19) as the dollar surged due to expectations of slower rate cuts by the US Federal Reserve, amidst inflation worries.

Patrick M. Ella, an economist at Sun Life Investment Management and Trust Corp., projected a total of 75 bps worth of rate cuts in increments of 25 bps for 2025.

“We are currently considering three cuts for the BSP (75 bps), rather than our prior forecast of four cuts (100 bps). We do not foresee them aligning with the Fed but rather responding to domestic data developments,” he stated.

The central bank is likely to continue reducing rates incrementally, as it is still cautiously observing potential upward risks to inflation, he added.

RISKS

Analysts also pointed out risks that could postpone the BSP’s rate-cutting schedule.

“For starters, the potential for tariffs from the US looms large, alongside the likelihood that global interest rate normalization will decelerate. These factors will influence the BSP’s decision to further loosen monetary policy (in 2025),” stated Ms. Tan.

“Nonetheless, there are upward risks on the horizon, particularly concerning the unpredictable effects of the Trump administration on local inflation, including remittances from overseas Filipino workers (OFWs) (in 2025),” remarked Mr. Asuncion.

Mr. Erece further emphasized the need to consider the actions of the US Federal Reserve.

“This inflation print being consistent with their targets while the necessity to boost economic growth may signal to the central bank to persist with their monetary policy easing,” he stated.

“However, it is paramount for the BSP to closely observe the Fed’s position alongside its own monetary strategies.”

The Fed made significant rate cuts in September, November, and December, but in their latest meeting indicated fewer rate cuts are expected in 2025.

“There’s a possibility that the Fed may shift to a hawkish approach as inflation remains persistent, particularly if Trump proceeds with his economic reforms such as tariff increases, leading to fewer rate cuts,” cautioned Mr. Erece.

“This could trigger further strengthening of the US dollar’s value and may compel the BSP to reassess its monetary policy easing trajectory to prevent rapid depreciation of the peso through limited or smaller rate cuts,” he added.