As we enter 2025, it’s essential to adopt a calculated and analytical perspective on what lies ahead for Bitcoin. By considering on-chain metrics, market cycles, macroeconomic indicators, and additional factors for alignment, we can transcend mere conjecture to create a data-informed forecast for the upcoming months.

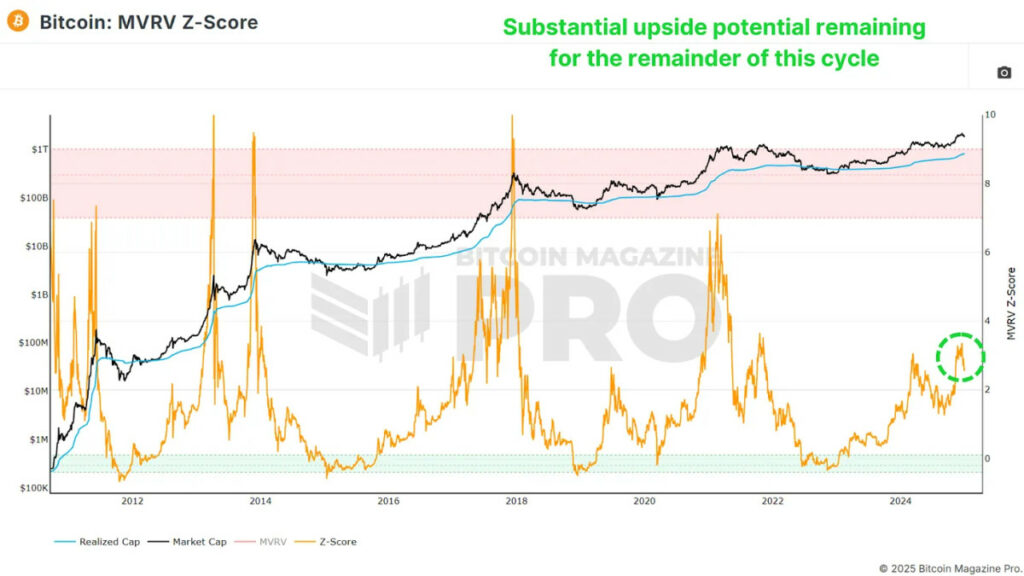

MVRV Z-Score: Significant Upward Potential

The MVRV Z-Score evaluates the relationship between Bitcoin’s realized price (the average purchase price of all BTC within the network) and its market capitalization. Normalizing this ratio for volatility gives us the Z-Score, which has historically provided a lucid understanding of market phases.

At present, the MVRV Z-Score implies we have substantial upward potential. While past cycles have witnessed the Z-Score surpassing values of 7, I believe that any figure above 6 signifies overextension, necessitating a closer examination of additional metrics to pinpoint a market peak. Currently, we are at levels similar to May 2017, when Bitcoin was worth merely a few thousand dollars. Considering the historical context, there exists potential for gains in the multiple hundreds of percent from our current standing.

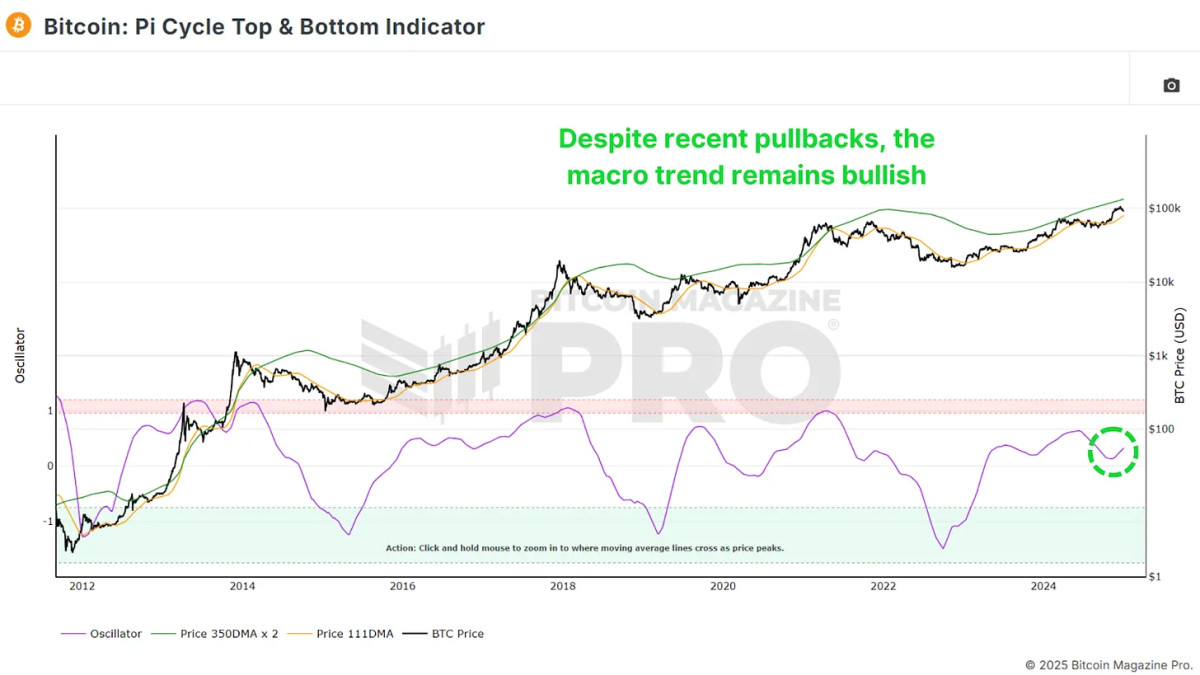

The Pi Cycle Oscillator: Bullish Momentum Resurfaces

An additional key metric is the Pi Cycle Top and Bottom indicator, which monitors the 111-day and 350-day moving averages (the latter multiplied by 2). Traditionally, when these averages intersect, it frequently indicates a Bitcoin price peak imminent within a few days.

The gap between these two moving averages has begun to ascend once more, indicating a resurgence of bullish momentum. While 2024 experienced phases of sideways movement, the current breakout suggests that Bitcoin may be entering a phase of heightened growth, likely extending over the next several months.

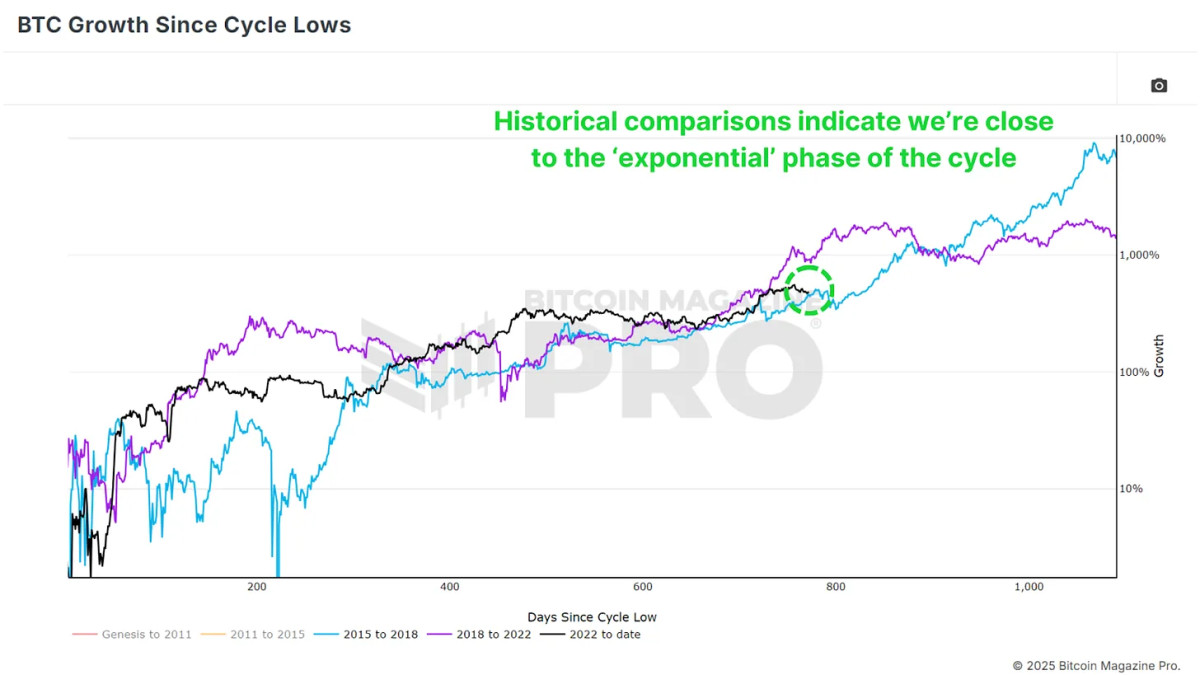

The Exponential Phase of the Cycle

For context, breaking the previous all-time high of $20,000 during the 2020 cycle resulted in a peak approaching $70,000—a 3.5x surge. Should we witness even a conservative 2x or 3x increase from the last peak of $70,000, Bitcoin could potentially reach $140,000–$210,000 in this cycle.

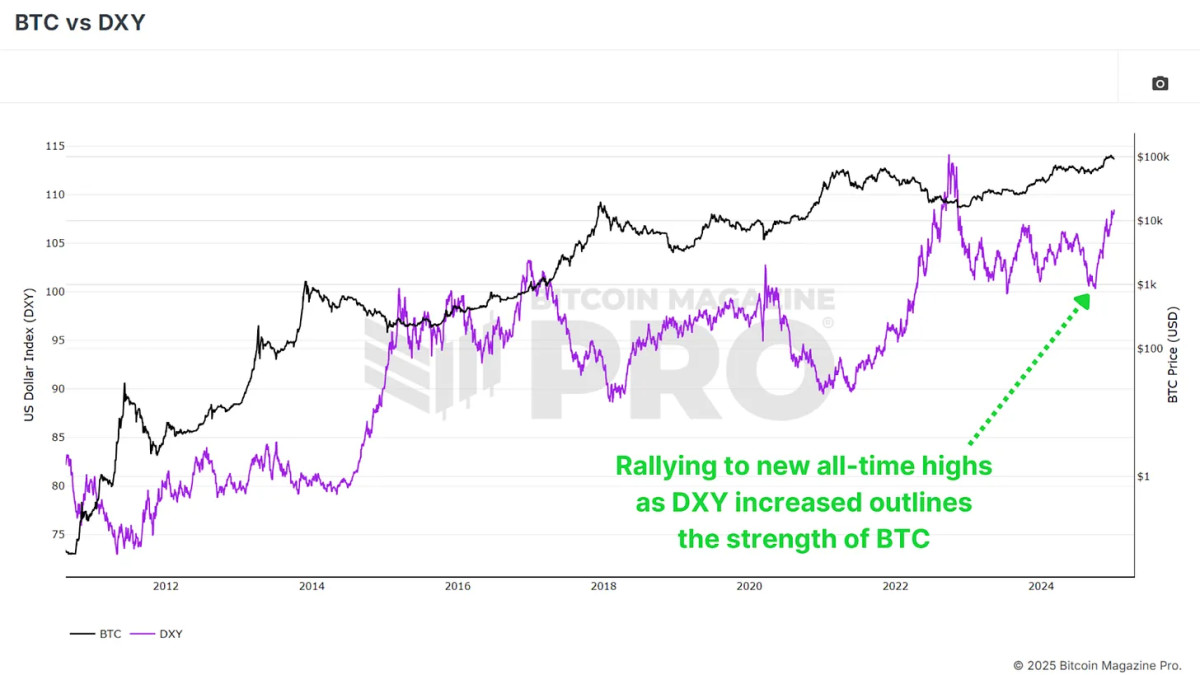

Macro Factors Enhancing BTC in 2025

Despite challenges in 2024, Bitcoin exhibited strong performance, even amidst a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY have moved inversely; thus, any downturn in the DXY’s strength could further propel Bitcoin’s upside.

Additional macroeconomic indicators, such as high-yield credit cycles and the global M2 money supply, indicate improving conditions for Bitcoin. The contraction in the money supply observed in 2024 is anticipated to reverse in 2025, establishing a more favorable environment.

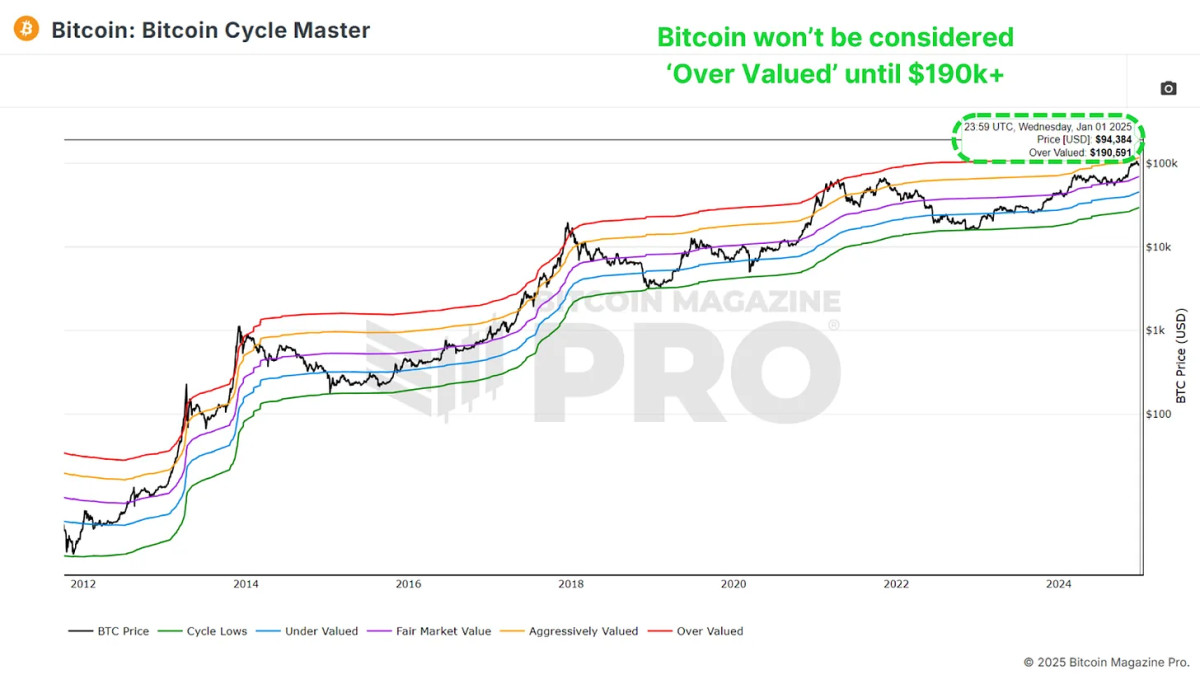

Cycle Master Chart: A Long Journey Ahead

The Bitcoin Cycle Master Chart, which consolidates various on-chain valuation metrics, illustrates that Bitcoin still possesses ample room for growth before it reaches overvaluation. The upper boundary, currently hovering around $190,000, continues to ascend, bolstering the outlook for enduring upward momentum.

Conclusion

At this moment, nearly all indicators are aligned for a bullish 2025. As always, past results do not ensure future outcomes; however, the data strongly indicates that Bitcoin’s finest days may still be forthcoming, even after a remarkably positive 2024.

For a more comprehensive exploration of this subject, take a look at a recent YouTube video here: Bitcoin 2025 – A Data Driven Outlook

For more nuanced Bitcoin analysis and to gain access to advanced features like live charts, customized indicator notifications, and extensive industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes solely and should not be construed as financial guidance. Always perform your own investigation before making any investment choices.