As we enter 2025, it’s essential to adopt a calculated and analytical perspective on what lies ahead for Bitcoin. By considering on-chain metrics, market cycles, macroeconomic indicators, and additional factors for alignment, we can transcend mere conjecture to create a data-informed forecast for the upcoming months.

MVRV Z-Score: Significant Upward Potential

The MVRV Z-Score evaluates the relationship between Bitcoin’s realized price (the average purchase price of all BTC within the network) and its market capitalization. Normalizing this ratio for volatility gives us the Z-Score, which has historically provided a lucid understanding of market phases.

At present, the MVRV Z-Score implies we have substantial upward potential. While past cycles have witnessed the Z-Score surpassing values of 7, I believe that any figure above 6 signifies overextension, necessitating a closer examination of additional metrics to pinpoint a market peak. Currently, we are at levels similar to May 2017, when Bitcoin was worth merely a few thousand dollars. Considering the historical context, there exists potential for gains in the multiple hundreds of percent from our current standing.

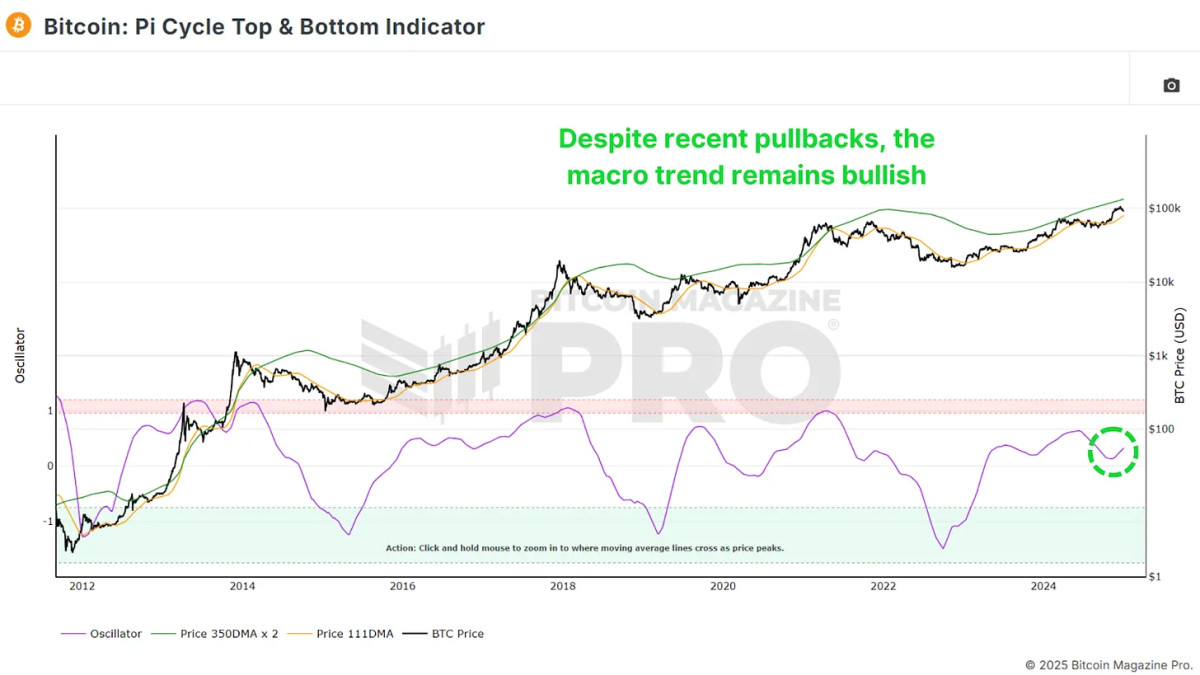

The Pi Cycle Oscillator: Bullish Momentum Resurfaces

An additional key metric is the Pi Cycle Top and Bottom indicator, which monitors the 111-day and 350-day moving averages (the latter multiplied by 2). Traditionally, when these averages intersect, it frequently indicates a Bitcoin price peak imminent within a few days.

The gap between these two moving averages has begun to ascend once more, indicating a resurgence of bullish momentum. While 2024 experienced phases of sideways movement, the current breakout suggests that Bitcoin may be entering a phase of heightened growth, likely extending over the next several months.

The Exponential Phase of the Cycle

According to previous cycles, we are approaching this breakout juncture. Although lower returns are anticipated in comparison to earlier cycles, substantial gains could still be attainable.

For context, breaking the previous all-time high of $20,000 during the 2020 cycle resulted in a peak approaching $70,000—a 3.5x surge. Should we witness even a conservative 2x or 3x increase from the last peak of $70,000, Bitcoin could potentially reach $140,000–$210,000 in this cycle.

Macro Factors Enhancing BTC in 2025

Despite challenges in 2024, Bitcoin exhibited strong performance, even amidst a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY have moved inversely; thus, any downturn in the DXY’s strength could further propel Bitcoin’s upside.

Additional macroeconomic indicators, such as high-yield credit cycles and the global M2 money supply, indicate improving conditions for Bitcoin. The contraction in the money supply observed in 2024 is anticipated to reverse in 2025, establishing a more favorable environment.

Cycle Master Chart: A Long Journey Ahead

The Bitcoin Cycle Master Chart, which consolidates various on-chain valuation metrics, illustrates that Bitcoin still possesses ample room for growth before it reaches overvaluation. The upper boundary, currently hovering around $190,000, continues to ascend, bolstering the outlook for enduring upward momentum.

Conclusion

At this moment, nearly all indicators are aligned for a bullish 2025. As always, past results do not ensure future outcomes; however, the data strongly indicates that Bitcoin’s finest days may still be forthcoming, even after a remarkably positive 2024.

For a more comprehensive exploration of this subject, take a look at a recent YouTube video here: Bitcoin 2025 – A Data Driven Outlook

For more nuanced Bitcoin analysis and to gain access to advanced features like live charts, customized indicator notifications, and extensive industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes solely and should not be construed as financial guidance. Always perform your own investigation before making any investment choices.