By Luisa Maria Jacinta C. Jocson, Reporter

HEADLINE INFLATION remained stable in January as decreased utility expenses countered a surge in food costs, preliminary information from the Philippine Statistics Authority (PSA) indicated.

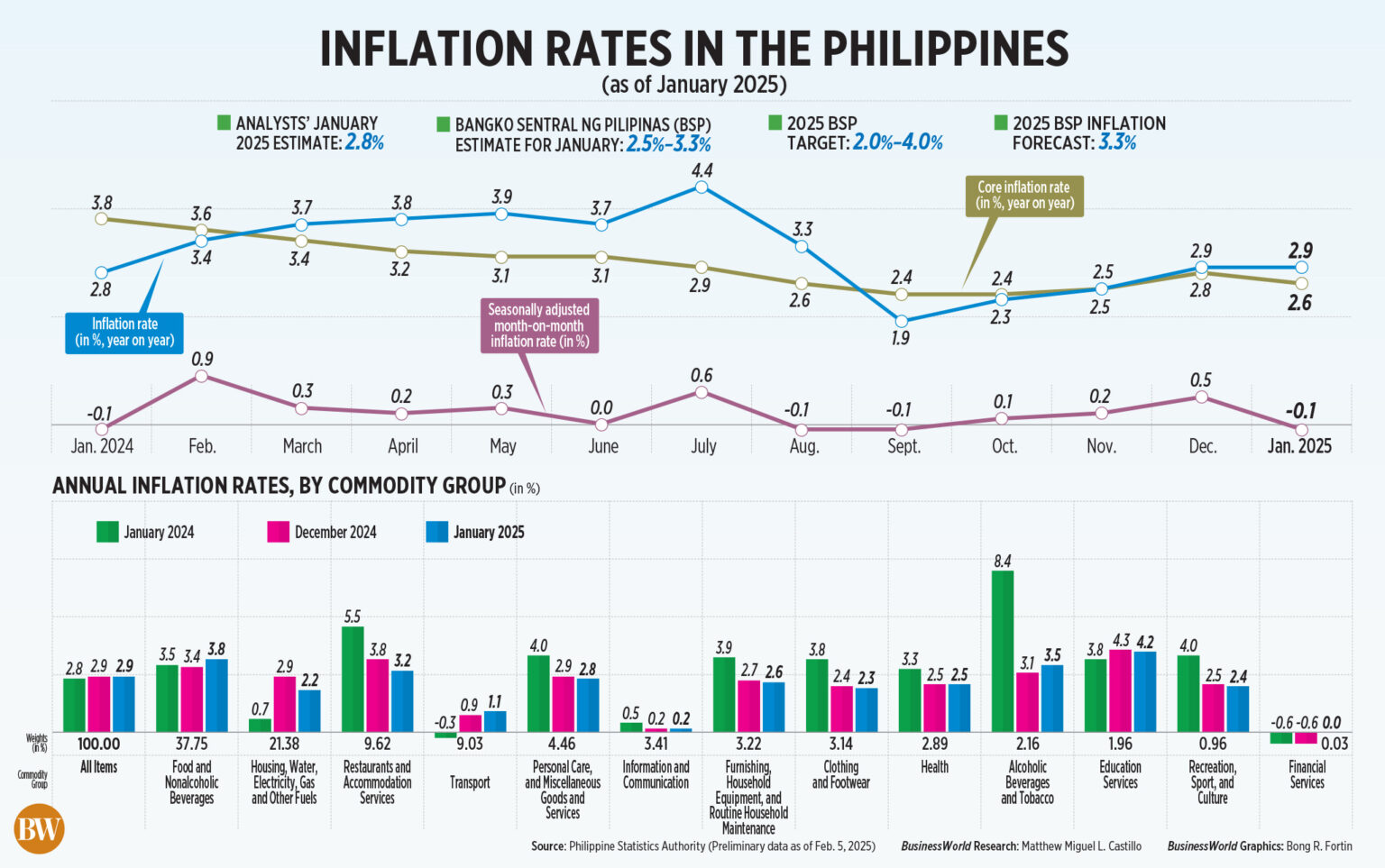

The consumer price index (CPI) increased by 2.9% year over year in January, unchanged from December. It also aligned with the 2.5%-3.3% projection from the Bangko Sentral ng Pilipinas (BSP).

The January figure was notably above the 2.8% median prediction in a BusinessWorld survey of 16 analysts.

“The recent inflation result is in line with the BSP’s evaluation that inflation will remain anchored within the target range throughout the policy horizon,” the central bank stated.

Core inflation, which excludes fluctuating prices of food and fuel, registered at 2.6% for the month — slower than the 2.8% noted in December and 3.8% a year prior.

The heavily weighted food and nonalcoholic beverage index remained the largest contributor to the overall CPI in January, making up a 50.3% share, noted National Statistician Claire Dennis S. Mapa.

The index accelerated to 3.8% in January from 3.4% in the previous month and 3.5% in the same month last year.

Food inflation alone increased to 4% from 3.5% in December and 3.3% in 2024.

Vegetables, tubers, plantains, cooking bananas, and pulses surged to 21.1% in January from 14.2% in December and the 20.8% drop reported the previous year.

Specifically, tomato prices exhibited a much higher annual growth rate of 155.7% compared to 120.8% the month prior, which constituted 0.4 percentage points (ppt) or 12.4% of January inflation.

Mr. Mapa mentioned that the rise in vegetable prices partly reflected the effects of typhoons.

Numerous storms struck the nation in the fourth quarter, causing billions of pesos in agricultural losses.

The increase in prices of meat and other parts of slaughtered land animals rose to 6.4% from 4.9% month-to-month. Meat of pigs rose to 8.4% from 5.1%, while poultry prices increased to 8.4% from 7.7%.

Mr. Mapa attributed the higher pork prices to occurrences of African Swine Fever (ASF) in several areas.

Information from the Bureau of Animal Industry indicated that about 88 municipalities across 19 provinces had active ASF incidents.

Meanwhile, fish and other seafood also accelerated to 3.3% from 1% the prior month.

RICE DOWNTREND

Conversely, rice inflation decreased to 2.3% in January from the 0.8% rate in December and a 22.6% increase a year earlier.

This was also the lowest since the -2.8% rice inflation figure in June 2020. It marked the first instance of rice showing a contraction since the -0.1% in December 2021.

“In light of the current price trend, it is anticipated that at least until July, we will experience negative inflation for rice,” Mr. Mapa added.

In January, the average cost of regular milled rice fell to P48.25 per kilogram from P49.65 the previous year. Well-milled rice decreased to P54.14 from P54.91, while special rice dipped to P63.13 from P63.90 year on year.

The Agriculture department on Monday announced a food security emergency regarding rice, which has remained stubbornly elevated despite tariff reductions. This declaration allows the National Food Authority to release buffer stocks at subsidized rates to help reduce the cost of this essential grain.

“Any measure to lower rice prices is always advantageous for our Filipino consumers, as rice carries a significant weight in our CPI basket,” Mr. Mapa noted.

Meanwhile, the PSA indicated that the housing, water, electricity, gas, and other fuels index was also a major contributor to inflation, decreasing to 2.2% in January from 2.9% in December. However, it rose from the 0.7% figure a year ago.

Manila Electric Co. reduced the overall rate by P0.2189 per kilowatt-hour (kWh) to P11.7428 per kWh in January, down from P11.9617 per kWh in December.

Data from the PSA revealed that rental inflation slowed to 2% from 2.4% in December, while water supply inflation eased to 6.2% from 6.8%.

There was an increase in water rates in January. Manila Water Co. raised prices by P5.95 per cubic meter, while Maynilad Water Services, Inc. increased rates by P7.32 per cubic meter.

Transport inflation also slightly rose to 1.1% from 0.9% in December and the 0.3% decline a year earlier.

In January, adjustments in fuel prices resulted in a net increase of P2.65 per liter for gasoline, P4.80 per liter for diesel, and P3.80 per liter for kerosene.

Data from the PSA showed that inflation for the lowest 30% of income households softened to 2.4% in January from 2.5% the previous month and 3.6% from the previous year.

Consumer prices in the National Capital Region (NCR) declined to 2.8% in January from 3.1% in December. Outside NCR, inflation remained at 2.9%, identical to the previous month.

The central bank indicated that inflation is expected to ease further in the upcoming months.

“The reduction in rice tariffs and negative base effects are anticipated to support disinflation,” it remarked.

Nevertheless, the BSP acknowledged that risks to the inflation forecast continue to trend upward, pointing to “possible increases in transport fares and electricity costs.”

“The influence of lower import tariffs on rice continues to represent the main downside risk to inflation… However, uncertainties in the external environment might dampen economic activity and market sentiment,” it added.

National Economic and Development Authority Secretary Arsenio M. Balisacan stated that the government is actively addressing food inflation as it remains “one of the government’s highest priorities.”

He mentioned that the government is executing interventions to alleviate the effects of La Niña and ramping up vaccinations against ASF, among other measures, to help control inflation.

DOWNSIDE RISKS

Meanwhile, HSBC economist for ASEAN Aris D. Dacanay noted that the risks to the inflation outlook are skewed to the downside, citing tariff reductions, the recent announcement of a food security emergency, as well as the enforcement of a maximum suggested retail price for rice.

Analysts are anticipating that the Monetary Board will reduce rates at its initial policy review of the year next week.

Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. stated that the likelihood of a BSP rate cut on February 13 has increased as inflation provides room for relief.

“Despite the slight surprise on the upside, we expect the BSP to continue to loosen the monetary reins to foster support for domestic demand,” Mr. Dacanay remarked.

HSBC anticipates that the Monetary Board will reduce rates by 25 basis points during the February 13 meeting.

“Inflation is still within the lower-bound range of the BSP’s 2-4% target band, which permits the central bank to adjust its focus towards growth,” Mr. Dacanay stated.

The unexpectedly weak GDP data might also “prompt the central bank to prioritize growth,” Mr. Neri added.

The Philippine economy expanded by a slower-than-anticipated 5.2% in the fourth quarter, culminating in a full-year 2024 growth of 5.6%. This fell below the government’s 6-6.5% objective.

Mr. Neri mentioned that the central bank will probably factor in the currency in its upcoming policy determination.

“The peso could experience pressure if the Federal Reserve maintains interest rates unchanged for an extended period. The BSP seems receptive to USD/PHP increasing as long as inflation stays within the target,” he stated.

Nonetheless, Mr. Neri remarked that more easing this year is improbable to be vigorous.

“Still, we believe the potential for reductions this year remains restricted. In addition to interest-differential induced portfolio outflows, the substantial current account deficit makes the economy more susceptible to escalating external shocks, such as global trade conflicts.”

BSP Governor Eli M. Remolona, Jr. has indicated the potential for 50 bps of rate reductions this year, noting that 75 bps or 100 bps might be “excessive.”

This could be executed in increments of 25 bps each in the first and second halves of the year, he further elaborated.

However, the BSP leader has stated that a rate reduction is still an option for the Feb. 13 assembly.

“Aggressively lowering the policy rate could heighten this vulnerability and place unmanageable stress on the peso. Thus, we persist in anticipating a total of 50 bps in RRP rate cuts this year, which will adjust the policy rate to 5.25% by year’s end,” Mr. Neri concluded.

The central bank commenced its easing cycle in August last year, reducing borrowing expenses by a cumulative 75 bps by the end of 2024. It implemented three consecutive rate cuts, lowering the benchmark to 5.75%.

REBASING

In the meantime, the PSA announced it will revise the base year of price indices to 2023 from 2018 beginning January 2026.

“We are planning to rebase it to 2023 and the technical team is already conducting the preparatory activities,” Mr. Mapa stated.

“I think next year, not this year. We are rebasing for both GDP and inflation rate, both for 2023,” he added.

The PSA periodically updates the CPI to ensure that the CPI market basket reflects goods and services typically purchased by households over time, revise spending patterns, and align its base year with that of GDP and other indices.

The rebasing is also in line with a PSA Board Resolution that approved the synchronized rebasing of price indices to base year 2006 and every six years thereafter.

“Currently, we are reviewing the commodity items from the latest family income and expenditures survey. We might adjust the weights of these commodity items,” Mr. Mapa said in a mix of English and Filipino.

The PSA modifies the weights of these items according to consumption, he noted.

“Secondly, we also examine items that are new in 2023 compared to 2018. There’s a commodity and outlet survey where we visit outlets to determine where consumers purchase typical commodities,” Mr. Mapa explained.

“When a report on inflation is generated, there are around 500,000 items collected nationwide by the PSA. It requires significant time to compile and acquire all this information,” he added.

The PSA sanctioned the CPI rebasing to 2018 from 2012, which became effective in 2022.