“`html

By Vonn Andrei E. Villamiel

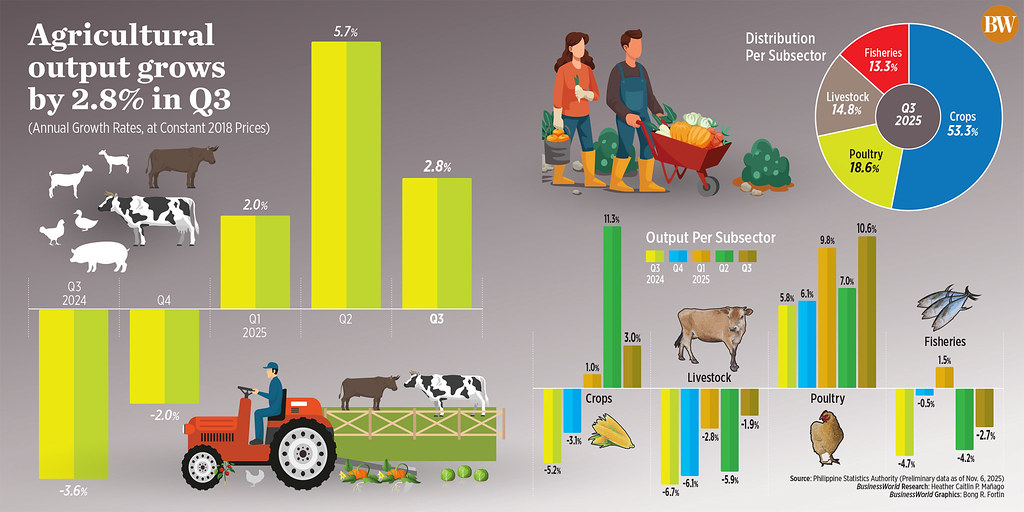

THE PHILIPPINES’ agricultural output rose by 2.8% in the third quarter, as robust crop yields and poultry production compensated for the drop in livestock and fisheries, the Philippine Statistics Authority (PSA) reported.

Data from the PSA revealed that the worth of agriculture and fisheries output surged by 2.8% to P408.94 billion in the July-to-September span, marking a recovery from the 3.6% decrease in the same timeframe last year.

Quarter over quarter, the growth in agricultural output decelerated from the eight-year peak of 5.7%.

“This increase was fueled by the rise in the worth of crop and poultry production. Nonetheless, the value of livestock and fisheries output contracted during the timeframe,” the PSA noted, referencing consistent 2018 prices.

At current price levels, the value of production in agriculture and fisheries reached P533.16 billion, lower than the preceding quarter’s output of P606.86 billion.

In the initial nine months, agricultural output averaged 3.5%, a recovery from the -2.2% in the corresponding period last year.

Agriculture Secretary Francisco P. Tiu Laurel, Jr. informed journalists that the agriculture sector is “moving in the right direction.” He showed optimism that the sector will rebound from the previous year’s 2.2% decline, which highlighted the effects of El Niño and several typhoons.

Crop output, contributing 53.3% of the total agricultural production value, surged by 3% to P218 billion in the third quarter. This marked a rebound from the 5.2% decline experienced in the same quarter last year.

During the initial nine months, growth in crop production averaged 5%, improving from the 4.7% decrease in the prior year.

Former Agriculture Secretary William D. Dar communicated to BusinessWorld via Viber that crop production increased in the third quarter despite challenging weather conditions due to an “expansion in rice hectarage, recovery in production capacity, and distribution of agricultural inputs and machinery.”

Palay (unmilled rice) production increased by 12.6%, bouncing back from the 12.3% contraction a year earlier. This output surge was supported by a 15.7% increase in the area planted with rice.

Palay output grew by an average of 8.3% in the January-to-September period, a recovery from the 7.7% decline recorded last year.

PSA data indicated that corn production fell by 2.9%, worse than last year’s 0.6% drop for the same period.

Coconut experienced a decrease of 2.1%, an improvement from a 3.5% drop in the previous year.

Crops with significant increases in output value included onion (77.3%), potato (47.8%), sugarcane (42.0%), coffee (25.9%), mongo (16.9%), tobacco (15.7%), and cabbage (13.3%).

Conversely, the production value contracted for abaca (15.4%) and sweet potato (11.4%).

Meanwhile, the poultry sector expanded by 10.6% annually to P75.96 billion in the third quarter, notwithstanding the risk of avian influenza. It represented 18.6% of total farm production during this period.

In the first nine months, poultry production experienced an average growth of 9.1%, an improvement from the 6.8% growth observed in the same duration last year.

Chicken production saw an annual increase of 12.4% in value, while chicken eggs and ducks registered 7.7% and 0.6% growth, respectively.

Duck eggs, however, fell by 4.3% this quarter, slightly better than a 5.7% decrease in the same timeframe last year.

“Poultry is anticipated to continue its growth due to the presence of multinational companies involved in poultry production, possessing the financial capability to address biosecurity challenges,” Danilo V. Fausto, president of the Philippine Chamber of Agriculture and Food, Inc. (PCAFI), mentioned to BusinessWorld via Viber.

LIVESTOCK, FISHERIES DECLINE

Meanwhile, the value of livestock production decreased by 1.9% in the third quarter, a slight improvement from the 6.7% decline a year ago. It contributed P60.51 billion, making up 14.8% of the total agricultural production value.

From January to September, livestock production fell by 3.5%, unchanged from the previous year.

Dairy was the sole bright spot in the livestock sector, showcasing a notable 34.7% increase in output from 13.2% the year before.

The hog sector saw a decrease of 1.4%, improving from the 8% drop reported last year.

Carabao recorded the largest drop in production value at 9%, succeeded by goat at 7.7%. Cattle also faced a decline of 2.7%.

Mr. Dar further remarked on the necessity for interventions to combat the spread of African Swine Fever (ASF), which continues to impact the hog sector.

“We require a collective societal approach to establish enduring and systematic measures to prevent the spread of ASF. The use of a well-researched and developed vaccine against ASF undergoing biosafety evaluations is essential,” Mr. Dar stated.

Conversely, fisheries production fell by 2.7% to P54.47 billion in the third quarter, representing 13.3% of the total output. This reflected a slight improvement from the 4.7% decline in the third quarter of 2024.

For the initial nine months, fisheries output decreased by 1.9%, more severe than last year’s 0.8% drop.

Significant declines were noted for cavalla (talakitok, 20.3%), Bali sardinella (tamban, 13.3%), tiger prawn (sugpo, 11.6%), and P. Vannamei (10.8%).

The value of seaweed production likewise dropped by 15.7% in the third quarter.

Substantial declines were also recorded for milkfish (bangus, 9.7%), mudcrab (alimango, 9.1%), slipmouth (sapsap, 7.4%), threadfin bream (bisugo, 6.7%), and roundscad (galunggong, 5.6%).

Notable growth was observed for bigeye tuna (tambakol/bariles, 52.8%), squid (22.6%), and skipjack (gulyasan, 15.9%).

More modest increases were recorded for grouper (lapu-lapu, 4.9%), tilapia (3.1%), yellowfin tuna (tambakol/bariles, 2.4%), frigate tuna (tulingan, 1.2%), and blue crab (alimasag, 1.2%).

Aside from extreme weather phenomena, the closure of fishing seasons in certain areas due to the degradation of fishery ecosystems and habitats likely contributed to the decline, as mentioned by Mr. Dar.

“We are a nation of islands where fisheries are regarded as a competitive advantage of the country. Greater attention should be directed towards the fisheries sector to incorporate interventions in hatchery and fingerling production, cold chain and storage, ice plants, and supply logistics,” PCAFI’s Mr. Fausto emphasized.

Source link

“`