“`html

THE NATIONAL GOVERNMENT’S (NG) budgetary position shifted to a surplus in April, as an increase in tax income balanced the reduction in state expenditures, the Bureau of the Treasury (BTr) reported on Tuesday.

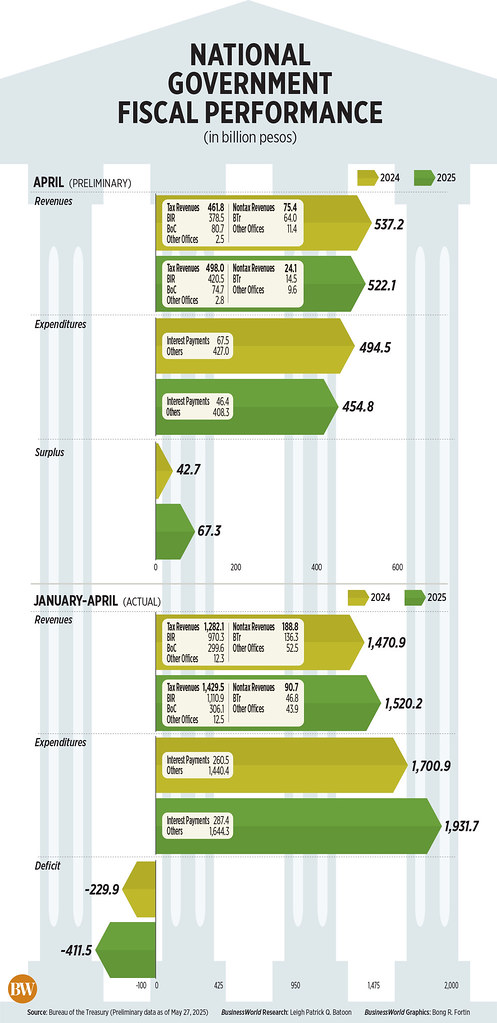

Figures from the Treasury indicated a P67.3-billion surplus in April, contrasting with the P375.73-billion deficit in March.

The surplus was also 57.51% greater than the P42.7-billion surplus recorded in April 2024.

The surplus was also 57.51% greater than the P42.7-billion surplus recorded in April 2024.

This marked the first budget surplus since the P68.36-billion surplus in January.

Revenue collections decreased by 2.82% to P522.1 billion in April from P537.2 billion in the same month last year, “primarily due to the timing of nontax revenues.”

Nontax revenues plunged by 68.08% to P24.1 billion in April from P75.4 billion in April 2024.

“This is because most government-owned and -controlled corporations (GOCCs) have yet to remit dividends, unlike the same period last year,” it noted.

BTr revenues fell by 77.42% to P14.5 billion in April, while other offices experienced a 15.64% drop to P9.6 billion.

Last week, the Department of Finance indicated that state-run entities had remitted P76 billion in dividends to the Treasury as of May.

In contrast, tax revenues rose by 7.84% to P498 billion in April from P461.8 billion in the same month in 2024.

The majority of tax revenue originated from the Bureau of Internal Revenue (BIR), whose collections increased by 11.1% to P420.5 billion in April compared to P378.5 billion a year prior.

“This robust performance was fueled by enhanced collections from corporate income tax (CIT), value-added tax (VAT), and personal income tax (PIT),” BTr stated, noting that the annual tax filing deadline was April 15.

Improvements in personal income tax and VAT collections were attributed to BIR’s initiatives to simplify tax filing through digital services, it added.

“The increase in VAT collections was also bolstered by the Bureau’s crackdown on fraudulent receipts and its sustained campaign against illicit trading,” the BTr mentioned.

The Bureau of Customs reported a revenue decline of 7.48% to P74.7 billion in April from P80.7 billion a year prior.

“This is partly due to the reduced working days for the month and the effects of lower import volumes amidst global trade difficulties,” the Treasury stated.

In April, US President Donald J. Trump declared a baseline 10% tariff on all trading partners, in addition to higher reciprocal tariffs on select nations, including the Philippines. The reciprocal tariffs have been suspended until July.

Conversely, government spending dropped by 8.03% to P454.8 billion in April compared to P494.5 billion in the same month last year.

The BTr attributed the reduction in state expenditures to lowered interest payments and subsidies to government firms, particularly the National Irrigation Administration.

“The timing of the transfer of the capitalization requirement for the Coconut Farmers and Industry Trust Fund also impacted the growth of April spending. Last year, the transfer was executed in April, while this year’s capitalization requirement was disbursed in March,” it noted.

Primary spending — which refers to total expenditures excluding interest payments — decreased by 4.37% to P408.3 billion in April from P427 billion a year earlier.

Interest payments dropped by 31.19% to P46.4 billion in April this year from P67.5 billion in the corresponding month in 2024.

The annual decline in interest payments was credited to the change in the timing of payments for both domestic securities and external loans related to Lenten and Eid’l-Fitr holidays.

“Fundamentally, budget surpluses are anticipated during April each year, coinciding with the tax collection/filing month. The budget surplus could lessen the necessity for additional borrowing/debt by the NG,” stated Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort.

Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc., suggested that the spending decline may be attributed to the election ban on certain public expenditures which began in late March and continued until election day.

“However, this surplus may not persist long as increased government spending is anticipated this year to bolster the economy,” he remarked.

4-MONTH GAP

Simultaneously, the NG’s fiscal deficit expanded to P411.5 billion in the January-to-April timeframe, 78.98% larger than the P229.9-billion deficit a year earlier, as the rate of expenditures surpassed revenues.

The BTr reported that the deficit surged due to the “accelerated growth in public spending aimed at stimulating economic activity and supporting priority programs of the Marcos Jr. administration.”

State expenditures escalated by 13.57% to P1.93 trillion in the first four months compared to P1.7 trillion in the same period last year.

Primary spending rose by 14.16% to P1.64 trillion, while interest payments increased by 10.35% to P287.4 billion.

On the other hand, revenues only edged up by 3.35% to P1.52 trillion in the January-to-April timeframe from P1.47 trillion a year earlier.

Tax revenues, which account for 94.03% of total revenues, went up by 11.49% to P1.43 trillion.

BIR revenues increased by 14.5% to P1.11 trillion in the first four months, driven by the intensified effort against counterfeit receipts, illicit trade, digitized tax submission, and higher excise tax collections.

Customs collections rose slightly by 2.16% to P306.1 billion by the end of April.

Meanwhile, nontax revenues plunged by 51.94% to P90.7 billion in the January-to-April timeframe compared to P188.8 billion a year earlier.

The NG’s deficit ceiling for 2025 is set at P1.54 trillion or 5.3% of gross domestic product. — Aubrey Rose A.Inosante

Source link

“`