By Luisa Maria Jacinta C. Jocson, Senior Reporter

FUNDS SENT BACK home by overseas Filipinos climbed 2.6% in March compared to the previous year, as reported by the Bangko Sentral ng Pilipinas (BSP) on Thursday, although this marked the slowest expansion in nine months.

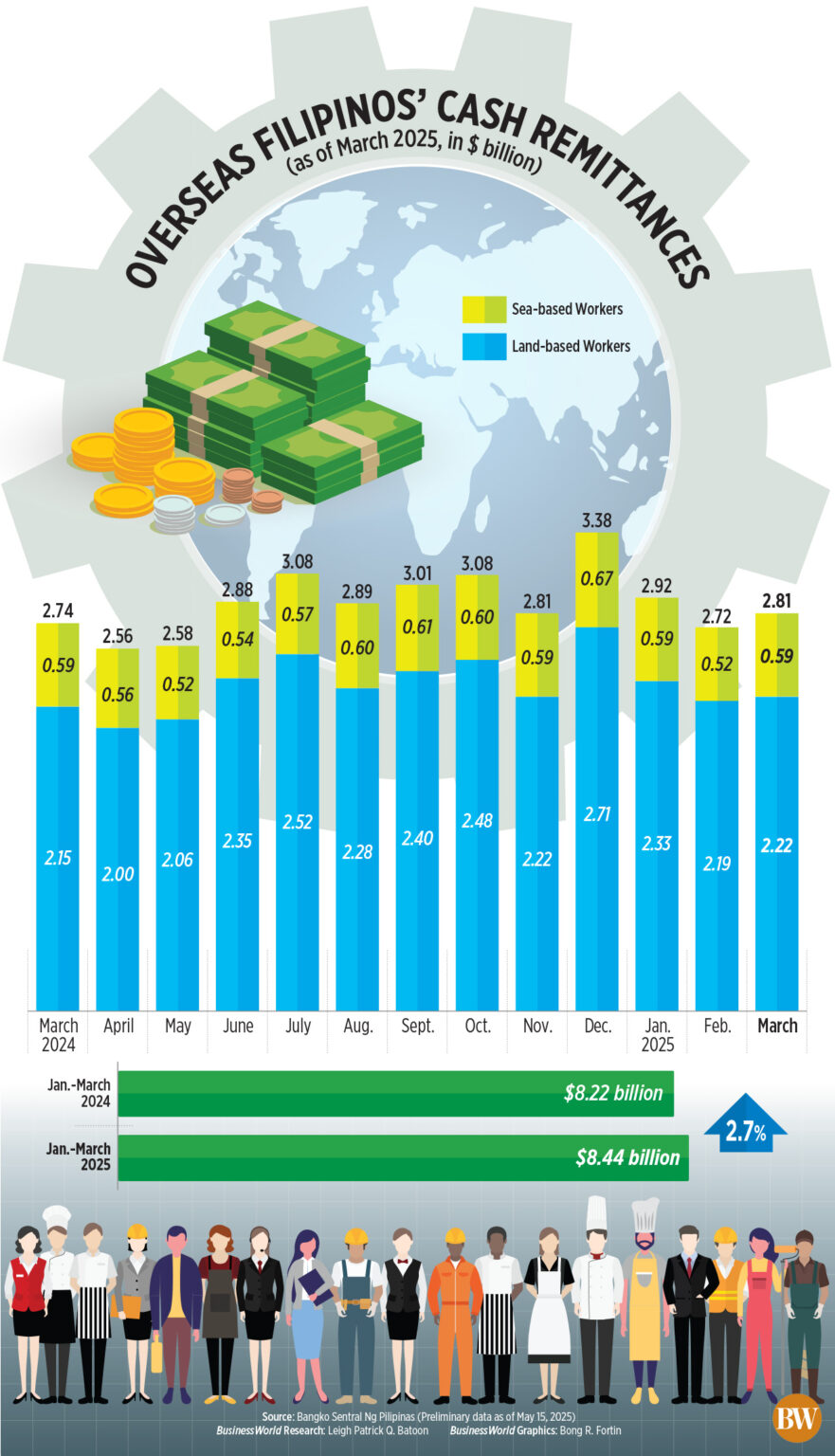

Monetary remittances from overseas Filipino workers (OFW) transmitted through banks reached $2.81 billion (P156.8 billion), up from $2.74 billion a year earlier.

Remittances from land-based employees rose 3.1% to $2.22 billion, whereas funds sent back by sea-based workers grew 1% to $595 million.

In the first quarter, cash remittances increased 2.7% to $8.44 billion compared to the previous year. Funds sent home by land-based workers surged by 3.2% to $6.74 billion, while sea-based workers’ remittances rose 1% to $1.7 billion.

“The increase in cash remittances from the United States, Singapore, Saudi Arabia, and the United Arab Emirates (UAE) was the primary factor behind the overall upsurge in remittances for January to March,” stated the BSP.

The US emerged as the leading source of remittances in the first quarter, contributing 40.7% of the total. This was followed by Singapore (7.6%), Saudi Arabia (6.2%), Japan (4.9%), UAE (4.6%), UK (4.4%), Canada (3.1%), Qatar (2.8%), Taiwan (2.8%), and Hong Kong (2.7%).

“Cash remittances increased in March and the first quarter predominantly due to steady demand for Filipino labor abroad, especially in healthcare, engineering, and domestic services,” remarked John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, in a Viber message.

He also pointed to seasonal influences, such as the Lenten period and educational expenses, which may have stimulated remittances during the quarter.

Michael L. Ricafort, chief economist at Rizal Commercial Banking Corp., mentioned that the sustained single-digit growth in remittances is a “positive aspect for the broader economy, acting as a key growth driver, particularly regarding consumer spending.”

BSP data indicated that personal remittances, which encompass in-kind inflows, rose 2.6% to $3.13 billion in March compared to the previous year.

Personal remittances from workers with contracts of a year or longer escalated 3% to $2.4 billion during the month, while those from workers with shorter contracts increased by 1.4% to $660 million.

For the last quarter, personal remittances climbed 2.7% to $9.4 billion compared to the prior year.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., asserted that remittances this year are expected to grow by 2.5% to 3% despite external challenges. “We foresee remittances as resilient and anticipate continued strong growth.”

The central bank predicts a 2.8% increase in cash remittances this year.

“In spite of global uncertainties, remittances continue to exhibit resilience, acting as a crucial support for household consumption and a safeguard for the nation’s external accounts,” stated Mr. Rivera.

Conversely, Mr. Ricafort highlighted the potential effects of US President Donald J. Trump’s stricter immigration policies on remittance flows.

“In the forthcoming months, protectionist approaches from President Trump, notably tighter immigration regulations, could impact some OFW remittances, particularly from the US,” he commented.

Mr. Trump initiated an assertive immigration campaign upon taking office in January, labeling illegal immigration as an “invasion” to enhance deportations.