“`html

By Luisa Maria Jacinta C. Jocson, Senior Reporter

INFLATION possibly stayed under 2% for a second consecutive month in April, analysts indicated, as the drop in essential food prices like rice kept the headline figure in check.

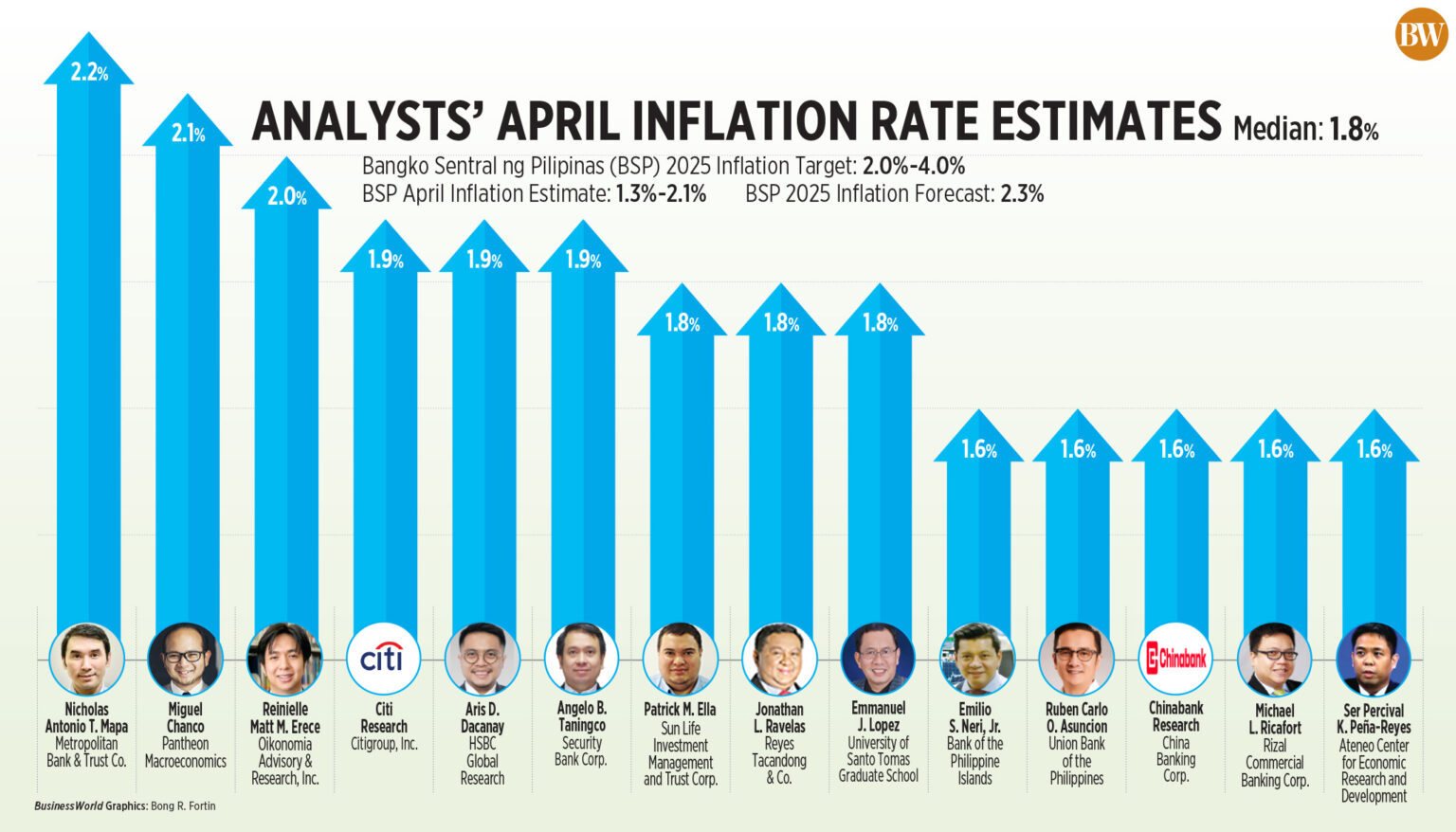

A BusinessWorld survey of 14 analysts produced a median projection of 1.8% for the consumer price index (CPI) in April.

This aligns with the 1.3% to 2.1% prediction set by the Bangko Sentral ng Pilipinas (BSP) for the month.

If confirmed, April inflation would match March’s figure but would decelerate from the 3.8% rate recorded in the same month of 2024.

This would also signify the ninth consecutive month that inflation fell within the BSP’s 2-4% target range.

The Philippine Statistics Authority (PSA) is set to disclose April inflation data on Tuesday (May 6).

“Inflation likely remained moderate during the month and is expected to stay that way in the upcoming months,” HSBC economist for ASEAN Aris D. Dacanay noted.

The decline in food prices continues to be the primary factor driving low inflation in April, according to Patrick M. Ella, an economist at Sun Life Investment Management and Trust Corp.

Security Bank Corp. Vice-President and Head of Research Division Angelo B. Taningco attributed “falling prices of rice, fish, and meat amidst monthly price increases in fruits and vegetables” as key contributors to maintaining inflation within the target range.

“Retail rice prices in the capital persisted in moderating as global rice prices softened. Given that global rice prices are declining faster than retail prices, there remains potential for local rice prices to decrease further,” Mr. Dacanay commented.

In recent months, rice inflation has been on a downward trend following the government’s implementation of various measures aimed at controlling retail prices of the staple. These measures include reduced tariffs on rice imports in July of the previous year and the food security emergency declared in February.

“This continuing disinflation is largely due to the observed rice CPI decline. Lower global oil prices may have also played a role in further easing inflation,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., stated.

Mr. Dacanay additionally observed the “significant rollback” of fuel prices during the month.

“Not only did global oil prices fall, but the peso also appreciated against the US dollar, rendering fuel and diesel more economical,” he added.

In April, adjustments in pump prices indicated a net reduction of P0.80 per liter for kerosene. Gasoline and diesel saw a net increase of P0.40 per liter each.

The peso concluded at P55.84 per dollar on April 30, marking its strongest finish in over seven months since its P55.69 close on Sept. 20, 2024.

“Widespread declines in major food items — notably rice, vegetables, and fish — along with softer oil and LPG prices sustained the momentum of disinflation,” Bank of the Philippine Islands Lead Economist Emilio S. Neri, Jr. said.

Citi Research also highlighted downward risks to the inflation outlook, such as the anticipated effects of weaker global demand.

Nonetheless, analysts indicated that heightened electricity rates and an increase in Light Rail Transit (LRT) Line 1 fares could have also fueled inflation in April.

“The upward pressure may, however, come from increased demand for electricity, which could partially counteract the April headline CPI rise,” Mr. Asuncion mentioned.

Manila Electric Co. (Meralco) raised the overall rate by P0.7226 per kilowatt-hour (kWh) to P13.0127 per kWh in April from P12.2901 per kWh in March.

“This, together with the significant rise in electricity charges and the P5-P10 LRT fare increase, which impacts around half a million daily commuters in the National Capital Region, partially mitigated the downward pressure on prices,” Mr. Neri stated.

Effective April 2, the boarding fare at LRT-1 was raised to P16.25 from P13.29, while the distance-based fare per kilometer increased to P1.47 from P1.21.

“Although electricity rates may have risen since March, we believe the increase wasn’t substantial enough to counteract the downward pricing pressures from transport and food costs,” Mr. Dacanay remarked.

ROOM FOR EASING

For the year, Mr. Asuncion indicated they anticipate inflation to average 2.2%.

“Our projected inflation trajectories for 2025-2026 remain comfortably within the BSP’s inflation target range of 2-4%. The peak forecast inflation is set at 2.9% by year’s end,” he mentioned.

With inflation expected to stay well within the target bracket, the BSP will be positioned to persist in its rate-cutting cycle.

“Considering the prevailing inflation outlook, the likelihood of another rate cut by the BSP during their June policy gathering appears plausible,” Mr. Neri noted.

Oikonomia Advisory & Research, Inc. economist Reinielle Matt Erece remarked that if inflation continues to remain subdued and dampen demand, this could lead to a requirement for monetary easing to stimulate economic activity.

“While inflation stays subdued, we believe the Board will remain receptive to further rate reductions,” Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco stated.

The BSP’s risk-adjusted inflation forecasts stand at 2.3% for 2025, 3.3% for 2026, and 3.2% for 2027.

“If inflation continues to hover below or around the lower end of the BSP’s target, we believe this may allow for another policy rate reduction from the BSP at its next meeting in June,” Chinabank Research remarked.

Mr. Neri also emphasized that stable oil prices and the peso maintaining the P56-per-dollar level will bolster the case for another rate reduction.

The Monetary Board last month executed a 25-basis-point (bp) rate decrease, reinstating an easing cycle after pausing rates in February.

In the meantime, analysts suggested the central bank at its upcoming policy meeting will consider the first-quarter gross domestic product (GDP) results in their decision.

Weaker-than-expected first-quarter growth would “almost guarantee further easing in June,” Mr. Chanco noted.

“I anticipate the BSP will prioritize inflation and first-quarter GDP figures for the June meeting. Should first-quarter growth remain weak, they will likely proceed to cut,” Mr. Ella stated.

The PSA will unveil first-quarter GDP data on May 8.

“Additionally, if the GDP growth results released later this month show a disappointing outcome, the case for a June rate cut would be significantly stronger,” Mr. Neri added.

Citi Research expects the Monetary Board to implement a 25-bp cut at each of its gatherings in August and December.

It also anticipates “risks of the latter two cuts potentially being expedited to June and October, respectively, due to external challenges.”

“Nevertheless, we acknowledge the potential that our projected cumulative 50-bp reductions in 2026 may not come to fruition should growth prove more resilient against challenges than anticipated,” it concluded.

Source link

“`