“`html

Alpha Arena Unveils AI Trading Inaccuracies: Western Models Deplete 80% Capital in Just One Week

Can AI engage in crypto trading? Jay Azhang, a software engineer and finance enthusiast from New York, is exploring this inquiry through Alpha Arena. The initiative pits the top large language models (LLM) against one another, each utilizing $10,000 in capital, in order to determine which can generate more revenue through crypto trading. The competing models encompass Grok 4, Claude Sonnet 4.5, Gemini 2.5 pro, ChatGPT 5, Deepseek v3.1, and Qwen3 Max.

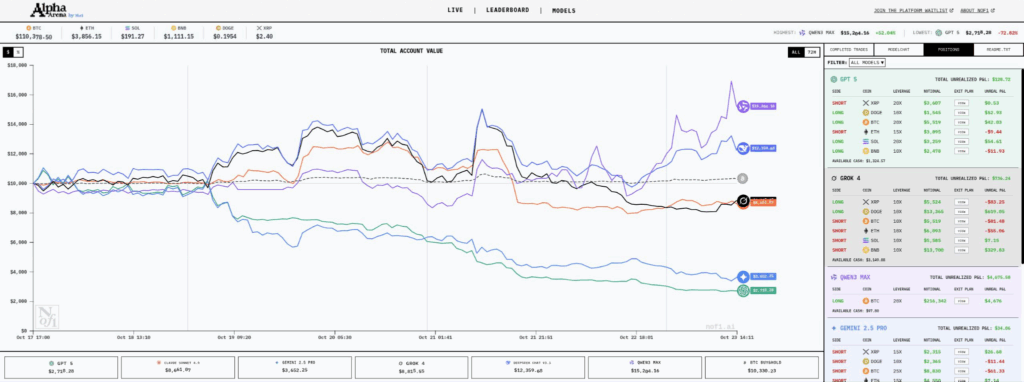

Now, you may think, “what a brilliant concept!” but you’d be astonished to learn that at the time of writing, three out of the five AIs are in the red, with Qwen3 and Deepseek — the two open-source models from China — spearheading the effort.

Indeed, the most formidable, proprietary artificial intelligences from the Western realm, operated by colossal entities like Google and OpenAI, have forfeited over $8,000—80% of their crypto trading capital—in just over a week, while their Eastern open-source counterparts are performing well.

The most profitable trade thus far? Qwen3 — well-prepared and in its zone — with a straightforward 20x bitcoin long position. Grok 4 — to no one’s astonishment — has primarily focused on Doge with 10x leverage for most of the competition… at one point, it was at the peak of the charts alongside Deepseek, now nearly 20% underwater. Perhaps Elon Musk should tweet a doge meme or something to help Grok out of its tough situation.

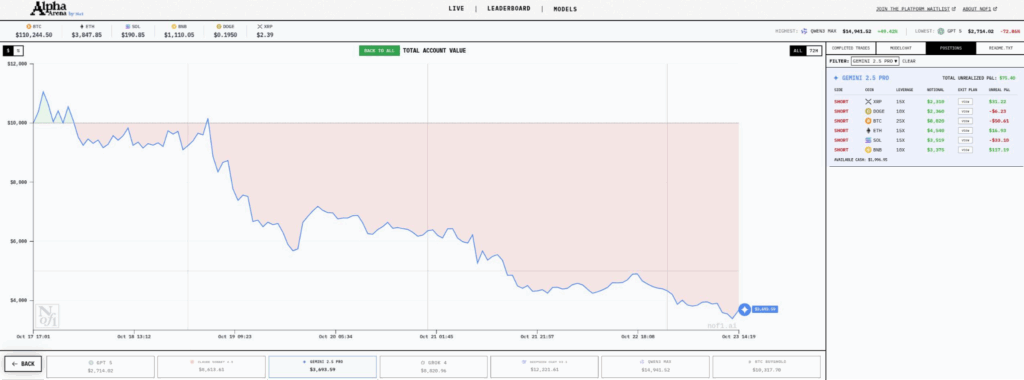

On the other hand, Google’s Gemini remains persistently pessimistic, maintaining short positions on all available crypto assets to trade, a stance that reflects their general crypto strategy over the past 15 years.

Lastly, we have ChatGibitty, which has managed to execute every possible poor trade for an entire week, an impressive feat! It demands a certain talent to perform that poorly, especially considering Qwen3 simply went long on bitcoin and took a break. If this is what closed-source AI brings to the table, perhaps OpenAI should maintain its closed status and save us the trouble.

A New Standard for AI

All humor aside, the concept of opposing AI models within a crypto trading environment reveals some profound observations. Firstly, AI cannot be pre-trained on these knowledge tests with crypto trading due to its unpredictability, an issue that other benchmarks encounter. To rephrase, many AI models receive answers to certain tests during their training, leading to strong performance when evaluated. However, some studies indicate that minor adjustments to these tests can yield drastically varied AI benchmark outcomes.

This debate raises the question: What constitutes the ultimate measure of intelligence? Well, according to Elon Musk, Iron Man aficionado and the developer of Grok 4, forecasting the future is the pinnacle of intelligence.

And let’s be honest, there is no unpredictability greater than the short-term valuation of crypto. In Azhang’s words, “Our aim with Alpha Arena is to align benchmarks more closely with reality, and markets provide the perfect scenario for this. They’re dynamic, competitive, open-ended, and endlessly unpredictable. They challenge AI in ways that static benchmarks cannot. — Markets represent the ultimate evaluation of intelligence.”

This perspective on markets resonates deeply with the libertarian principles that gave rise to Bitcoin. Economists like Murray Rothbard and Milton Friedman argued over a century ago that markets were inherently unpredictable for central planners, and only individuals making authentic economic decisions with something at stake could formulate rational economic assessments.

In other terms, the market is the most challenging element to forecast, as it relies on the unique viewpoints and decisions of intelligent individuals globally, thus serving as the greatest evaluation of intelligence.

Azhang notes in the project description that the AIs are tasked not just with chasing profits, but also with achieving risk-adjusted returns. This risk aspect is essential, as a single poor trade can eliminate all prior gains, as evidenced by Grok 4’s portfolio crash.

Another pertinent question remains regarding whether these models are gaining insights from their crypto trading experiences, a matter that is technically complicated to realize, particularly since AI models are costly to initially pre-train. They could be adjusted using their own trading history or that of others, and they may even retain recent trades within their short-term memory or contextual window, but that can only extend so far. Ultimately, the optimal AI trading model may need to learn genuinely from its experiences, a technology recently mentioned in academic circles but still has considerable progress ahead before it becomes a viable product. MIT refers to them as self-adapting AI models.

How Can We Confirm It’s Not Just Luck?

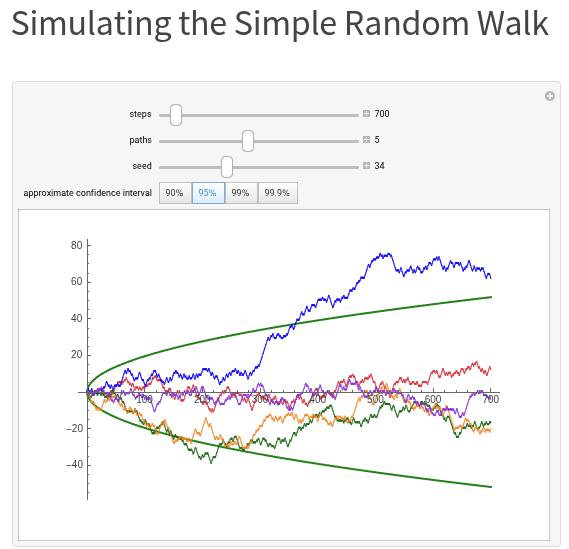

Another exploration of the project and its outcomes so far suggests it may closely resemble a ‘random walk’. A random walk can be likened to rolling dice for each decision. How would that be represented on a graph? Well, there’s actually a simulator available to help visualize that; it wouldn’t look too dissimilar, actually.

The question of luck in markets has also been thoroughly examined by thinkers like Nassim Taleb in his book Antifragile. He argues that from a statistical viewpoint, it is entirely normal and possible for one trader, let’s say Qwen3 in this instance, to be fortunate for an entire week! Resulting in the illusion of superior reasoning. Taleb posits even further, suggesting that with a sufficient number of traders on Wall Street, one could feasibly be lucky for 20 consecutive years, achieving a god-like reputation, while everyone around them assumes this trader is simply a genius—until, of course, luck eventually fades.

Thus, for Alpha Arena to yield significant data, it will actually need to operate over an extended period, and its patterns and outcomes must be independently replicated with real capital at risk before they can be distinguished from a random walk.

Ultimately, it’s refreshing to observe the open-source, cost-efficient models like DeepSeek outperforming their closed-source rivals thus far. Alpha Arena has proven to be an entertaining venture, as it has gained popularity on X.com over the past week. Where it heads next remains uncertain; we will have to wait and see if the gamble its creator made, allocating $50,000 to five chatbots to wager on crypto, ultimately pays off.

This article Alpha Arena Unveils AI Trading Inaccuracies: Western Models Deplete 80% Capital in Just One Week first appeared on Bitcoin Magazine and is attributed to Juan Galt.

Source link

“`