“`html

Credible Crypto, a highly regarded market analyst with 479,900 followers on X, became notably optimistic about XRP in an October 15 video, asserting that the token’s long-term framework “still appears absolutely phenomenal” despite “the most catastrophic and unprecedented liquidation incident in crypto history.” He characterized last Friday’s market-wide collapse—“approximately 10 times larger than the FTX failure”—as a bottom-forming occurrence and indicated that XRP’s crucial support remained intact on closing basis, maintaining his double-digit price forecast.

XRP Aims for Double-Digits

The analyst’s primary assertion is clear: the sharp descent to fresh lows across various platforms did not disrupt XRP’s long-term upward trend. He points out a monthly demand zone between approximately $2.00–$2.40, emphasizing that even post the flash-liquidity rout “we did not witness any 4-hour closes below $2.30,” and that the deeper prints at $1.17 on several exchanges were results of forced liquidations rather than genuine selling.

“Ultimately on the higher time frames, once again it looks excellent,” he remarked, noting that XRP’s previous five-wave surge initiated around ~$0.49; as long as the price stays above the origin of that impulse, he interprets the recent decline as a mid-cycle adjustment rather than a cycle peak. In his words: “This is not the conclusion of the bull run for XRP… we have much further to climb.”

Related Reading

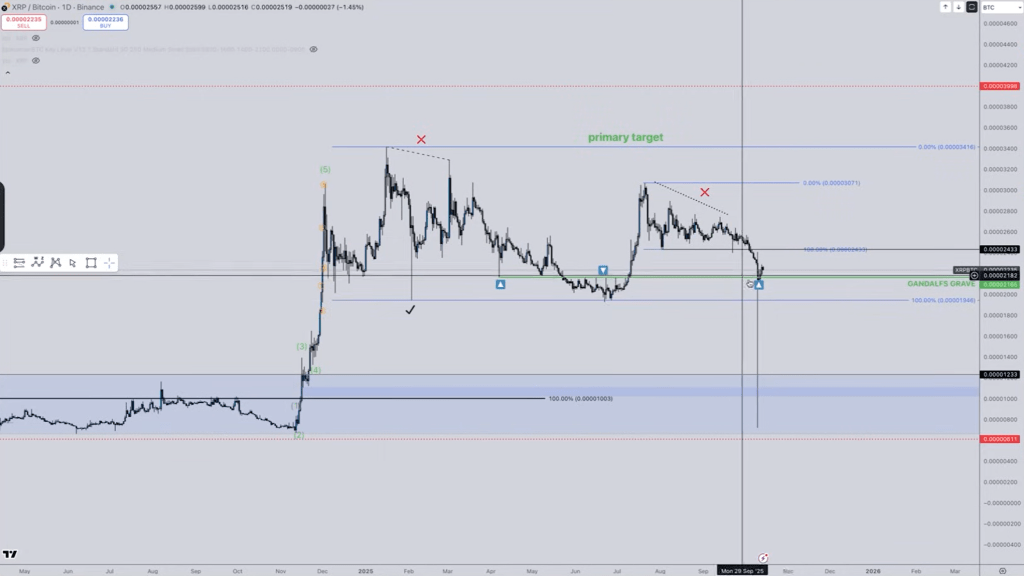

He outlines clear tactical markers. On the USD pair, the initial significant supply area lies around $2.70–$3.11; acceptance beyond that zone would imply the onset of the next wave. On relative pairs, he points out a now-familiar horizontal level he refers to as “Gandalf’s grave” on XRP/BTC—a previous multi-touch resistance that recently shifted to support and was respected on hourly closes even during the downturn.

The path ahead, in his narrative, divides into two equally plausible scenarios. In the first, Bitcoin surges to $130–$150k in a parabolic expansion while XRP trades sideways; this rotational dynamic would drag XRP/BTC lower toward a deeper, long-term demand zone even as XRP/USD maintains a higher base above ~$1.90–$2.30.

In the second scenario, XRP finds stability here and surges earlier, with XRP/BTC launching directly and “the minimum move… a 50% upward move against Bitcoin,” which would position XRP/USD at new all-time peaks. He warns that a gradual decrease in XRP/BTC would be a characteristic, not a flaw: “If you’re not fully invested in XRP, that is when you should get completely loaded,” he advised.

Importantly, Credible Crypto connects the XRP pathway to Ethereum’s upcoming phase. He argues ETH exhibited “one of the most pristine impulsive movements” in years—a complete five-wave surge from ~$2,000 to ~$4,700—then outlined two scenarios.

In scenario one (the more aggressive), that $2,000–$4,700 surge is wave one of a significantly larger sequence towards $10,000+, with the ongoing retracement constituting wave two before a $5k–$6k escalation phase.

Related Reading

In scenario two (less aggressive), ETH is lacking a final wave-five push to new records just above $5k, and afterward would experience a broader, deeper wave-two correction. He even provides a stark invalidation for scenario two: if ETH drops to ~$2,700–$2,800, the overlap with wave-one territory would invalidate it, implicitly supporting scenario one. Regardless, he emphasizes, “sub-$2,000 Ethereum is likely off the table for the remainder of the cycle.”

Why is this significant for XRP? Because if ETH achieves a smooth run to and surpasses $5k first, XRP/ETH will likely fall into a deeper green demand zone before reversing—timing that would align with XRP/USD stabilizing while the ETH phase completes. He regards that as a positive signal, not a drawback: a final dip in XRP/ETH toward higher-time-frame demand would “indicate when we might be seeing favorable risk-reward opportunities for long trades on XRPUSD,” and the longer the base lasts, “the greater the potential expansion.”

Credible Crypto’s strategy for confirmation is clear-cut. On XRP/USD, monitor for an impulsive five-wave thrust off the lows and for clear acceptance above $2.70–$3.11. On XRP/BTC, either a rapid reversal from the “Gandalf’s grave” test or a controlled decline into a deeper, pre-identified demand block that would set up a stronger USD-denominated breakout afterward. On XRP/ETH, a move to the green demand zone would likely align with ETH’s final push past $5k, after which he anticipates the cross to reverse significantly in XRP’s favor.

At the time of writing, XRP was trading at $2.42.

Featured image created with DALL.E, chart from TradingView.com

Source link

“`