“`html

Bitcoin treasury corporations have emerged as one of the most significant demand catalysts in this cycle. Altogether, 86 publicly listed companies now possess over 1 million BTC on their financial statements. What initiated with MSTR (Strategy) in 2020 has since proliferated throughout the corporate arena, with fresh participants appearing seemingly each week. However, a detailed examination of their acquisition history uncovers a surprising revelation: many of these firms could be retaining substantially more Bitcoin today had they adhered to a straightforward, rules-based accumulation strategy.

MSTR Dominates the Current Landscape of Bitcoin Treasury Holdings

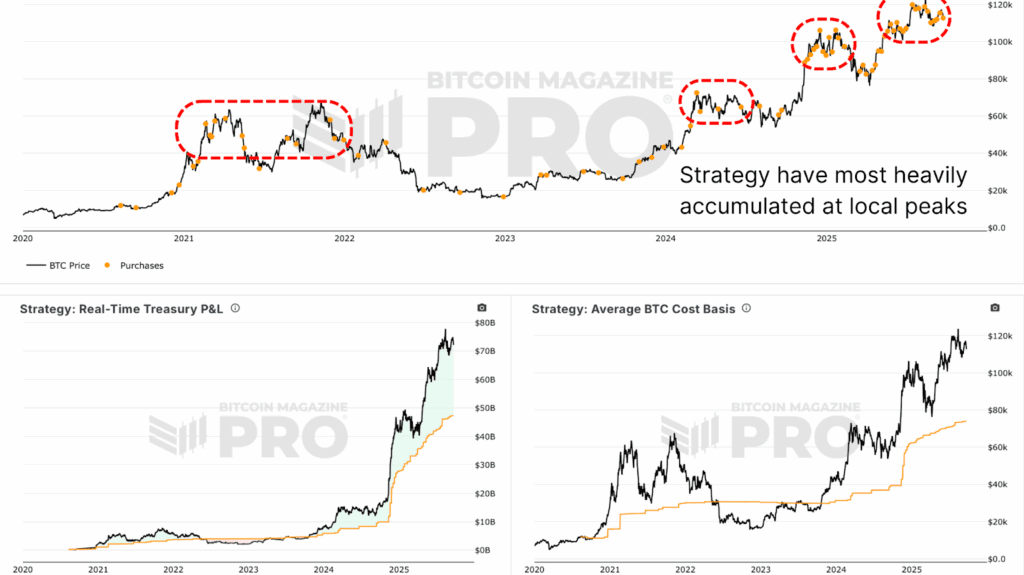

MSTR (Strategy) continues to be the undeniable frontrunner among corporate Bitcoin holders, boasting nearly 640,000 BTC. Across all Leading Public Bitcoin Treasury Companies, more than 1 million BTC is now securely stored, a circumstance that permanently diminishes liquid supply and bolsters Bitcoin’s monetary premium (assuming, naturally, they never divest!) Although this has been a tremendous net advantage for Bitcoin’s supply-demand dynamics, the data indicates that a significant portion of these acquisitions happened during overheated market climates, especially at local peaks.

MSTR’s Case: Acquiring at the Peaks in Bitcoin Cycles

Consider MSTR’s (Strategy) activities as an illustration. The organization made some of its largest investments during late 2024, as Bitcoin soared past $70,000 following ETF approvals. This was hardly uncommon, as the broader treasury sector exhibited the same tendency of front-loading acquisitions during euphoric times.

While this is understandable (capital is most easily raised when prices are climbing and optimism is high), the outcome is that treasury companies frequently tend to overpay. In reality, backtesting indicates that waiting for even slight pullbacks could have saved firms 10–30% on average compared to their actual entry points. Certainly, no one possesses a crystal ball to foresee price movements, but at the very least, avoiding purchases immediately following exponential percentage increases in a matter of weeks would likely be advantageous!

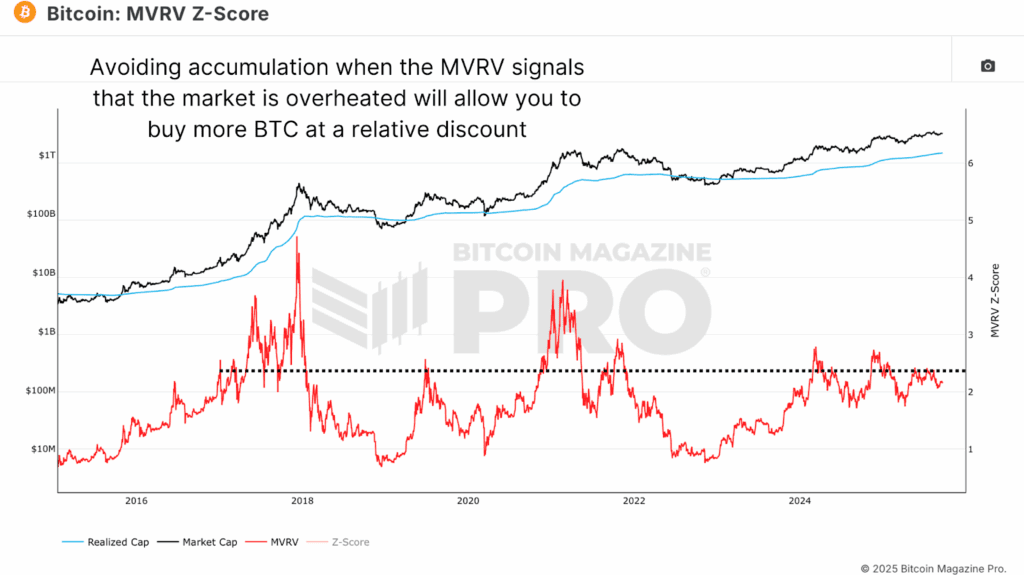

A Straightforward MVRV Data-Driven Solution for MSTR and Treasuries

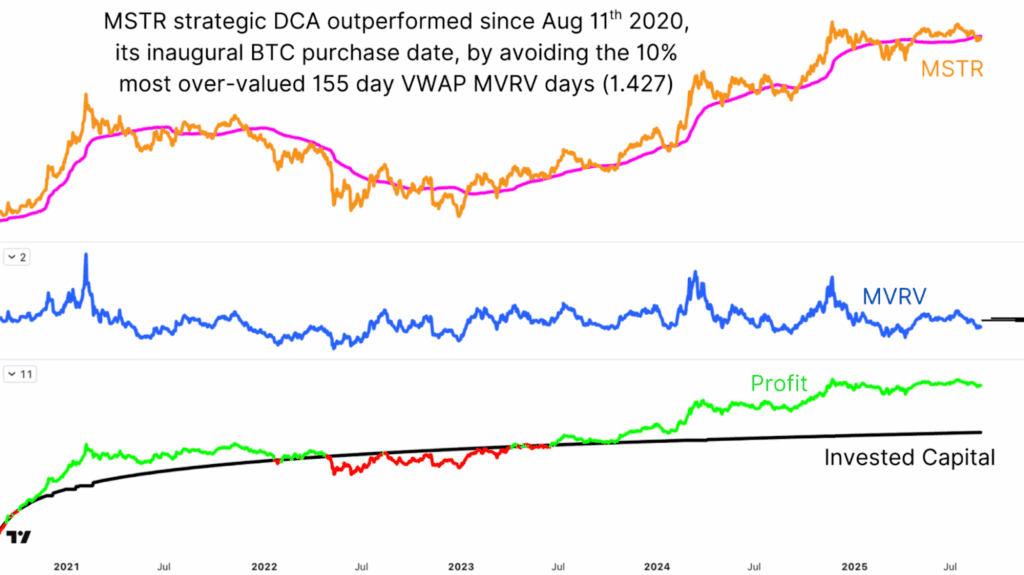

One simple modification could have led to a significant impact: employing the MVRV Ratio as a parameter. This method is not intricate. It doesn’t aim to pinpoint exact bottoms, nor does it depend on subjective evaluation. Rather, it utilizes a rolling MVRV percentile threshold to refrain from investing during the most exuberant phases of bullish markets.

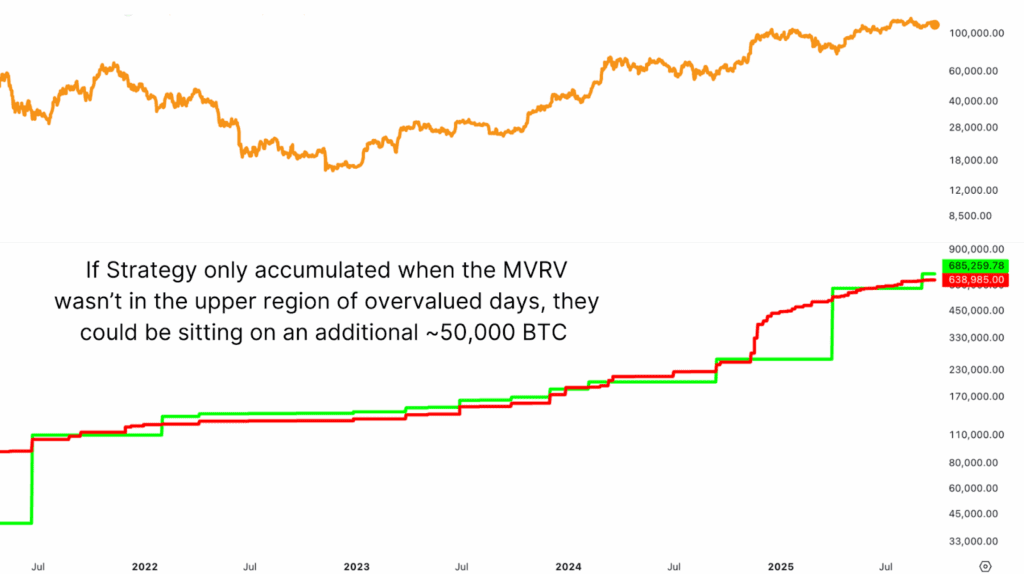

By steering clear of acquisitions when the MVRV ratio was in its top 20% of historical metrics (an indicator of overvaluation) and simply allocating that capital during cooler periods, MSTR (Strategy) alone

“““html

would possess nearly 685,000 BTC presently, almost 50,000 BTC surpassing its existing holdings.

Based on current valuations, that translates to over $5 billion in extra Bitcoin. To contextualize, the “lost” Bitcoin roughly matches the total lifetime assets of the other Active Bitcoin Treasury Companies (excluding Marathon Digital).

Comparable frameworks have been experimented with in various markets including altcoins, equities, and the S&P 500, consistently outperforming blind dollar-cost averaging. Strategic dollar-cost averaging significantly surpasses emotional dollar-cost averaging almost independently of market circumstances.

Consequences for MSTR, Treasuries, and Individual Investors

For treasury entities, applying this model could translate into billions in additional value over time. Individual investors can employ the same principle of simply refraining from pursuing rallies during euphoric periods and allow the market to approach them instead.

Undoubtedly, we need to recognize the subtleties. Corporations encounter limitations when it comes to capital acquisition, executing large block transactions without slippage, and addressing shareholder anticipations. Nonetheless, even within those constraints, an uncomplicated data-informed filter could significantly enhance results.

Conclusion: MSTR’s Journey to More Intelligent Bitcoin Accumulation

Bitcoin treasury organizations have positively impacted the network in considerable ways. Their aggregate 1 million BTC assets diminish supply, amplify the money multiplier effect, and underscore the increasing institutional acceptance of Bitcoin. Nevertheless, the data indicates that a majority could undoubtedly enhance their performance. A straightforward strategy of steering clear of purchases during overheated phases could have yielded MSTR (Strategy) alone an extra 50,000 BTC, presently valued at over $5 billion.

For corporations and individuals alike, the lesson remains unchanged: discipline excels over FOMO. Treasury accumulation has transformed Bitcoin’s supply dynamics, yet the forthcoming evolution may involve more astute accumulation techniques that optimize returns and minimize market volatility without raising risk.

For a more comprehensive exploration of this subject, view our latest YouTube video here:

This Simple Bitcoin Strategy Would Have Made Them Billions

For further data, charts, and expert insights into bitcoin price movements, visit BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for additional expert market insights and evaluations!

Disclaimer: This article serves informational purposes exclusively and should not be construed as financial counsel. Always conduct your research prior to making any investment choices.

Source link

“`