Sure, here’s a rephrased version of your content while maintaining the original HTML format:

“`html

Sir Tim Berners-Lee, computer expert, creator of the internet and an all-around decent individual, penned some thoughts in The Evening Standard earlier this week, contending that division, conspiracies, and mental health dilemmas online arise from design shortcomings that must be addressed — even if that necessitates regulation.

The article is directly based on chapter 13, “Design Issues,” from his newly published book “This Is for Everyone: The Unfinished Story of the World Wide Web,” which I recommend everyone read.

I concur with Berners-Lee’s assessment. Yet regulation is not the remedy. The web’s deterioration is not simply a design mishap; it is equally an economic issue. Design decisions are influenced by incentives, and those incentives have been skewed by fiat currency and the advertising model it supports. Inexpensive capital from the fiat-driven venture capital landscape diverted Silicon Valley from hacker-centric engineering towards surveillance-based profit generation.

To remedy the internet, we require open-source protocols and open-source currency.

The internet can be rectified without regulation. However, we cannot devise a solution while disregarding the monetary challenges that influence design. The economic environment — quarterly shareholder dominance and fiat inflation — pressures businesses to emphasize engagement, outrage, and surveillance advertising. Bitcoin alters this equation. It alleviates inflationary pressures and potentially disrupts the advertising model by facilitating new monetization methods that align with user interests rather than exploit them. When paired with open protocols, Bitcoin serves as a catalyst for a more liberated, ethical web.

What Went Awry with World Wide Web

Berners-Lee identifies two primary symptoms: division and mental health deterioration. He is correct.

1. Division and Deterioration of Collective Reality

Berners-Lee states:

“The most alarming symptom is polarization. Social media, as it currently functions, drives users to adopt extreme political stances and vilify the opposing side. This complicates constructive interaction, permits bizarre conspiracy theories to thrive, and favors demagoguery over reasoned discussion.”

Division is tangible. Yet amplification goes in both directions. The very algorithms that bring conspiracy theories to the forefront also elevate truths that mainstream media may overlook. In a climate of censorship and propaganda, this amplification has occasionally served as the sole means for truth to emerge.

The deeper problem is that individuals no longer inhabit the same reality. A breaking news story splinters into conflicting narratives based on whether it disseminates via Twitter, TikTok, Bluesky, or Reddit; whether shaped by left-leaning fact-checkers or right-leaning commentators; whether summarized by Grok or ChatGPT. Each group delegates “truth formation” to its own authorities, who are incentivized to provide emotionally favorable facts. LLMs can also fabricate synthetic personas to disrupt dialogue at scale. Regulation will not restore trust here — as the issue is not solely what circulates, but how trust is cultivated in the first place.

However, algorithms are tailored for outrage since outrage is lucrative. Regulation will not alter this, as it’s as much an economic concern as it is a technical one.

As Neal Howe and William Strauss elucidate in “The Fourth Turning,” we find ourselves in a crisis period: Consensus deteriorates, power shifts, and old structures disintegrate. Practically, this translates to increased friction online — tribal feeds, narrative conflicts, and escalating coordination costs. In other words, we should anticipate the wreckage visible today, and there are steps we can take to address it.

2. Mental Well-being and Addictive Algorithms

Berners-Lee remarks:

“Many social media participants report experiencing mental health challenges following extended usage. The list of ailments associated with social media is concerning: anxiety, depression, envy, feelings of inadequacy, isolation, and body image issues.”

I concur, social media is both liberating and damaging. Search inquiries related to anxiety surge alongside usage, and the list of harms is extensive: depression, feelings of inadequacy, body image struggles, isolation. This is certainly an issue that warrants repair.

Berners-Lee asserts:

“Social media firms are utilizing machine-learning techniques to render users addicted to their platforms. These systems are intentionally addictive, inundating people with increasingly extreme content, leading to alternating feelings of anger and sadness.”

This is not by chance. Over twenty years ago, executives and engineers in Silicon Valley learned how to design addictive systems at BJ Fogg’s Persuasive Technology Lab at Stanford (his book, for those interested, is titled “Persuasive Technology”), with some even attending retreats at his residence to delve deeper into these concepts. The *Like* button, infinite scroll, and red notification alerts were all derived from his teachings and were crafted to hijack dopamine pathways.

Jack Dorsey, addressing the Oslo Freedom Forum in 2024, discussed the harm inflicted by the algorithms developed by these companies:

“The genuine discussion should revolve around free will. We are being programmed based on our expressed interests, and through these discovery mechanisms, we are instructed on what is engaging — and as we engage with this content, the algorithm increasingly develops this bias.”

Dorsey has previously mentioned how Twitter began as a protocol vision before venture capital diverted it towards growth, control, and ad monetization. Having witnessed the corruption of that vision, it’s no mere coincidence that Dorsey now supports open-source protocols like Nostr, Bitchat, and previously Bluesky. His investments confirm that platforms cannot be reformed internally. Only protocols, inherently open, can safeguard free will from algorithmic capture.

Berners-Lee has proposed that algorithms could be redesigned to maximize joy rather than outrage. It’s a commendable vision, one I wish were achievable — but under current incentives, it is not. Research indicates that high-arousal emotions, especially anger, disseminate more rapidly than calmness or positive sentiments.

Past attempts to pivot have proven costly. For example, when Facebook modified its News Feed in 2018 to mitigate harmful content, users…

“““html

spent 50 million fewer hours daily on the site and publishers experienced a traffic downturn. Recent assessments verify the identical trend: Platforms that demote contentious content observe significant declines in engagement and revenue. (Related research can be found here, here, here and here.)

As long as corporations are obligated by their fiduciary responsibility to enhance shareholder profits, regulators cannot compel them to intentionally earn less as long as outrage is more lucrative than happiness.

Oversight of the Internet

Berners-Lee has consistently been one of the internet’s staunch supporters. He advocated for net neutrality, encryption, and decentralization. He cautioned against surveillance long before it became trendy. He has been a proponent of open participation and user empowerment.

Therefore, it is somewhat unexpected for Berners-Lee to acknowledge that oversight may be essential. He even cites bad-faith figure Yuval Noah Harari to bolster this argument:

“If a social media algorithm suggests a hate-fueled conspiracy theory to individuals, the blame lies not with the creator of the conspiracy theory, but with those who engineered and unleashed the algorithm.”

While I reluctantly agree with Harari in this context, let’s not forget who we’re engaging with. He is a World Economic Forum favorite, a steadfast proponent of technocratic solutions and someone who has referred to bitcoin as a currency of mistrust. His perspective tends toward centralization, surveillance, and governmental power. His reasoning is cloaked in logic but promotes less autonomy and increased control.

Berners-Lee acknowledges: “While I typically resist regulating the web, in this case, I concur.” I regret to say that regulation is a precarious slope we should strive to avoid.

It’s due to Berners-Lee’s status as a defender of the internet that his acceptance of regulation seems somewhat defeatist. Has the unrelenting rise of algorithmic manipulation, misinformation, and addictive design worn him down? Possibly. However, regulation is not the solution.

Another note on regulation… When governments intervene, they solidify incumbents and employ “safety” as a pretext for censorship. They are also profoundly inept — the EU’s cookie regulation is an exemplary case: It benefited no one, accomplished nothing, and left users grappling with irritating pop-ups.

True democracy online should be crowdsourced and constructed with open protocols — guidelines without rulers.

The Economic Challenges of a Free and Thriving Internet

Now let’s address the core issue. The principal concern is fiat currency. Its complete implementation in 1971 represented a pivotal moment: productivity continued to rise, but real wages stagnated. WTF Happened in 1971? illustrates the divergence starkly — inequality, debt, housing expenses, and social decline all surged after Nixon severed the last tie to gold.

Prior to 1971, prices and wages were relatively consistent. For centuries, under sound money, there was balance. During the brief classical gold standard, the Belle Époque ushered in a golden era of innovation and relative abundance. Prices remained stable, and by most indicators, life thrived. That stability evaporated once fiat money became prevalent.

Since that time, and at an accelerating rate, individuals have had to exert more effort for diminishing returns. Companies have been compelled to extract more productivity while becoming less ethical. Recall Google’s “Don’t be evil” slogan? This is likely the malignant force that led Sergey, Larry, and Eric to lose their innocence.

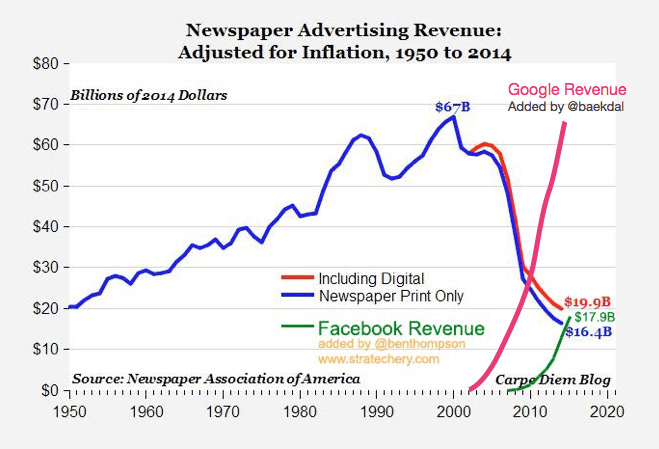

Speaking of Google, its advertising model dismantled the traditional media business model, rendering it reliant on state funding and corporate sponsorships. Governments now utilize media as PR tools, which is a significant contributor to the polarization problem we are witnessing online.

The venture capital model, driven by low-cost fiat credit, distorted Silicon Valley motivations from hacker-led innovation to surveillance-driven profit extraction. Centralization and monopolization are characteristics of easy credit and the Cantillon effect.

Jeff Booth estimates technology exerts a natural deflationary influence of approximately 5% annually, while Saifedean Ammous contends that actual inflation — not CPI, but monetary expansion — hovers around 15-16%. Governments counter deflation with currency creation; companies respond by demanding more from users in an ever-accelerating race to the bottom.

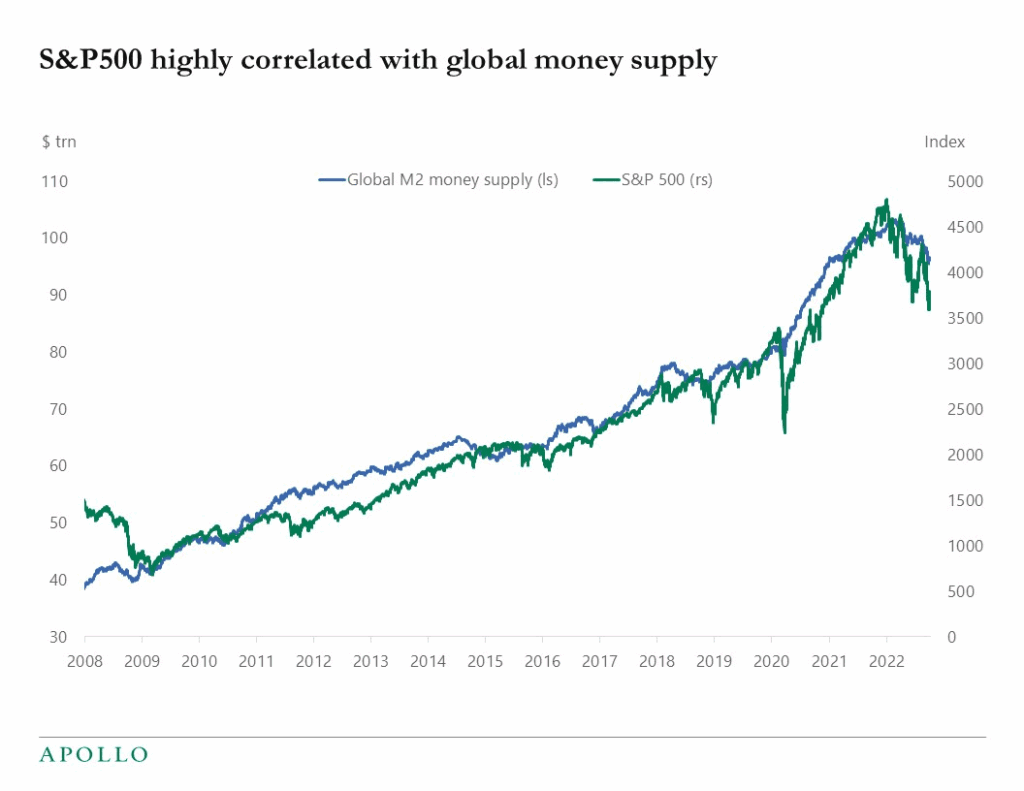

The result is apparent in equity markets: the Mediocre 493 enterprises on the S&P 500 are fundamentally deteriorating, and the S&P, propelled by the Magnificent 7, essentially reflects the money supply.

“““html

And resting upon fiat, fiduciary obligations and quarterly disclosures entrapped organizations in a direct confrontation with inflation. Fiduciary obligations, entrenched in 19th-century U.S. legislation, merely mandated directors to operate in shareholders’ best interests. However, the SEC’s 1970 directive for quarterly 10-Q disclosures — coupled with Milton Friedman’s 1970 article in the New York Times asserting that the singular duty of business is to enhance profits — solidified the ethos of “quarterly capitalism.”

| Year | Event | Impact on Corporate Governance / Incentives |

| 19th century | Fiduciary responsibilities established in U.S. corporate legislation. | CEOs and directors are compelled to prioritize shareholders’ welfare. |

| 1934 | U.S. Securities Exchange Act | Granted SEC the power to mandate periodic reports from publicly traded companies. |

| 1970 | SEC enforces quarterly 10-Q reporting | Commences the culture of Wall Street earnings cycles, with frequent short-term performance assessments. |

| 1970 | Milton Friedman releases “The Social Responsibility of Business is to Increase Its Profits” (NYT). | Popularizes the concept of shareholder supremacy as the aim of corporations. |

| 1971 | Nixon halts gold convertibility — beginning of the fiat era. | Increasing inflation necessitates that corporations surpass not only growth anticipations but also inflationary pressures. |

| 1980s | Wall Street’s leveraged buyouts + stock-based CEO remuneration. | Entrenches a short-term earnings focus: Failing to meet quarterly expectations becomes perilous for CEOs. |

| 2000s–present | “Quarterly capitalism” prevails. | CEOs face pressure from markets and shareholders to meet quarterly EPS goals. |

This convergence — fiat currency, shareholder supremacy, quarterly disclosures, and venture-funded adtech — produced a perfect storm. Organizations are structurally motivated to incite outrage, dependency, and extract user data. Regulation cannot alter this as long as the foundational monetary system remains flawed. Until we alter our trajectory and revert to sound money, design solutions will inevitably collapse under economic strain.

Tim Berners-Lee, Bitcoin is the Solution!

Bitcoin serves as both a remedy for dysfunctional currency and a basis for innovative online business models. It is neither an application nor a corporation — rather, it is a monetary underlying layer that redefines incentives fundamentally.

I’m uncertain about Berners-Lee’s position on Bitcoin specifically. Publicly, he has dismissed cryptocurrency as a speculative gamble. On that, I concur. Bitcoin stands apart: no insiders, no venture backing, no foundations, no changing regulations. If he acknowledges that difference, excellent; if not yet, perhaps soon.

Rectifying currency

Bitcoin amalgamates the finest characteristics of gold — longevity, rarity, uniformity, unforgeable expense — with the best qualities of fiat — divisibility, transportability. The outcome is irrefutably the most outstanding money ever conceived: It’s additionally boundary-less, resistant to censorship, decentralized, openly programmable, constrained by thermodynamics and intrinsically digital.

In contrast to Bitcoin, it becomes increasingly evident with each passing year that the fiat system is disintegrating beneath us, as Bitcoin thrives in its shadow. Bitcoin provides a means to defuse the global debt crisis rather than permit it to implode, correcting the trajectory of monetary history by reinstating global money on a solid foundation.

The ramifications are colossal, if/when Bitcoin ascends as fiat’s successor. For the first time in recent memory, society wouldn’t have to struggle against the current just to remain stagnant. With sound currency, the inherent deflationary advantages of technological advancement can benefit everyone, not be drained away by those nearest to the source.

Jeff Booth, in “The Price of Tomorrow,” emphasizes that technology is essentially deflationary, meaning it provides more for less. However, under fiat currency, this deflation is obscured by inflation, debt, and growth targets. Bitcoin aligns money with technology. Its fixed supply ensures that the benefits of technological deflation are distributed to all, rather than being siphoned off.

Realigning online incentives

“If you perceive the internet as akin to a nation-state, it will possess a currency native to it, and no single party or institution will orchestrate this occurrence, nor will any one party or institution have the ability to halt it.” – (Jack Dorsey, Quartz)

Now that we possess an internet-native currency, the inquiry is… what can it facilitate?

Firstly, Bitcoin has the potential to revolutionize incentives online. It can achieve this by permitting micropayments, streaming sats, and peer-to-peer monetization, allowing users to directly support creators. Platforms can generate revenue without compromising their users’ data to advertisers. This may reduce the influence or even eliminate an advertisement-driven, data extraction model that compels platforms to prioritize outrage.

It will also disrupt the venture capital paradigm, as currently, those closest to the financial resources disproportionately benefit. As Bitcoin lacks a central bank to generate additional money, all participants find themselves on a relatively level playing field, and consequently, investment should become more decentralized once more.

From

“““html

there, completely fresh dynamics can arise. Protocols and applications won’t be tied to growth-at-all-costs systems dictated by venture capital; they can expand naturally, financed by the very users who depend on them. Value transforms into the measure, not quarterly expansion or ad clicks. Developers can deliver products that address genuine issues, and be compensated directly in sats. Communities can aggregate resources without intermediaries, nurturing projects from the grassroots rather than awaiting sanction from above.

In this setting, the internet can ultimately align with its initial principles — open, interoperable and user-centric — because the financial layer itself is open, interoperable and user-centric. Bitcoin lays the groundwork for that alignment.

Bitcoin is not merely confined to repairing the web — it exists upstream of it. Without stable currency, design solutions will perpetually tilt toward exploitation. With robust money, platforms can embrace models that are ethical by default. With internet-native currency, creators can receive direct payments. Bitcoin serves as the fulcrum where flawed incentives yield to healthier systems — both online and offline.

“The internet, our most powerful tool of liberation, has been converted into the most perilous enabler of totalitarianism we have ever encountered.” – Julian Assange

Resolving this does not necessitate government oversight. It necessitates realigning incentives — through open protocols and Sound Money.

Open Source Solutions

Berners-Lee highlights open source instruments like Polis, Mastodon, and Fora as encouraging trials in more wholesome online discourse. Building upon these initiatives, a new surge of protocols merges the same open ethos with native internet currency, aligning incentives in manners that advertising-driven models never could.

With Bitcoin as the economic foundation, protocols can tackle the design layer. These systems are operational, early, and require wider adoption and an exceptional application — yet they already display how to realign incentives absent regulation.

Mastodon illustrates what’s achievable with open source federation and timelines constructed from individuals you opt to follow, rather than engagement-driven algorithms. While its aversion to relying on advertising is a strength, the lack of a native payment system presents a constraint.

Enter Nostr

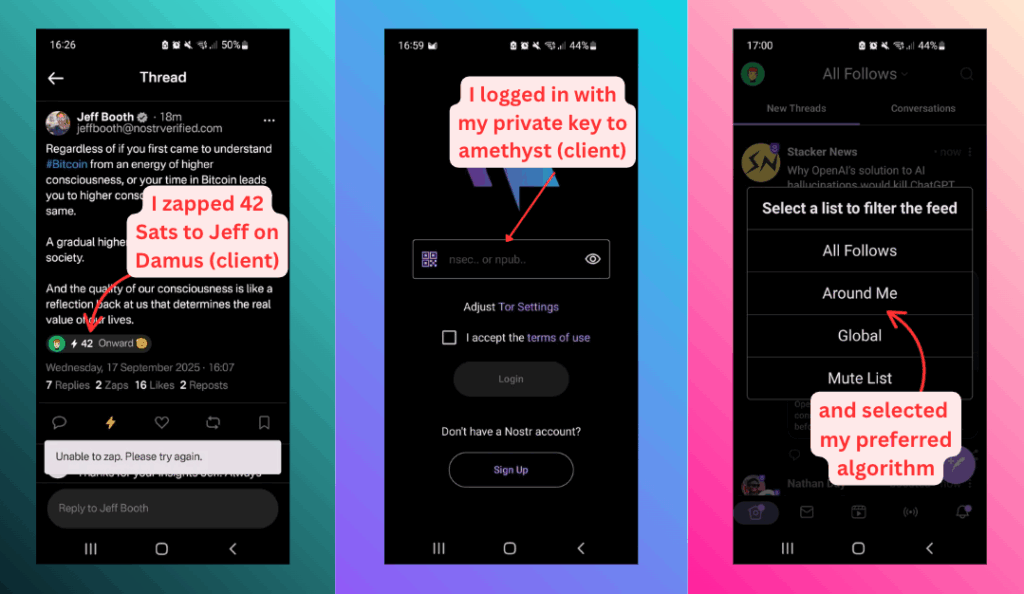

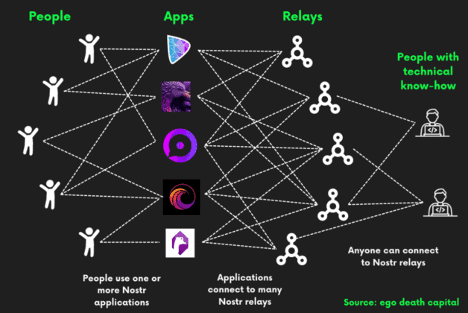

Introduced in late 2019 by Fiatjaf, Nostr (“Notes and Other Stuff Transmitted by Relays”) is an uncomplicated protocol that separates identity and content from any single application. Keys recognize users; relays convey signed events. Multiple clients (Damus, Amethyst, Primal, Iris, Alby) read and write to the same social network, yielding genuine interoperability — the kind of cross-client, cross-application portability Berners-Lee advocates.

Users select relays and curate their own feeds, placing algorithmic choice firmly into their possession. This resonates with the concept Harvard professor Jonathan Zittrain proposed — and which Berners-Lee underscores in his publication — for refined controls to divert content from conspiracy rabbit holes. Unlike that platform-centric vision, Nostr empowers users directly, with its algorithmic adaptability constrained only by the protocol’s infancy.

While payments aren’t integrated into the foundational design, Lightning “zaps” are becoming prevalent — instant, native tipping and payments linked to posts and profiles. This combination — open communication plus open currency — facilitates grassroots coordination and swift iteration without gatekeepers. Deletion is suggestive (clients/relays might honor it), ensuring practical permanence and accountability throughout the network.

Read more: Nostr: censorship-resistant communication

Protocols, Infused with Bitcoin

Chaumian Mints

Cashu by Calle brings Chaumian eCash to Bitcoin — private, bearer-style tokens that can operate alongside Nostr or independently. It facilitates swift, private micro-flows; Calle also co-established BitChat with Jack Dorsey, adapting these concepts into a user-facing chat environment.

Reputation Systems

Community Notes demonstrates that cross-faction context can mitigate misinformation. Incorporate transparent weighting, DIDs, and Web-of-Trust primitives, and you establish a resilient, portable reputation. Utilize sats as skin-in-the-game (bonds/slashing for deceitful signals), and the mechanism strengthens without centralized censors.

Spam Resistance

Spam isn’t novel and it isn’t exclusively online. Usenet has managed inundations for decades as a decentralized, user-operated network with no central authority. Adam Back’s Hashcash illustrated the fundamental principle: attach a minimal proof-of-work cost and abuse declines. The same economics apply now with bitcoin — sats-priced frictions via Lightning (or Ark Protocol) render bot farms and propaganda costly while ensuring honest participation remains affordable.

Spam is fundamentally a numbers game: When it’s free, it proliferates; add costs and you restore the signal. Consider refundable per-post/per-DM deposits, PoW stamps or rate limits priced in sats— good-faith interaction remains sustainable while mass manipulation becomes uneconomical.

In Conclusion

Sir Tim Berners-Lee is accurate regarding the symptoms. Our perspectives diverge concerning the remedy. Regulation cannot undo centralization orchestrated by states and corporations; it merely fortifies governments into the issue it partly engineered.

The decline didn’t originate with poor UX. It commenced with flawed currency (and all the issues therein) and the end of sound money (1971), compounded by shareholder-primacy dogma, which bent incentives toward immediate nominal gains and surveillance advertising. From that point, outrage financed the system, while integrity dwindled.

The solution is Bitcoin reinstating the world to sound money, enabling open protocols to enhance the web effectively.

Forget the regulators.

Fix the currency, fix the planet.

Source link

“`