“`html

BitMine Immersion Technologies has incorporated nearly $70 million worth of Ethereum into its assets, elevating the company’s ETH reserves to a value close to $8.66 billion.

Related Reading

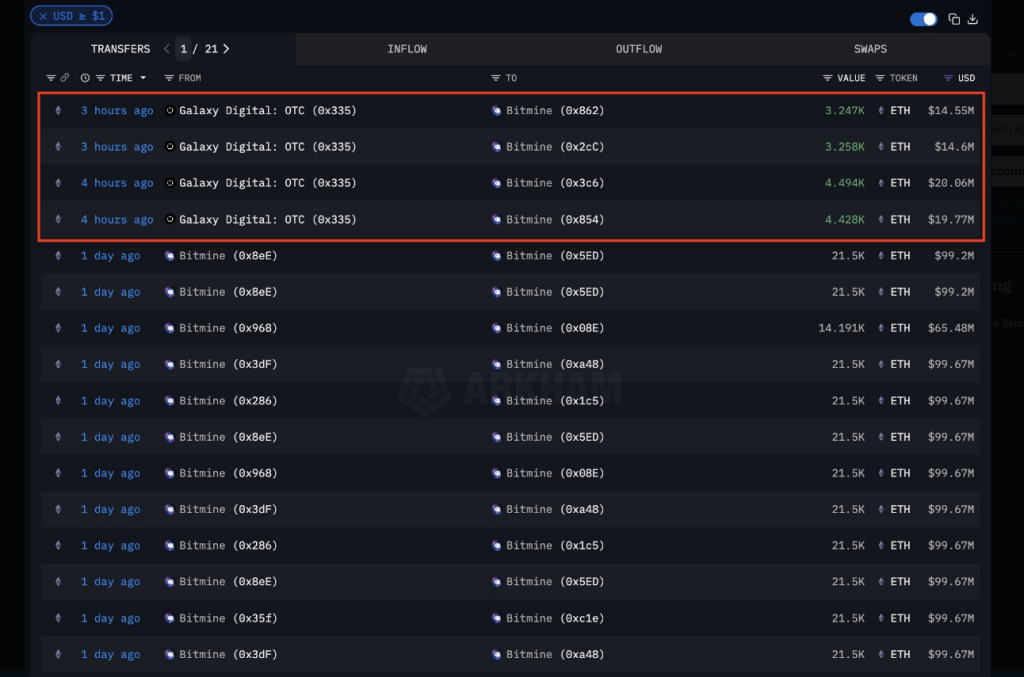

According to reports, the acquisitions were executed via Galaxy Digital’s over-the-counter desk and came in multiple segments instead of a single transaction.

Acquisition Divided Into Four Installments

The recent acquisitions were divided into four transactions: 3,247 ETH ($14.50 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20 million), and 4,428 ETH ($19.75 million).

This amounts to approximately 15,427 ETH, tallying around $69 million at the figures mentioned. Based on public trackers referenced in the report, these transactions were likely orchestrated OTC trades meant to prevent affecting the spot market.

TOM LEE IS PURCHASING EVEN MORE $ETH

Tom Lee’s Bitmine has just acquired another $69M of ETH from Galaxy Digital. Their total holdings now stand at $8.66 BILLION of ETH.$BMNR remains optimistic about $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

What Portion Of Ethereum Does BitMine Possess

Reports have indicated that BitMine currently possesses around 1.95 million ETH. That holding is appraised at approximately $8.66 billion based on the same pricing referenced in the report.

Experts monitoring corporate treasuries suggest that corporate and institutional ETH reserves combined make up a few percent of the circulating supply, and BitMine is listed as one of the largest individual holders.

The figures might appear significant in comparison to the total ETH supply, yet the percentage varies depending on which supply metric is applied — circulating, staked, or otherwise secured.

Market Dynamics Behind The Transaction

Acquiring substantial quantities on OTC desks is routine for public enterprises and major players. It minimizes slippage and keeps significant orders off public order books.

The ETH involved here shifted without obvious price fluctuations. Some transfers were detectable on-chain; the private conditions of OTC contracts typically remain undisclosed.

According to reports referencing blockchain trackers like Arkham, the on-chain movements aligned with the size and timing described.

Risks, Accounting, And Tactics

Holding significant amounts of a fluctuating token entails genuine risks. A steep decline in ETH would affect BitMine’s balance sheet. Concurrently, consistent accumulation indicates a definite strategic position on future appreciation.

Market watchers compare this tactic to others that maintain crypto as part of their corporate treasury, and regulatory bodies and accountants will scrutinize how such holdings are represented in quarterly disclosures.

Related Reading

Corporate Accumulation Intensifies

Some particulars remain ambiguous. Reports cite Arkham and Strategic Ether Reserve as the main sources, but OTC transactions do not disclose complete pricing details, and the precise terms are often confidential.

Since those transactions occur off-exchange, public documents indicate transfers but not all pricing specifics. The activity of large holders tends to attract heightened scrutiny when ETH moves sharply in either direction.

Based on these figures, this transaction is yet another indication of substantial corporate accumulation of ETH.

Featured image from Unsplash, chart from TradingView

Source link

“`